Amidst the wild tempest of market chaos, the sturdy AVAX price refuses to bow, stubbornly camped around the $30 hill. Like a dog with a bone, it gnaws at hope, fed by the strange vigor creeping back from the realm of real-world assets and some on-chain mumbo jumbo that analysts love to babble about.

RWA Growth: The New Fuel Injector in AVAX’s Rusty Engine

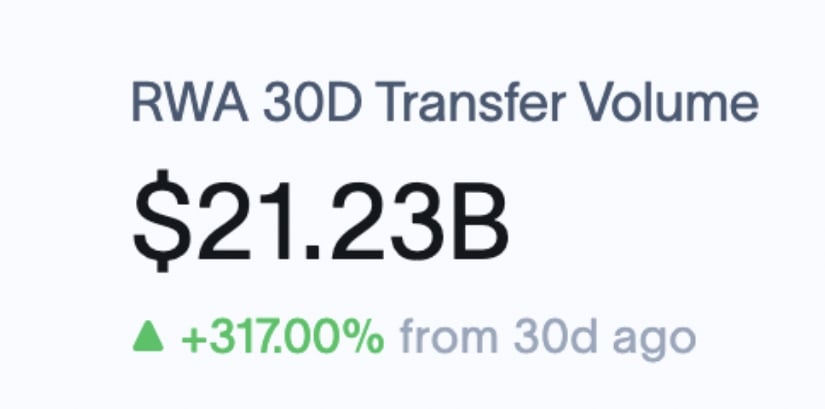

The RWA transfer volumes on AVAX just exploded to $21.23 billion over the last month, a laughable 317% leap from the previous measly figures. It’s as if tokenized assets and the old-school institutional crowd finally remembered this chain exists.

While most chains are still chasing their own tails, Avalanche might be quietly pocketing the capital flows, stacking bricks for its fragile castle. If the momentum holds, AVAX might just have found its shaky pillar of price narrative – or so the dreamers say.

Dream Big or Go Home: AVAX Aiming for $100+?

Our friendly neighborhood oracle, Chill on Value, lays out a roadmap where AVAX loafs between $25 and $30 like a cat napping, before suddenly sprinting to $50, and perhaps, if the stars align and the coffee kicks in, blasting past $100 in Q4. The lows have been rising, like a cautious climber testing the icy path-don’t fall yet, folks!

The chart whispers of volatility, sneak attacks by bears, and the eternal tug-of-war between bulls and impatience. The $28 to $30 zone is the battleground where warriors watch their backs, while $47 to $50 looms as the giant gatekeeper, ready to either let the caravan pass or shoo it back with a grunt.

The $30 Zone: AVAX’s Rocky Cliffhanger

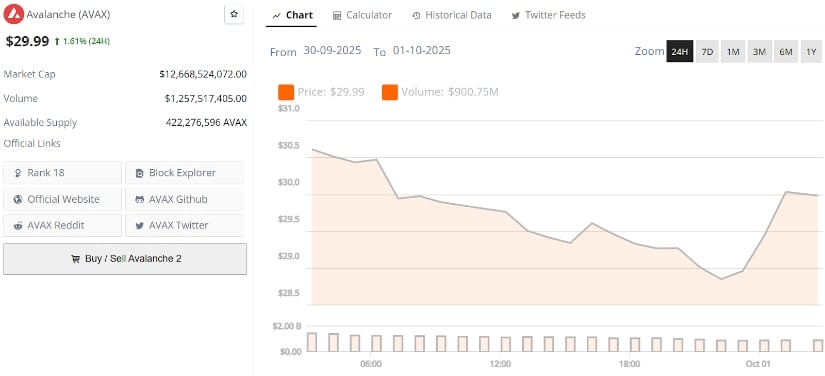

Currently twirling near $29.99 (the market’s equivalent of that “almost perfect” score), AVAX’s daily hustle is nothing to sneeze at, pushing over $900 million in volume. The token stumbles with lower highs, a clumsy dance of uncertainty, yet holds a fragile hope around that magic $30 plateau.

Should it slip below the $28 safety net, expect a tumble to $25, like a cat knocked off a ledge. Yet, a bounce over $32 could open the floodgates to $38, $40, and maybe pizza money by the weekend. Momentum indicators twiddle their thumbs in neutrality, like indifferent referees awaiting some actual action.

On-Chain Tally: Proof That AVAX Isn’t Just Spinning Its Wheels

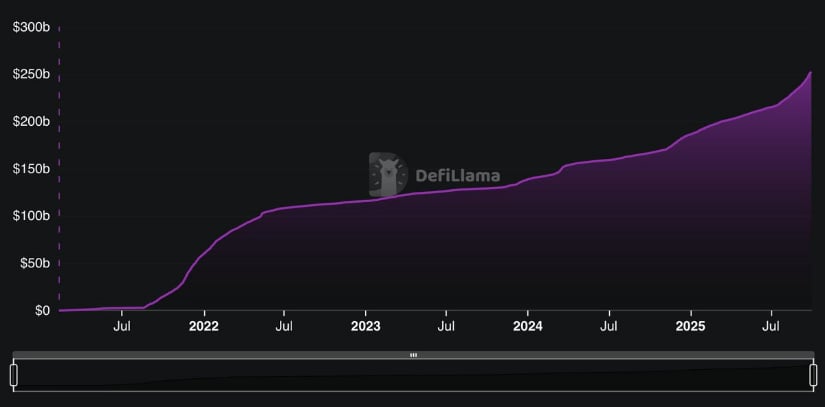

Cumulative trading volume on AVAX’s DEXs has crossed $250 billion – a number so big it could make your head spin faster than a politician’s promises. Despite price hiccups worthy of a soap opera, the network’s activity grows steadily, a heartbeat amid the chaos.

For those clutching their tokens in hope and sweat, this buzzing network action signals that maybe, just maybe, the fundamentals are catching up to the hype-or at least trying to.

Momentum Signs: Is AVAX Warming Up or Just Stretching?

According to Shan Specter, AVAX holds onto higher lows, a bit like a stubborn mule refusing to lie down. The RSI hangs in the middle, neither throwing a tantrum nor basking in euphoria. The MACD tries an awkward upward shimmy, hinting that the party might just get started.

With AVAX ETFs on the horizon and these mildly hopeful signals, the $47 and $89 price tags remain the shiny carrots dangling ahead-promises of glory or another cruel tease.

In Conclusion: AVAX’s Rocky Road Ahead

AVAX blends stubborn grit with soft whispers of real strength. The surge in real-world asset dealings and steady on-chain hustle lend some weight to the dreams of $50 to $100 targets. Yet, the $28 to $30 zone remains a harsh checkpoint-fall below, and the journey might involve some soul-searching retreats.

Q4 looks like a tense season, with Avalanche poised at a precarious crossroads, hoping the market gods smile upon its shaky fundamentals, or at least don’t throw too many rotten tomatoes its way.

Read More

- One Piece Chapter 1174 Preview: Luffy And Loki Vs Imu

- Mewgenics Tink Guide (All Upgrades and Rewards)

- Top 8 UFC 5 Perks Every Fighter Should Use

- How to Play REANIMAL Co-Op With Friend’s Pass (Local & Online Crossplay)

- Sega Declares $200 Million Write-Off

- Violence District Killer and Survivor Tier List

- All Pistols in Battlefield 6

- Full Mewgenics Soundtrack (Complete Songs List)

- All 100 Substory Locations in Yakuza 0 Director’s Cut

- Gold Rate Forecast

2025-10-01 23:10