What are AI tokens?

In simpler terms, AI tokens function as the payment method inside AI-driven systems, letting users purchase services, obtain data, and take part in platform functions. Some AI tokens come with the added benefit of giving their owners a say in shaping the future of the associated project through voting rights.

Many AI token initiatives encourage user participation in their protocol or project through compensating them for actions like supplying data, sharing computing power, or creating AI applications. The excitement surrounding AI tokens suggests that there is still significant potential for expansion within this sector according to various key performance indicators.

AI crypto market overview

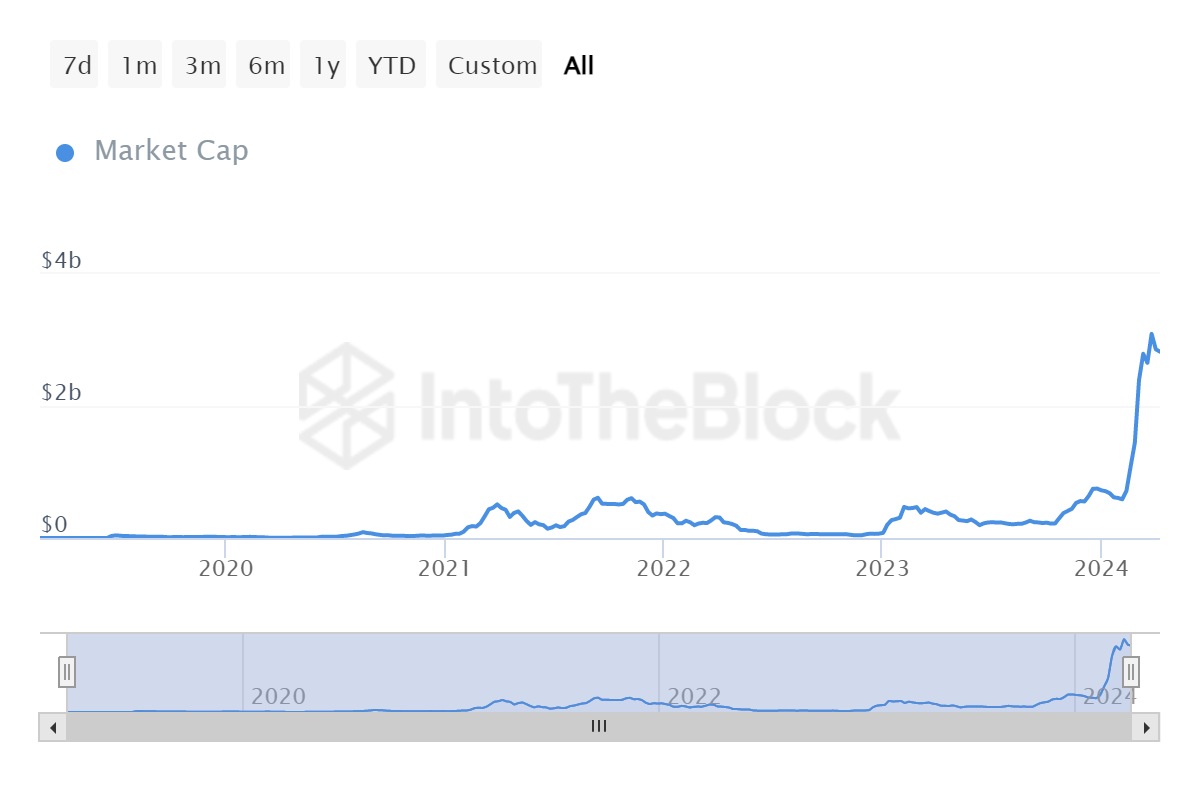

In the last few months, there’s been a remarkable increase in the AI token market, as trading volumes and market values have risen dramatically on different platforms. Yet, even though AI tech has made considerable progress, this industry is still in its infancy.

The increase in cryptocurrencies connected to artificial intelligence technology is a clear sign of this asset class’s expanding promise as the AI sector’s influence on the global tech industry continues to expand. This growth has been remarkable, even surpassing Bitcoin’s recent record-breaking price surge to $73,600.

On February 22, the average growth rate for sector tokens was 7.7%, with Ocean Protocol’s OCEAN and Fetch.AI’s FET experiencing gains above 10%. Meanwhile, the CoinDesk 20 Index (CD20), representing major cryptocurrencies, saw a rise of 2.68% during this timeframe.

Worldcoin’s WLD saw the highest gain among AI tokens, soaring 30% to reach a new all-time high of $7. Founded by OpenAI CEO Sam Altman, Worldcoin’s rise is seen by some traders as a bet on OpenAI’s growth.

Vitalik Buterin, co-founder of Ethereum, tweeted about the possibility of AI evaluating smart contracts, causing less-recognized tokens such as 0x0 and TokenFi’s TOKEN to surge by up to 15%, due to their connection to this topic.

