So, Bitman has declared Arbitrum “the best ETH eco by a million miles” on X, which is basically like saying your cat is the best cat in the world. But hey, who are we to argue? The market is buzzing like a bee on a sugar high, and everyone’s got their eyes peeled for a potential breakout. ARB has already strutted its stuff above $0.44, forming a lovely ascending channel. Some folks are convinced this is just the beginning of a glorious rise to the top. 🐝✨

Technical Outlook: Arbitrum Eyes Key Levels Within Ascending Channel

Currently, Arbitrum is dancing within a well-defined ascending channel, recently prancing above the $0.44 mark. Analyst Tom B has pointed out that the next critical resistance is lurking around $0.5176, which could either send the bulls galloping forward or have them tripping over their own hooves. If the momentum holds and the bulls clear this level, we might just see a retest near $0.55 to $0.57. Fingers crossed! 🤞

But wait! If ARB can’t keep its act together above current levels, we might be looking at a pullback toward the lower band of the channel, with $0.44 being the key decision point. A breakdown below that could send ARB tumbling down to the $0.30 zone. It’s like a rollercoaster ride, but without the safety harness. 🎢

Arbitrum Under a Major Mixed Sentiment Environment

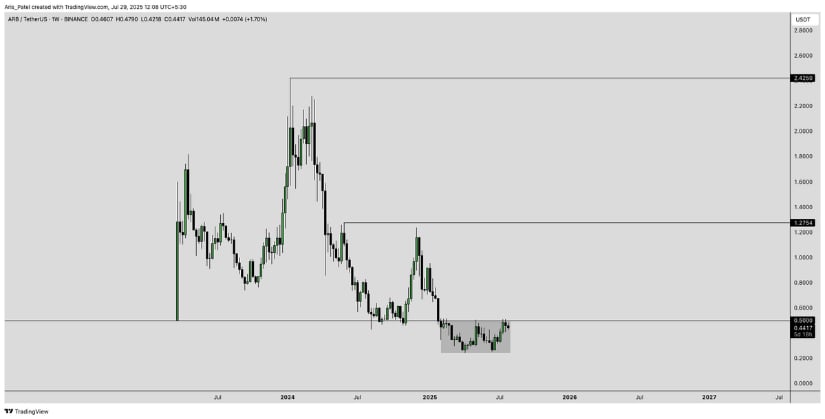

Now, let’s talk about the analysts—Aris and Smcapitalclub—who seem to be playing a game of “good cop, bad cop.” Aris is feeling bullish, sharing a long-term weekly chart where ARB looks like it’s finally stabilizing after a dramatic downtrend. The range between $0.44 and $0.50 is being treated as a cozy little base, and if ARB can push through, we might be looking at targets as high as $1.23 and even $2.65. Dream big, right? 🌈

On the flip side, Smcapitalclub is waving a caution flag, pointing to “dynamic liquidity” lurking beneath ARB’s current price. Their 6H chart suggests a potential breakdown from the ascending structure, with a yellow path leading to the $0.32 to $0.34 liquidity zone. It’s like a game of hide and seek, but with money. 💸

So, we’ve got a classic mid-range tension setup here. While the weekly timeframe suggests ARB might be forming a larger base, the intraday risks are still lurking like a cat waiting to pounce. Until Arbitrum price reclaims $0.48 to $0.51 with some serious conviction, the risk of short-term liquidity grabs will likely stick around like an unwanted houseguest. 🏠

Arbitrum Ecosystem Growth Tilts the Bias Toward Bulls

Despite the mixed signals, Arbitrum’s on-chain fundamentals are flexing their muscles. ShinoXBT has noted that the network just recorded an all-time high of over 20.28 billion ARB in net inflows for July. That’s like a party where everyone shows up with gifts! 🎉

Perpetuals trading volume also surpassed $837 billion, solidifying Arbitrum’s status as a major liquidity hub. The narrative is shifting toward institutional adoption and real-world asset (RWA) infrastructure. While retail sentiment is still wrestling with range-bound price action, these emerging fundamental triggers could be just what we need to kickstart the next move. Let’s hope! 🙏

Arbitrum Price Prediction Targeting 12X

Building on this newfound strength, analyst CryptoSmith0x is bringing a longer-term perspective into focus with a clean breakout from a weekly falling wedge. The chart shows Arbitrum has broken above the descending trendline resistance. With price now curling upward and maintaining structure above the $0.46 mark, the setup is adding weight to the broader bullish narrative. It’s like a plot twist in a rom-com! 📈

This formation aligns beautifully with previous H2 levels, including the $0.51 resistance from Tom B’s ascending channel outlook and the $1.23 macro zone highlighted by Aris. If the wedge follows its historical pattern, we might just be looking at a significant 12X move in the long term. Who doesn’t love a good comeback story? 📖

Final Thoughts: Can Arbitrum Chart Its Way to a 12X?

Despite the mixed short-term signals, Arbitrum’s broader structure is starting to favor the bulls, especially with the weekly falling wedge breakout and rising on-chain momentum. The key resistance at $0.51 is pivotal. If the bulls can reclaim and defend this level, it could mark the start of a broader trend, giving real weight to the long-term Arbitrum price prediction targeting $1.23 or even beyond. Fingers crossed! 🤞

That said, the full 12X upside remains a long-term vision and would require far more growth within the Arbitrum ecosystem itself. Increased developer activity, real-world adoption, and deeper institutional involvement will be essential to fuel such a rally. So, let’s keep our eyes peeled and our wallets ready! 💰

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Epic Games Store Free Games for November 6 Are Great for the Busy Holiday Season

- Overwatch is Nerfing One of Its New Heroes From Reign of Talon Season 1

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- How to Unlock & Upgrade Hobbies in Heartopia

- Sony Shuts Down PlayStation Stars Loyalty Program

- The Mandalorian & Grogu Hits A Worrying Star Wars Snag Ahead Of Its Release

- Meet the Tarot Club’s Mightiest: Ranking Lord Of Mysteries’ Most Powerful Beyonders

- Battlefield 6 Open Beta Anti-Cheat Has Weird Issue on PC

2025-07-30 00:36