Bitcoin sits at a positively nosebleed-inducing $107,059. The market cap is $2.12 trillion—enough to buy everyone on Ankh-Morpork a drink, twice. With $27.75 billion changing hands in the last 24 hours, the market is doing its best impression of a Discworld beggar: simultaneously wild and entirely unimpressed.

Bitcoin – Now Less Like A Roller Coaster, More Like Vetinari’s Plots

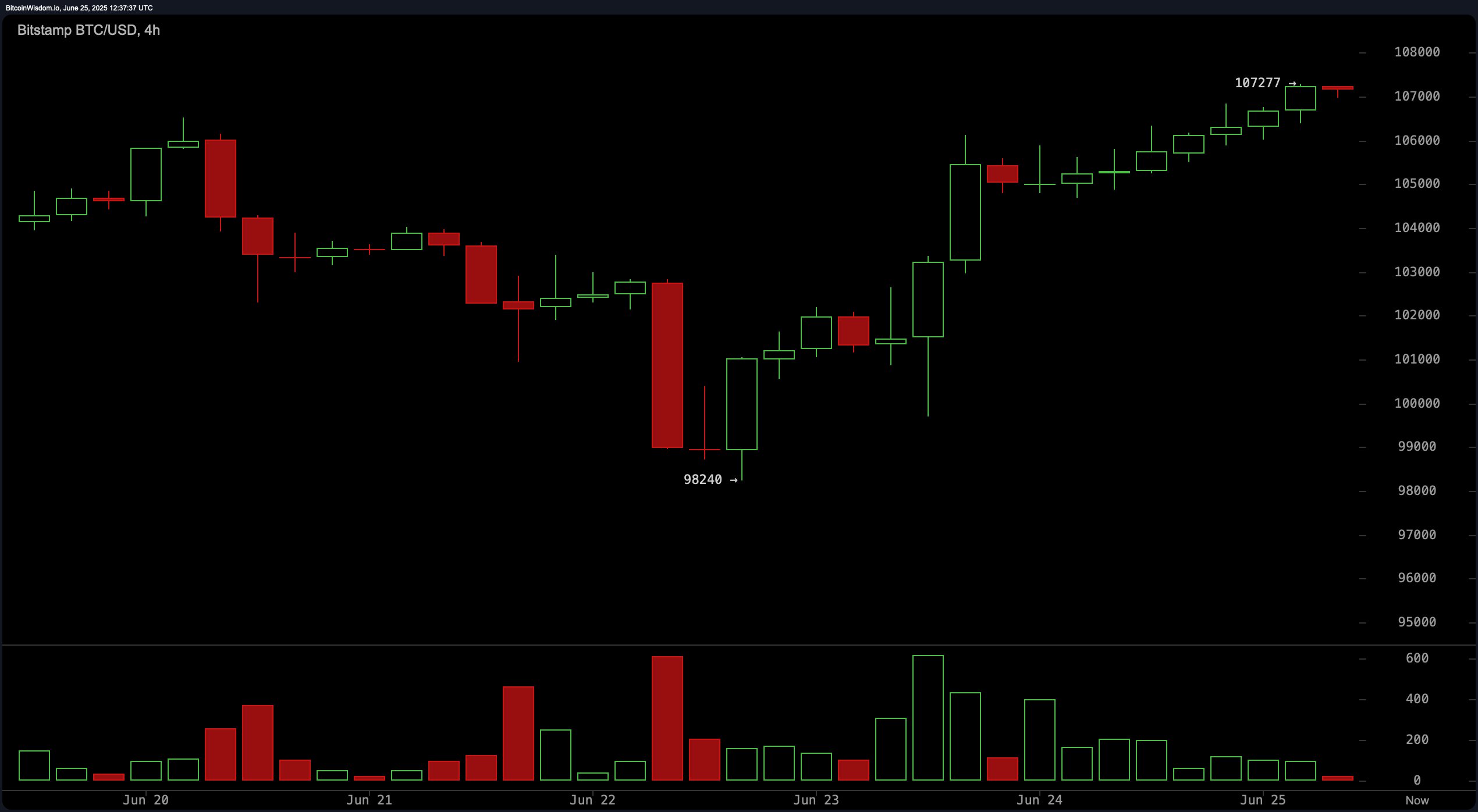

Could this be a rebound or merely a cunning disguise? From the daily chart, bitcoin has bounced up from a recent low of $98,240, which, for reference, is a lot of bananas. After being savagely walloped down by a selloff that would make Cut-Me-Own-Throat Dibbler flinch, it dashed past $106,000 aided by, naturally, a bullish engulfing candlestick—because nothing says “confidence” like a pattern named after an aggressive hug. Support stands at $98,240, resistance at $112,000, and the bulls are lurking like librarians eyeing overdue books. Buyer volume is wary but, like Nobby Nobbs on payday, seems inclined to stick around.

On the 4-hour chart, bitcoin is attempting a V-shaped recovery—possibly the letter V as written by an optimistic chicken—leaping from $98,240 to $107,277. This trend’s so bullish it might start demanding hay. Higher highs, higher lows, aggressive buyers, and sellers finally growing tired play their parts. Pullbacks around $104,500–$105,000 (former resistance, now support: see, people can change) might be where hopeful adventurers stage their next ambush. If things hold, $108,000 is within reach. Anyone who thinks risk died of neglect should keep an eye on $103,000, just in case it pops up like the luggage in a quiet street.

If you’re the sort who likes their action quick and their snacks quicker, the 1-hour BTC/USD chart reveals a bullish flag fluttering in the gentle breeze of speculation. Above $106,000, the price loiters like Rincewind in the presence of responsibility, hinting that a breakout might brew. Breach $107,300 with party-level volume and the brave souls (scalpers, or just slightly manic street performers) could chase it to $108,000–$108,500. Should price slip below $106,200, the mood will turn faster than a wizard defending his hat.

