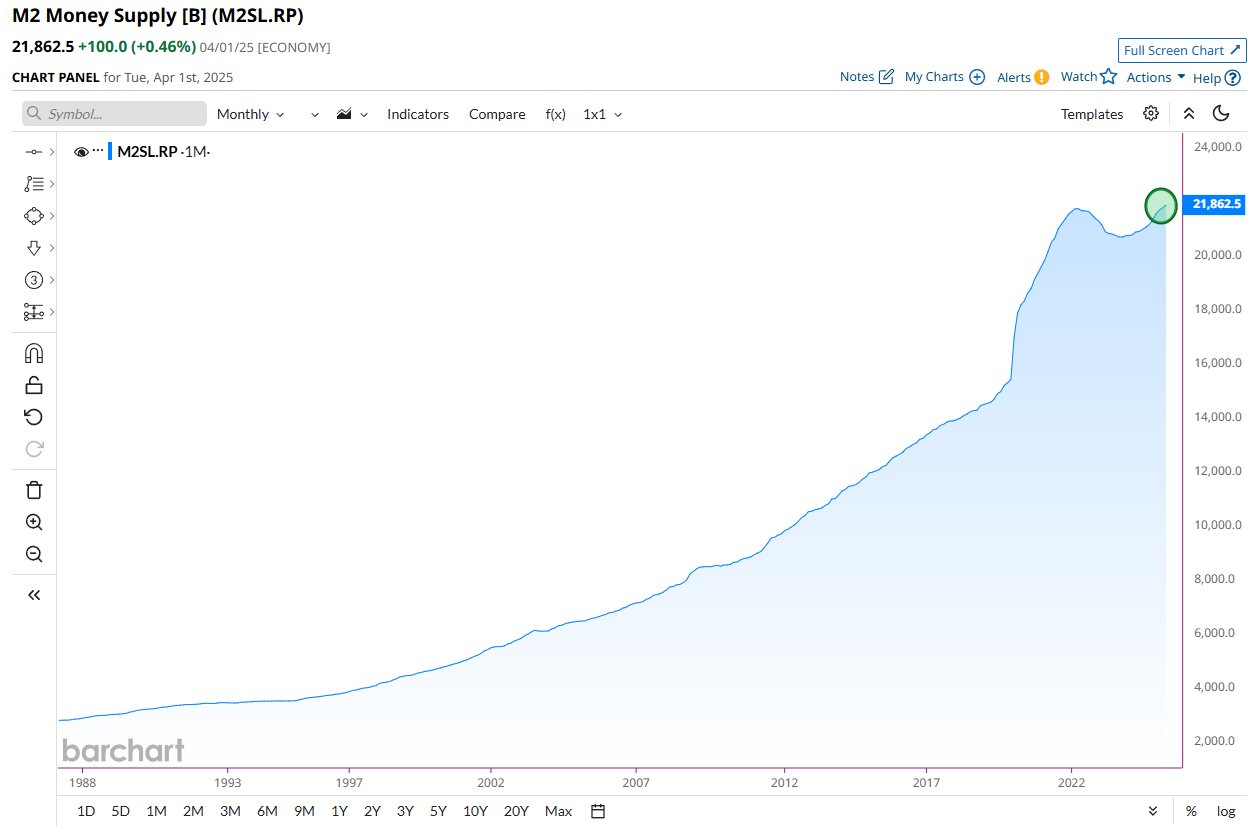

The M2 money supply has astonishingly reached a staggering $21.86 trillion, sparking a glimmer of hope among investors that Bitcoin (BTC) might soon join the exuberant party. 🎉

This financial fireworks display comes amid a backdrop of economic chaos: rising national debt, reckless government spending, and inflation that makes your grocery bill resemble a small mortgage. Who knew we could be so optimistic? 🤔

How a Record $21.86 Trillion in M2 Might Make Bitcoin Look Good in Comparison

For those who prefer their economics served plain, M2 measures all the money floating around—think cash, checking accounts, savings, and all the fancy mutual funds—basically, the entire Potemkin village of the US economy. 🏦

According to the latest data from Barchart (which knows more about money than your bank account), this figure has hit an all-time high of $21.86 trillion. Truly, a moment of celebration—if only for economists to weep into their spreadsheets.

The surge coincides with America’s delightful economic malaise. A pseudonymous analyst known as Tech Lead (because genuine identity is overrated) took to X (TED Talk for the Twitter-addicted) to reveal the US debt-to-GDP ratio has skydived into the stratosphere. Apparently, we’re all just sitting on a financial firework ready to explode. 🎆

Net interest payments now gobble up 20% of federal revenue—because paying interest on debt is apparently more fun than a barrel of monkeys—and government spending continues to outrun the revenue like a marathon runner after free pizza.

“M2 money supply surging to all-time highs. Money printer is on,” he proclaimed, sounding like a man who’s just found his country’s magic money tree. 🌳

Yet, amidst this monetary madness, experts are increasingly convinced Bitcoin might be the silver lining—or at least a shiny distraction—in this economic circus. Their optimism hinges on history: broadly, when M2 grows, Bitcoin tends to follow suit, as if attracted by the siren song of digital gold.

“On average, M2 Global Money Supply tends to lead BTC price by around 12 weeks. Recently, M2 hit a new all-time high of $21.86 trillion. That strongly suggests BTC may follow suit in the coming months,” Weiss Crypto confidently claimed, as if predicting the future is as easy as guessing tomorrow’s weather. ☀️

Tech Lead also chimed in, adding his sage wisdom.

“There’s a lot of mixed signals, but the only one that really matters is liquidity. Follow the money,” he said, sounding like a financial Sherlock Holmes in a pinstripe suit.

So, why does Bitcoin tend to rise when the M2 balloon inflates? Well, as M2 expands, it dilutes the value of everyday cash, prompting investors to seek refuge in Bitcoin—our digital Ark during the flood of fiat. Plus, more liquidity fuels speculation, like throwing gasoline on a fire that’s already burning.

Lower interest rates make boring old savings accounts less appealing—who needs a 0.5% return when Bitcoin might turn into a rocket? 🚀

“When you follow Global M2 money supply, you realize everything else is just noise,” investor James Wynn quipped, perhaps while sipping a very expensive coffee.

Adding to this chorus of economic prophecy, mathematician and analyst Fred Krueger (no relation to the nightmare villain) pointed out that since 2000, the global money supply and US debt have both been growing at roughly 8% annually.

But fear not! Bitcoin is not just a leaky bucket losing 8% of its value yearly. It’s more akin to a rocket—growing at a staggering 40% per year, and possibly saving your portfolio from the impending financial apocalypse. 💼🔥

“Basically, we have a ‘leaky bucket’ that loses 8% of its value a year. Stocks almost make up for it. Not after taxes. Housing does not make up for it. At all. Bitcoin doesn’t leak and is growing 40% per year,” Krueger asserted, making it sound almost poetic.

These clamorous signs point to a bullish future for Bitcoin, which had previously peaked at an eye-watering $111,917 on May 22, only to tumble down like a teenage rollercoaster. 🎢

According to BeInCrypto, Bitcoin has faltered by 2.9% over the past week and currently trades around $104,529—a modest dip to remind us that in crypto, it’s always a rollercoaster, not a merry-go-round.

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Nvidia Reports Record Q1 Revenue

- Switch 2 Sales Soar to Historic Levels

2025-06-05 11:13