Imagine you’re sipping your artisanal coffee, and suddenly, Quant (QNT) decides to be the Wall Street daredevil of the year. Its price is teetering on the edge of a 47% jump, possibly breaking through what I’d call “that last annoying barrier,” which, frankly, sounds like a VIP velvet rope for cryptocurrencies. As if all the supply on exchanges weren’t enough to make investors sweat, the big players who hold a ton of QNT are now feeling generous—scooping up more like it’s a Black Friday sale on tokens. 🤑

Just last Wednesday, QNT climbed to $116, sprouting 95% from its springtime low—probably because it’s tired of being ignored by crypto enthusiasts. It’s now hanging around its January highs, probably checking itself out in the mirror and thinking, “Yeah, I look good.”

And here’s the twist: the world of real-world asset tokenization isn’t just a fancy buzzword anymore; it’s a booming industry with over $23 billion worth of assets tokenized. Apparently, more folks are trusting that their assets will magically turn into blockchain fairy dust—climbing over 13% in the last month alone, reaching 113,794 holders. Who knew that digital assets could be so popular? 🧙♂️

Quant isn’t just sitting around basking in the attention. It’s playing a vital role in this RWA party with its overledger solution—think of it as a digital Uber for blockchain networks, making sure everyone from old-school banks to tech giants like Amazon and Oracle can share the same ride. The overledger system is basically a three-layer cake of transactions, messaging, and rules—layered so smoothly, even Gordon Ramsay would be impressed. 🍰

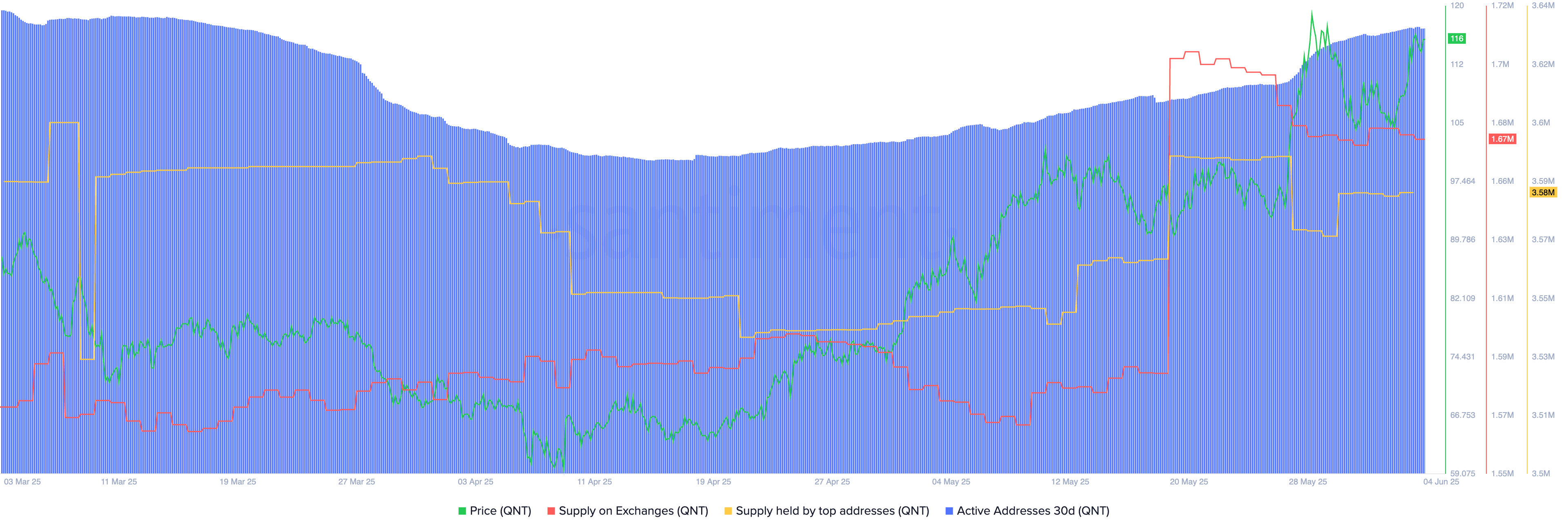

Big intelligence like the Bank of England, BNY Mellon, and even the European Central Bank are cozying up to Quant, working on projects like the digital euro—because what’s more charming than a virtual currency, right? Meanwhile, the high-rolling wallets of top addresses are stocking up, increasing their holdings from 3.54 to 3.58 million tokens since March, while exchange supplies are trickling down—a bit like that one cousin who likes to hide snacks from everyone.

This growing love affair extends beyond ownership; Quant’s network activity has exploded, with more and more anonymous users hopping on board. It’s like a crypto rave, but with less glow sticks and more digital signatures. 🎉

Quant’s Price is Riding the Hydration Wave — Will It Survive the Big Hurdle?

If you’re still skeptical, look at the daily chart—QNT has been on a rollercoaster with a solid upward trend in the last two months. Remember when it dipped to $58.75 amidst a market panic? Yeah, good times. Now, it’s forming a “golden cross,” a fancy term that just means the big, slow-moving averages crossed in a way that might mean more upward action. The last time that happened, Bitcoin probably threw a party.

Its next big obstacle? The tiny, but mighty $120 mark—think of it as the velvet rope outside a nightclub. Break that, and we’re eyeing the November high of $171.48—that’s a veritable 45% jump, enough to make even the most stoic investors grin like Cheshire cats. Or at least chuckle nervously. 🎯

Read More

- AI16Z PREDICTION. AI16Z cryptocurrency

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Top 8 UFC 5 Perks Every Fighter Should Use

- USD ILS PREDICTION

- Tainted Grail: How To Find Robbie’s Grave

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Mandragora Adds Permadeath & New Game Plus

2025-06-06 16:04