- 72 crypto ETFs waiting like a crowded DMV line — and now Paul Atkins might cut the line. 🤷♂️

- New SEC boss Paul Atkins: Will he speed things up or just shuffle paper like his predecessor? 🧐

So here we are again, the crypto market’s bouncing back like that annoying cousin who never leaves a party early, and now everyone’s eyeballing these 72 crypto ETF applications like they’re the next big thing. Or just hoping they don’t get lost in regulatory limbo forever.

Eric Balchunas’ Crypto ETF Soap Opera

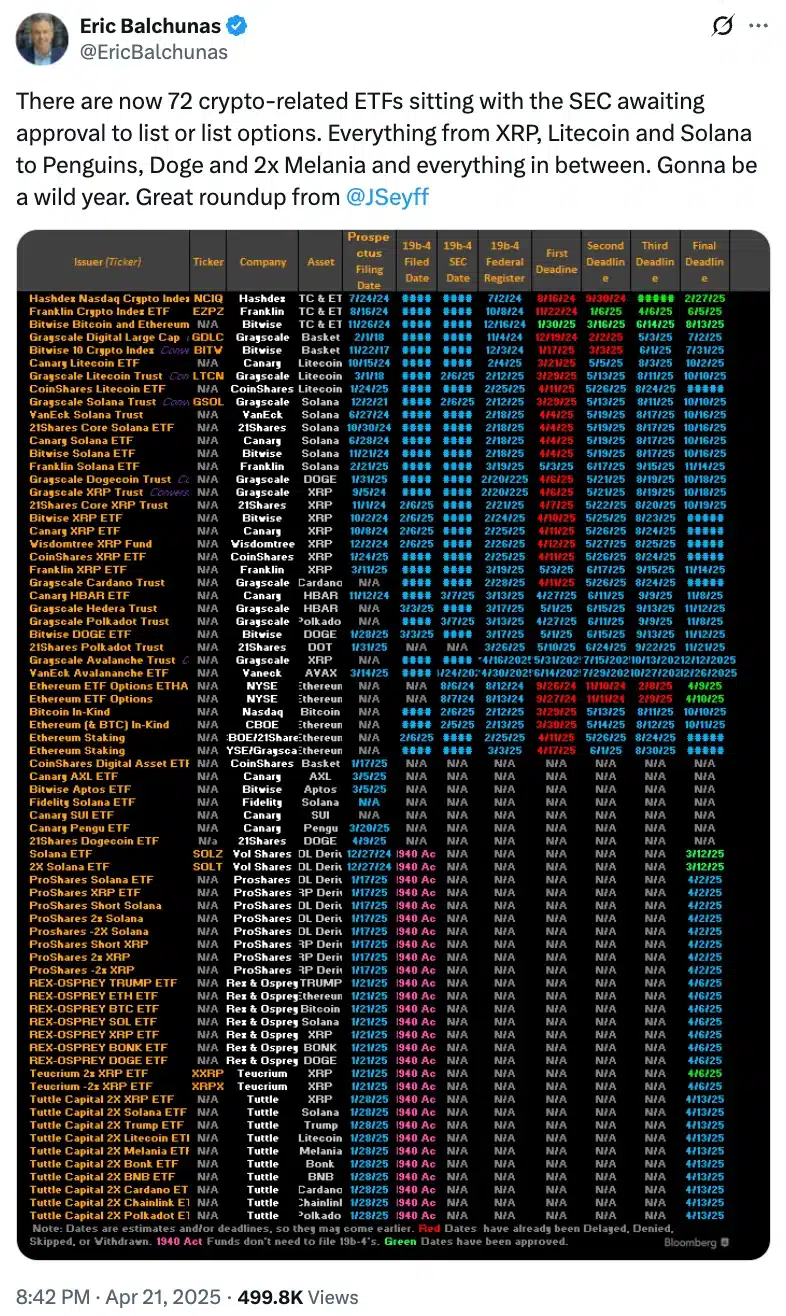

Bloomberg’s senior ETF analyst Eric Balchunas spotted this mountain of crypto ETF proposals waiting for the SEC’s nod—72 in total. That’s right, seventy-two. You could start your own crypto ETF zoo at this point.

Thanks to analyst James Seyffart for keeping the list — it’s a bit like a fantasy football draft, except instead of touchdowns, you get “spot ETFs” and “leveraged funds.” Fun!

This buffet includes everything from your basic Bitcoin cousins to more exotic characters like Ripple (XRP), Solana (SOL), Litecoin (LTC), and yes, even Dogecoin (DOGE) — the crypto world’s class clown.

And wouldn’t you know it? XRP is hogging the spotlight with 10 filings. Apparently, everyone wants a piece of that Ripple pie. 🍰

The Meme ETF Madness and Other Oddities

It’s not just the boring mainstream cryptos hogging the limelight. Now you’ve got a parade of risk-laden, meme-themed ETFs strutting down Wall Street like they own the place. Leveraged, inverse, memecoin, you name it. It’s like the circus came to town but brought a financial twist.

Case in point: the “Melania 2x” ETF from Tuttle Capital. Yeah, you read that right. Who knew former First Lady endorsements would enter crypto ETF territory? 🎩

The filers range from old pros like Bitwise and Grayscale to new kids on the block like Canarx and, of course, Tuttle Capital — because every party needs some wild cards.

Not random picks, though. These assets have muscle: strong market caps, fans galore, and investors who apparently love the rollercoaster ride.

Solana is the shiny new kid on the blockchain — speedy, NFT-friendly, and dabbling in DeFi like it’s the tech equivalent of a multitasking ninja.

So the scene is set: institutional investors are kicking Bitcoin and Ethereum to the side for a bit, broadening their crypto horizons. Diversify or die trying, right?

Paul Atkins vs. Gary Gensler: SEC Smackdown or Just a New Coat of Paint?

Now enter Paul Atkins, the new SEC head who’s promising to be the crypto whisperer instead of the strict hall monitor Gensler was.

Atkins told Congress,

“My top priority? Work with my buddies in the SEC and Congress to make digital asset rules that actually make sense… you know, rational and principled stuff.” 🙄

So basically, no more wild goose chases and red tape marathons. Atkins is waving the possibility of clarity in one hand and maybe even approvals in the other. Feels a little like waiting for a miracle, but hey, miracles happen.

And guess what? While the U.S. clumsily tries to catch up, South Korea is eyeing Bitcoin ETFs too, but only if Japan gets their act together first. Nothing like a little international crypto leapfrog to spice things up.

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- AI16Z PREDICTION. AI16Z cryptocurrency

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Nvidia Reports Record Q1 Revenue

2025-04-24 01:22