As Bitcoin, that most capricious of digital curiosities, doth approach the formidable sum of one hundred thousand dollars—a number likely to inspire either jubilation or faint-heartedness—various learned persons and their arcane instruments declare that a most notable explosion of interest might soon bedeck the horizon. Foremost among these prognosticators is the curious figure known as Bitcoin’s Apparent Demand, which hath recently taken a spirited leap from its languishing depths, thereby suggesting a rekindling of market affections and diligent hoarding.

A Most Vigorous Revival in Bitcoin’s Apparent Desire

According to a recent dispatch from the denizens of CryptoQuant, penned by the industrious IT Tech, this Apparent Demand has returned to the positive realm whence it had been exiled for many a week, languishing in the dreariness of crimson figures.

For those not initiated into such financial tomfoolery, this tally—being a summation over the recent thirty days—endeavours to capture the net appetite for Bitcoin by espying accumulations in private purses and the ebbing tide of coins from exchanges. A sudden swelling in this ledger signals that the amphitheatre of buyers is growing, which is commonly presumed to gird the loins for a bullish dance—a price rally, if you will.

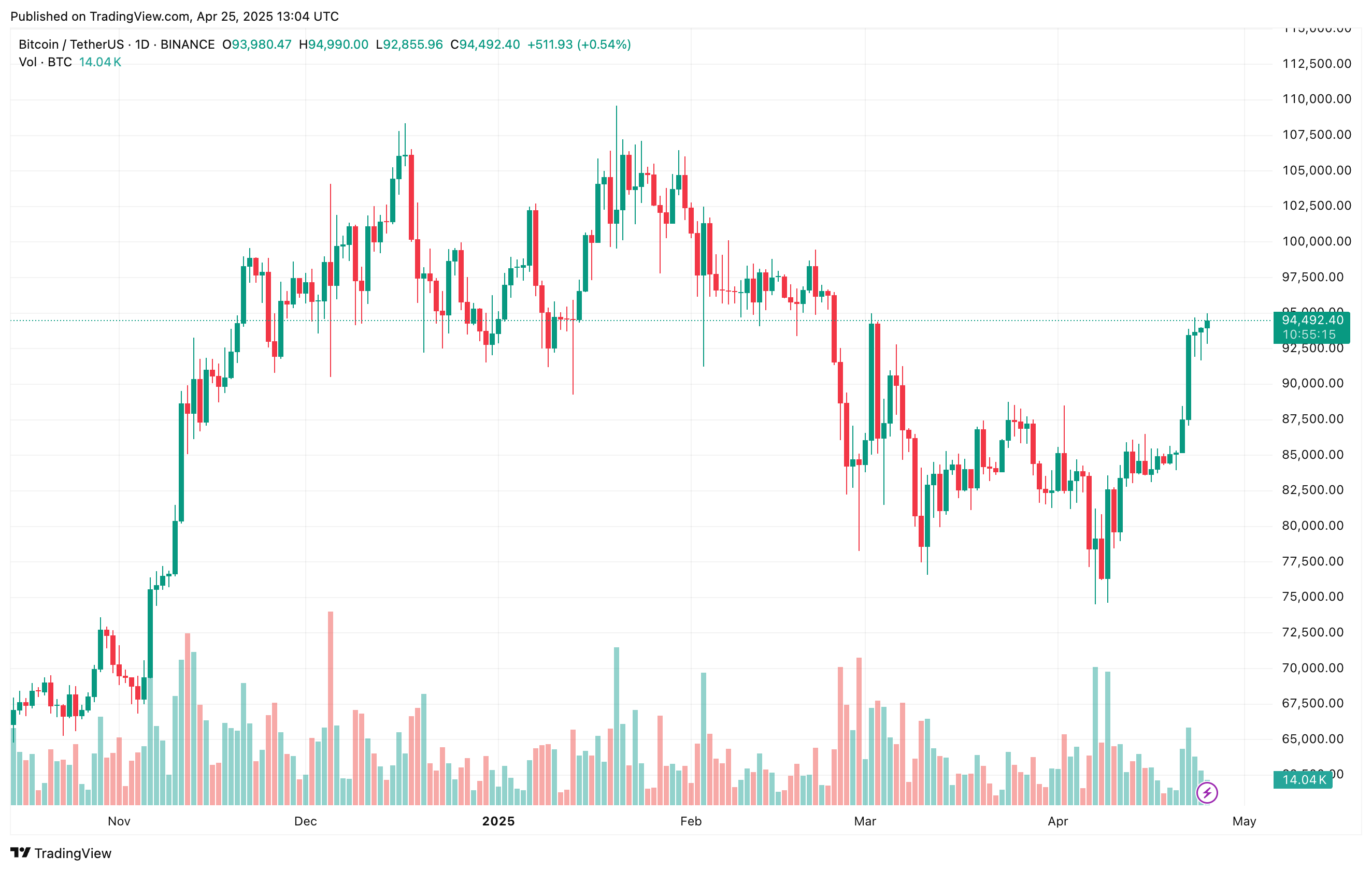

Observe, if so inclined, the accompanying chart where this spirited resurgence is laid bare, reflecting changes in the supplies dormant for a year, duly adjusted with daily coin dispensation—as though to measure the true heartbeat of organic demand amidst this tumultuous ballet.

Earlier, this demand hath plummeted so far as to be firmly in the red—dipping below the grotesque figure of negative two hundred thousand, a hue and cry that betokened a faltering breath in market zeal. Yet now, with a flourish, it strides back into positivity, as if the once slumbering capital hath now taken its tea and stirred itself anew. One brave soul did remark:

The demand pivot doth coincide with Bitcoin’s recent rise beyond eighty-seven thousand dollars, implying that this revival is not mere speculative whimsy but grounded in bona fide chain-bound transactions.

This marks the first time since the fickle month of February that such optimism hath been recorded, and it pairs well with the influx of sprightly investments into spot Bitcoin ETFs—as well as the determined clutching of coins by those long committed to this endeavour.

Data from the notable SoSoValue reveals that for five days running, American-held spot BTC ETFs have witnessed an influx exceeding two and a half billion dollars. In total, no less than thirty-eight billion have thus been amassed in these instrumentalities—a sum that might provoke envy or bewilderment in the unacquainted.

Does a Bitcoin Rally Await the Bewildered Masses?

Master IT Tech advises us that such reversals in Apparent Demand have hitherto been portents of either grand ascents or stalwart periods of price resilience. Should this current trend persist, Bitcoin might indeed marshal sufficient vigour to contest the ninety-thousand-dollar bastion very soon.

Nonetheless, prudent voices caution that Bitcoin must cling fast to its present stronghold near ninety-one thousand five hundred dollars to sustain any upward flirtations. This price is of particular consequence, being close to the realized holdings of those fleeting BTC possessors, as shared by CryptoQuant’s enlightened Crazzyblockk.

Adding yet another flourish to this speculative opera, the notable soothsayer Rekt Capital hath declared that a weekly close north of ninety-three thousand five hundred dollars—secured thereafter as steadfast support—is requisite for a clear passage to the elusive hundred-thousand-dollar summit. At the very moment of this writing, Bitcoin doth trade at ninety-four thousand four hundred ninety-two dollars, enjoying a modest ascent of two percent in the previous day.

Powered by Pollinations.AI free text APIs. [Support our mission](https://pollinations.ai/redirect/kofi) to keep AI accessible for everyone.

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- AI16Z PREDICTION. AI16Z cryptocurrency

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Nvidia Reports Record Q1 Revenue

2025-04-26 08:57