I’m thrilled about the potential use of AI in formally verifying codes and identifying bugs in Ethereum’s system. With the current major concern being software glitches, an effective solution for addressing this issue would be truly groundbreaking.

— vitalik.eth (@VitalikButerin) February 19, 2024

Despite the recent hype, several metrics for the key AI tokens indicate further sector growth.

Fetch.ai (FET)

With Fetch.ai, you can easily create, implement, and profit from AI solutions without needing to modify current APIs. It seamlessly links various integrations together to form new services that can be accessed using just one simple command.

Established in 2017 and introduced on Binance in 2019, this AI laboratory is located in Cambridge. The lab’s platform, which went live on its mainnet in 2020, combines decentralized machine learning with a distributed ledger technology.

The system is equipped with self-governing software entities that enhance services, manage Internet of Things gadgets, and ensure secure interaction and automation. Capable of carrying out queries, brokering deals, exchanging information, and forecasting outcomes autonomously.

Fetch.AI relies on its own token, FET, for conducting transactions and accessing features on its platform. This token is necessary for using services, data, infrastructure, and AI models. It’s also used for registering accounts, depositing funds as collateral, and earning rewards for network contributions. FET makes it possible for users to deploy agents and participate in the Fetch.AI Open Economic Framework.

Recently, there have been reports suggesting that SingularityNET, Fetch.ai, and Ocean Protocol are in discussions to merge their tokens into a new ASI token, estimated to be worth approximately $7.5 billion. Pending community approval, this merger could be announced soon and would result in the formation of a collaborative “Superintelligence Collective.” Ben Goertzel from SingularityNET would lead this collective, while Humayun Sheikh from Fetch.ai would chair it. Each platform would continue to operate independently but would also benefit from the collaborative efforts of the collective.

Render Token (RNDR)

Render Token (RNDR) powers a decentralized GPU cloud computing network designed for high-demand tasks like AI/ML training and rendering. Users can stake and lock up RNDR tokens to access GPUs within the network

Suppliers on the Render Farm marketplace are motivated to lend their graphics processing power through the use of RNDR tokens as compensation. Currently, the total value of all RNDR tokens in circulation amounts to $1.22 billion.

In the realm of AI and Web3, Render stands out by specializing in the GPU distribution marketplace, earning it a distinguished role as a leader. To strengthen this leadership, Render is forming alliances with notable figures in the blockchain tech industry.

In spite of the market’s prevailing tendencies, Render has been bucking the trend and exceeding predictions, showcasing its distinct worth and esteem in the sector. With artificial intelligence in blockchain progressively advancing, Render, together with Fetch.ai, is well-positioned to reap substantial benefits as the industry reaches maturity, owing to their early adoption.

Bittensor (TAO)

Bittensor strives to make AI development accessible to all by establishing a decentralized network where individuals can build and share machine learning (ML) models. In this community, various ML models communicate and learn from one another, leading to a more open-ended and inclusive setting for the advancement of artificial intelligence.

Using AI and blockchain together, Bittensor provides a fresh method for creating artificial intelligence. This fusion taps into cryptocurrency’s transformative power while ensuring responsible usage. The goal is to lower the threshold for entering AI development, leading to increased accessibility and stimulating more creativity in this area.

In 2021, Bittensor was introduced by the Opentensor Foundation, which is spearheaded by developers Jacob Robert Steeves and Ala Shabaana. The main objective of the Opentensor Foundation behind Bittensor is to build a unified and harmonious global network of computing power for creating open-source and accessible AI technologies.

On the “subtensor” network operated by Bittensor, there are several interconnected “subnets.” At present, thirty-two of these subnets are in use. To engage with a subnet, users must pay with TAO tokens for membership.

In simpler terms, this model promotes expansion and top-notch performance by inviting users to join in as either miners or validators, depending on their available computer power. Essentially, it motivates active engagement and strengthens Bittensor’s self-governing AI community.

TAO has been among the winners of the current rally, with market cap soaring 500%.

In the last seven days, TAO has experienced a significant surge, growing by more than 18% and reaching its present value from $609.71. The highest price this coin has ever reached is $757.60.

Over the past week, the trading volume for Bittensor has surged by an impressive 643.0%, coinciding with a 0.7% rise in its total circulating supply.

Approximately 31.32% (or around 6.58 million) of the total supply of 21.00 million tokens is currently in circulation. The market value of TAO ranks 28th, with a valuation of about $4.68 billion.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- BICO PREDICTION. BICO cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD COP PREDICTION

- VANRY PREDICTION. VANRY cryptocurrency

- USD PHP PREDICTION

- USD CLP PREDICTION

- USD ZAR PREDICTION

- FJO PREDICTION. FJO cryptocurrency

2024-04-15 05:09