As a seasoned crypto investor with a knack for spotting trends and a penchant for taking calculated risks, I have to admit, the recent surge of Dogecoin has piqued my interest. Having ridden the rollercoaster of cryptocurrency market fluctuations since its inception, I’ve seen firsthand the unpredictable nature of this dynamic world.

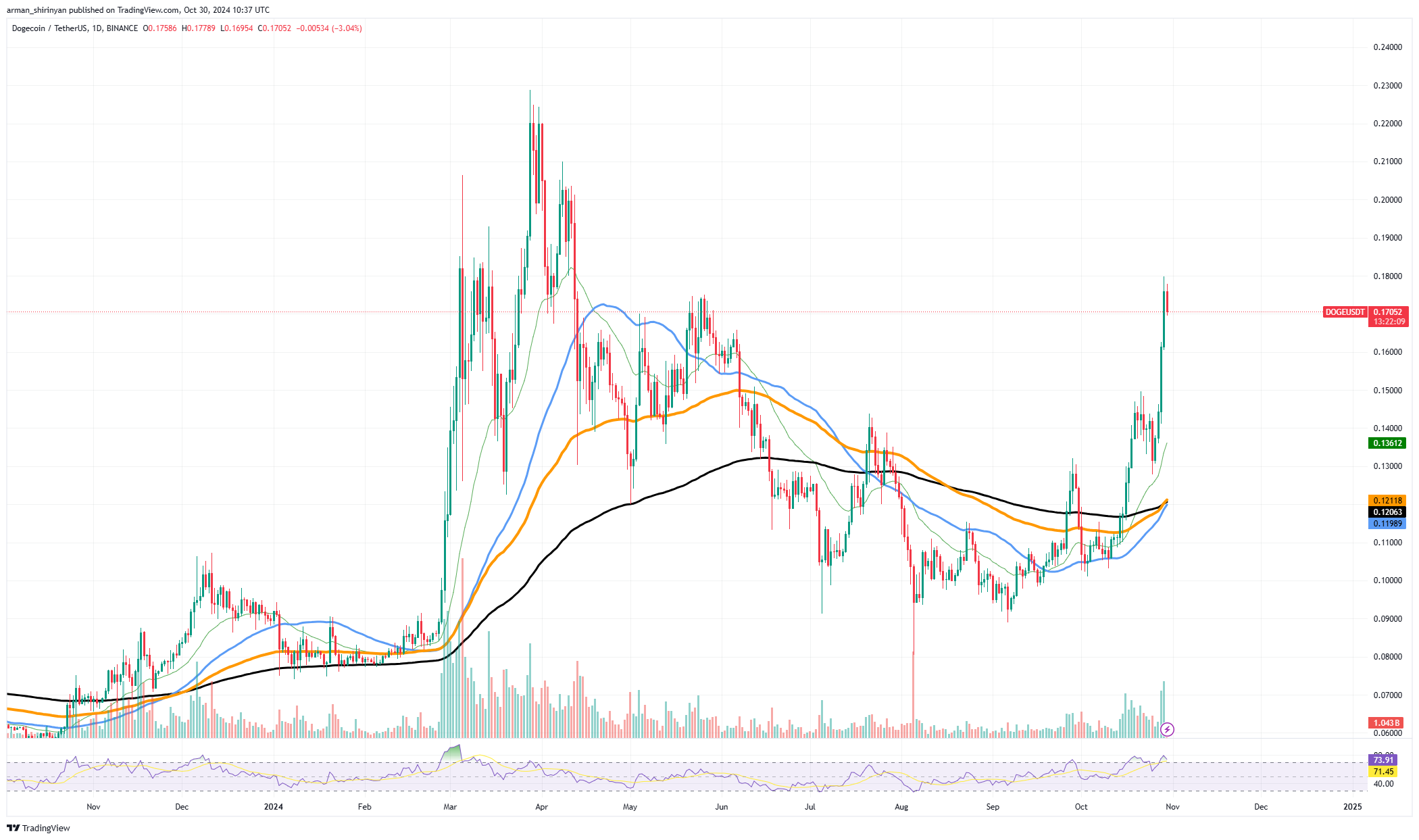

Lately, the significant surge in value for Dogecoin has ignited conversations about whether it could potentially reach the coveted $1 threshold. The asset’s robust upward trajectory is evident from the rapid rise in its price over just a few days, which amounted to a 24% increase.

Despite past significant price spikes, reaching a value of $1 for Dogecoin (DOGE) would mark its first time and establish a new milestone for the digital asset. The substantial trading activity and renewed enthusiasm during the recent surge hint at potential future growth for DOGE. However, achieving a price of $1 isn’t solely dependent on short-term market momentum; it requires sustained buying interest, preferably backed by a broader market uptrend, especially in Bitcoin, to materialize effectively.

Previously, Dogecoin (DOGE) has benefited from its meme popularity and support from well-known figures. But for it to reach a significant price point such as $1, a mix of favorable market conditions, strong institutional interest, and overall crypto market expansion is required. The path of DOGE is heavily affected by Bitcoin‘s performance. As new funds flow into the cryptocurrency sector, altcoins like DOGE often mirror Bitcoin’s upward trend.

If Bitcoin enters a new expansion period and overall market optimism remains strong, it could boost the likelihood of DOGE rising to higher valuations. Additionally, the worth of Dogecoin might be enhanced, along with investor appeal, if its infrastructure and community see further progress, such as expanded payment options or integration into novel projects.

Presently, DOGE is facing resistance at approximately $0.18. Pushing past significant resistance points could potentially uncover further price objectives if the positive trend persists; short-term achievable goals might be around $0.25 and $0.50. However, reaching $1 would likely require a prolonged bullish phase and increased market involvement.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- PlayStation and Capcom Checked Another Big Item Off Players’ Wish Lists

- EUR CAD PREDICTION

- Black Ops 6 Zombies Actors Quit Over Lack Of AI Protection, It’s Claimed

- APU PREDICTION. APU cryptocurrency

- XDC PREDICTION. XDC cryptocurrency

- POL PREDICTION. POL cryptocurrency

- MNT PREDICTION. MNT cryptocurrency

- EUR INR PREDICTION

2024-10-30 16:15