- Ah, BTC’s daily on-chain transaction volume in profit—an impeccable mirror reflecting the often bemusing behavior of investors during those delightful price movements.

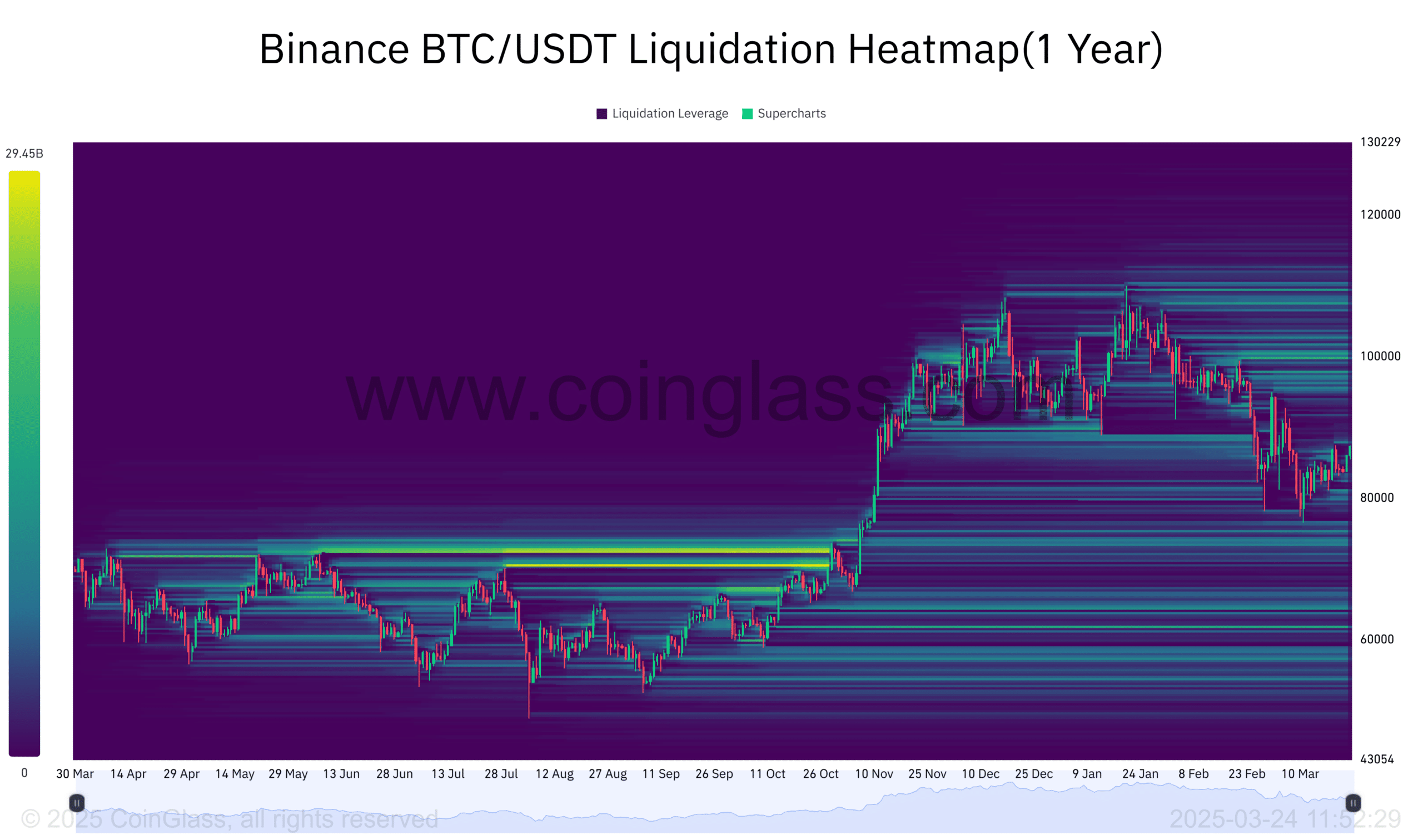

- The famed BTC liquidation heatmap on Binance—a kaleidoscopic window into the mind-boggling world of leveraged positions and the all-too-fleeting notion of market stability.

Observe Bitcoin’s (oh-so-celebrated) supply in loss (%). It’s like peering into the collective soul of the market, each percentage point a whisper of sentiment and price behavior.

In the grotesque theater of early 2022, the supply in loss peaked at a rather dramatic 21.9% as Bitcoin plummeted below the $20K stage, reflecting manic selling pressure amid the audience’s bearish lamentations.

Ah, the sweet fluctuation, as if Bitcoin were doing an awkward dance between $20K and $30K throughout the enchanting years of 2022 and 2023, stabilizing the supply in loss between a mere 10% and 15%—indicating a diminished yet persistent pressure, like a soap bubble held precariously between fingers.

By mid-2024, as Bitcoin soared toward $70K, the supply in loss gracefully declined, whispering below 5% by early 2025 as prices waltzed to a riveting $94K.

This delightful downward trajectory suggested a decrease in selling pressure—like an optimistic choir of holders singing sweet melodies of confidence, as fewer were caught drowning in their losses. The correlation—ah, that splendid dance—between a dwindling supply in loss and rising prices kindled an increasing investor confidence, almost piquant in its efficacy.

As more market participants clutched their assets, anticipating a pot of gold at the end of the metaphorical rainbow, the panic selling seemeth to dwindle, adorning our glorious 2025 outlook with an optimistic sheen.

