Will Bitcoin Really Reach $250,000? Everyone’s Betting on the Crazy Ride! 🚀😂

In the vast, echoing corridors of financial hope and despair, Bitcoin dances—sometimes like a sober gentleman, other times like a drunken poet—predicting a future that makes gold look like yesterday’s news. Recent analysts, with the serious face of those who think fortune-telling is a profession, declare that Bitcoin might soar past $200,000 next year. Yes, you read right—more zeros than a trolley full of circus elephants. And perhaps, in a final act of bravado, will even hit $250,000 by 2025—an astonishing figure that seems as real as a unicorn sipping martinis in Wall Street’s back room. Traders, beware: the swings are more violent than grandma’s knitting needles, and the short-term dips may leave your portfolio in tears—though isn’t that part of the charm? 🎢😂

Bitcoin’s Gold Crush: A Love Story in Ounces

According to the oracle of Bitcoin forecasts, Apsk32, gold and Bitcoin are locked in a slow waltz—gold reaching a sassy $3,500 per ounce while Bitcoin lags behind, plotting its dramatic rise. Instead of gazing at the dollar bills, he compares Bitcoin to ounces of gold, shielding himself from the inflation monster hiding under Fed’s bed. Seems simple enough: if gold’s doing well, Bitcoin is just waiting in the wings to steal its thunder—probably while wearing a shiny hat and carrying a bag of digital gold, just in case you missed the memo. Who needs paper when you’ve got ounces, right? 🤷♂️

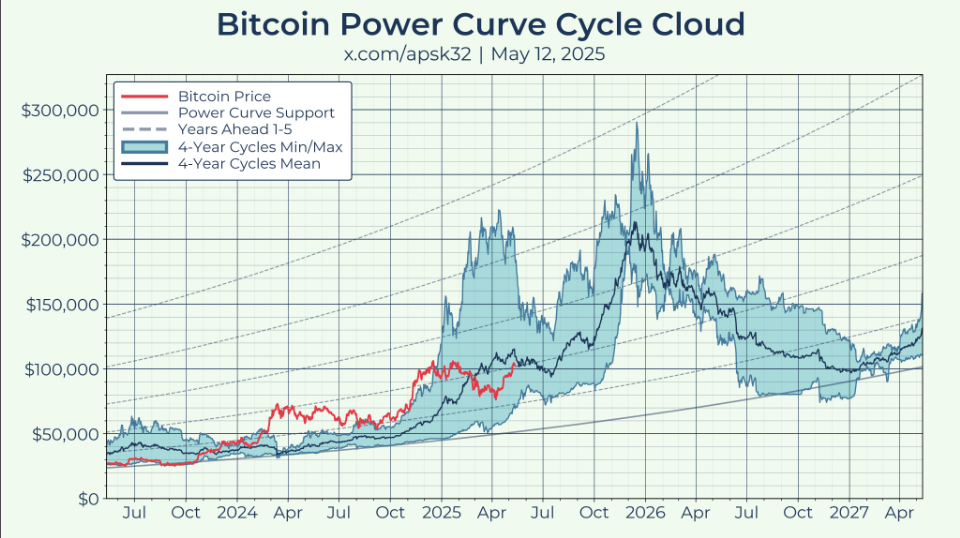

The Power Curve: Bitcoin on a Rollercoaster

Apsk32 draws a “power curve,” as if plotting some New Age spiritual guide—except it curves around Bitcoin’s market cap in gold ounces, stretching back to its 2017 nightmare of $20,000. According to this mystical chart, 2025 might see Bitcoin reaching above $200,000—an ascent so high, even Icarus might look down with envy. If Bitcoin keeps improving its position relative to gold, the returns could surpass even the most optimistic dreams. As the analyst self-assures, hope springs eternal—so hold onto your hats, or better yet, your Bitcoins. 🧙♂️

Bitcoin’s position relative to gold has gotten better since April. That’s my magic trick—hope for higher-than-expected returns later this year. 🎩✨

BTC-USD borders on greed—scary, sure—but isn’t that where we’re supposed to be when dreaming of riches? Better to be greedy than melancholy, no? 😏

— apsk32 (@apsk32) May 16, 2025

Forecasts and Fantasies: How High Can It Go?

While some prophets whisper of $444,000 as if it’s the price of a fancy latte—five years ahead of its time—Apsk32 prefers the more modest $220,000. Still, he concedes, there’s a “decent chance” it hits $250,000, which is romantic and all, but let’s not get carried away. After all, that’s roughly a tenfold jump from late 2022’s $22,000, enough to make even the most hardened hodler blush with joy. But remember, in the unpredictable land of crypto, today’s victory could turn into tomorrow’s nightmare faster than you can say ‘blockchain.’

Gold’s Future and Bitcoin’s Fantasies

Other wise sages suggest that if gold reaches $5,000 per ounce—imagine that, a shiny metal so dear, it crowd-sells the moon—and Bitcoin claims half of gold’s market cap, then our beloved digital gold could be worth over $920,000. Of course, this hinges on scenarios, not promises, so don’t sell your old gold just yet—unless you’re keen on gambling with your grandmother’s jewelry. 🤔

The Rarity and the Risks: Supply Meets Drama

Bitcoin’s supply is as finite as the patience of a bored auditor—limited to 21 million coins. Every four years, a halving event occurs, making new Bitcoin scarcer and scarier, as if each coin were the last cookie in the jar. The next halving is in 2024, reducing miner rewards from 6.25 to 3.125 BTC—probably causing miners to consider knitting sweaters instead. But beware: demand isn’t constant, and the whims of the market can turn snake oil into gold—or vice versa. In this game, volatility isn’t just an inconvenience; it’s the main act. 📉📈

Risks, Rewards, and the Comedy of Chaos

Gold and Bitcoin are two unpredictable lovers—sometimes they drop, sometimes they soar—like a slapstick comedy without the laugh track. Traders brace for surprises: a sudden profit-taking plummet, or Bitcoin’s unpredictable swings of 20% or more in a single day. Political chaos, tech upgrades, and regulators have a habit of crashing the party just when things seem calm. Nevertheless, cryptic scenarios help brave investors plan their conquest—or retreat swiftly if the market dances out of tune. 🎭

Read More

- Nine Sols: 6 Best Jin Farming Methods

- How to Unlock the Mines in Cookie Run: Kingdom

- Top 8 UFC 5 Perks Every Fighter Should Use

- Link Click Season 3 Confirmed for 2026—Meet the Mysterious New Character Jae Lee!

- Delta Force: K437 Guide (Best Build & How to Unlock)

- USD ILS PREDICTION

- USD RUB PREDICTION

- Invincible’s Strongest Female Characters

- How to Get 100% Chameleon in Oblivion Remastered

- MHA’s Back: Horikoshi Drops New Chapter in ‘Ultra Age’ Fanbook – See What’s Inside!

2025-05-17 03:10