Oscillators meanwhile, are mostly neutral, presumably sipping tea and watching with mild interest. RSI twiddles its thumbs at 56, the Stochastic limbers up at 69, and the CCI asks, “Is this my bus?” at 54. ADX? A thoroughly uninspired 17. The momentum whispers “buy” at 1,447, while the MACD sulks with a bearish -19. In other words, the instruments are arguing amongst themselves about whose turn it is to drive. The overall verdict: standoffish but slightly optimistic, like Vimes with a lead.

Moving averages (MAs) are feeling rather frisky. The EMA and SMA for 10, 20, 30, 50, 100, and 200 periods have all burst out the door shouting “bullish!” loud enough to startle Sergeant Angua. Short-term momentum (10-period EMA: $105,051, SMA: $104,607) winks knowingly, while longer-term averages (200 EMA: $93,942, SMA: $96,056) hold up their end of the optimistic banner. The message? Bulls have formed an orderly queue, but they’d appreciate volume and confirmation before launching a full parade. 🥳

Bull Verdict:

Bulls have every reason to swagger. All major moving averages have thrown their arms around each other, kicking their legs and singing bullish anthems from both short and long timeframes. If volume can goose a breakout above $107,300, momentum may break into an undignified sprint, heading for $112,000 and possibly a bar tab that will never be paid.

Bear Verdict:

But don’t uncork the celebratory klatchian coffee just yet. Oscillators mutter darkly, and the MACD threatens to call its lawyer: if bitcoin can’t clear $107,300 and stumbles below $106,000, there’s a risk of plunging back toward the $102,000–$101,500 cellar, where only trolls and forgotten optimism dwell. 🐻

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Who Is the Information Broker in The Sims 4?

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- All Kamurocho Locker Keys in Yakuza Kiwami 3

- How to Unlock & Visit Town Square in Cookie Run: Kingdom

2025-06-25 17:16