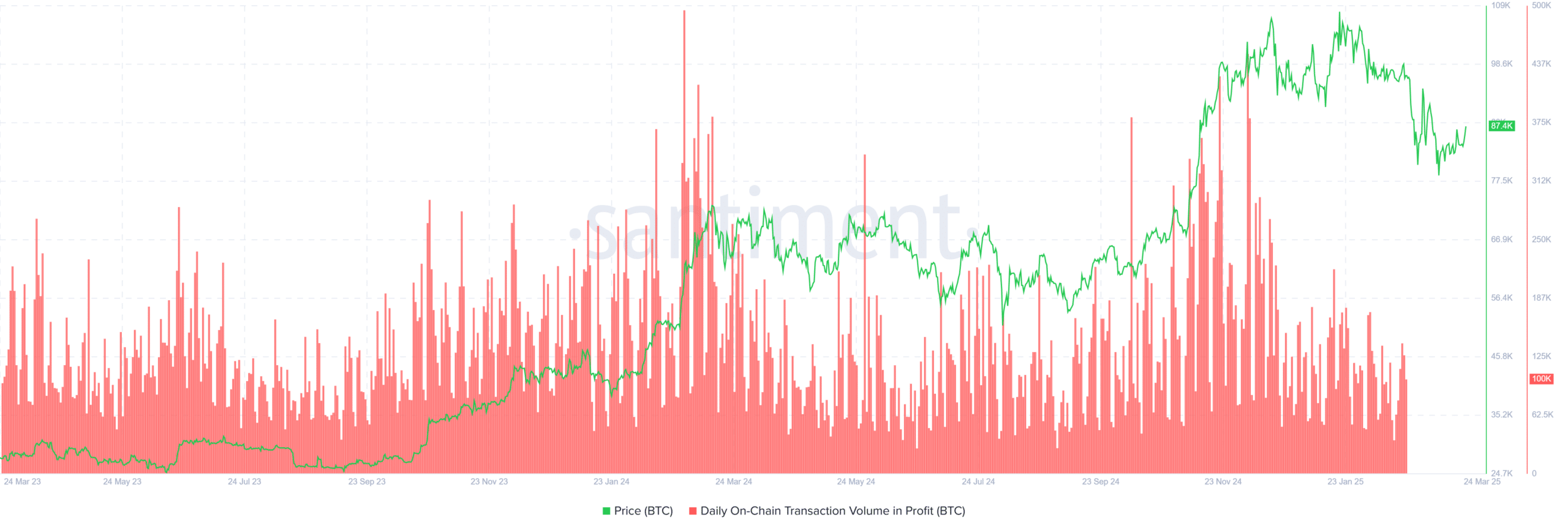

BTC’s daily on-chain transaction volume in profit

Moreover, Bitcoin’s delightful daily on-chain transaction volume in profit shines a spotlight upon investor behavior, as if we were all spectators at a circus of price movements.

In early 2024, while BTC was frolicking around $60K, profit-taking was as rare as a unicorn—indicating a cautious market sentiment lurking in the shadows.

Yet, as Bitcoin pirouetted to $87K by the grand finale of 2024, transaction volume in profit spiked like confetti at a New Year’s Eve party, signaling an exuberant profit realization as investors eagerly capitalized on the exhilarating rally.

However, by early 2025, as Bitcoin adjusted itself to a dignified $77K, the transaction volume in profit began to decline, suggesting that fewer holders were on the brink of an active selling spree, aligning neatly with the declining supply in loss.

Thus, our profit-savvy investors opted for the thoughtful, selective art of profit-taking rather than a chaotic mass exodus, contributing to price stability—how rational and profoundly amusing!

Indeed, this trend fortified the broader market sentiment, proclaiming that confidence in BTC’s long-term value held steady, much like a cat perched atop a precarious ledge, despite the temptations of short-term corrections.

Market stability or instability?

The BTC liquidation heatmap on Binance—a veritable trove of insights into the labyrinth of leveraged positions and market stability—unfolds like a poignant drama under a flickering spotlight.

High liquidation zones around $60K–$70K in mid-2024 invoked a sense of recklessness, as excessive leverage led to a wail of forced liquidations during bouts of volatility that sent traders into a trance.

As Bitcoin reveled in its ascent to $87K by late 2024, the liquidation levels sank lower, suggesting a more harmonious balance among traders—a symphony of financial finesse at play.

By early 2025, as Bitcoin found its footing around $77K, liquidation activity stood resolutely low. This affirmation, intermingled with the declining supply in loss, indicated that fewer unfortunate souls were swept away in the tides of forced liquidations, drawing a laugh from the stoic observers.

Such a delightful lowering of liquidation risks contributed to a marketplace brimming with more stability, allowing Bitcoin’s price action to flourish under the nurturing sun of organic demand, rather than the shadows of excessive leverage.

This enchanting environment set the stage for Bitcoin’s potential continued growth in 2025, with diminished downside risk hiding behind a curtain, waiting to spring forth surprising applause.

Thus, as BTC adoption blossoms like spring flowers, and institutional interest blooms with the vigor of a thousand suns, market participants may witness an exquisite tapestry of continued price appreciation, woven by long-term confidence and the whimsical dance of speculative trends.

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- AI16Z PREDICTION. AI16Z cryptocurrency

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Nvidia Reports Record Q1 Revenue

2025-03-24 21:16