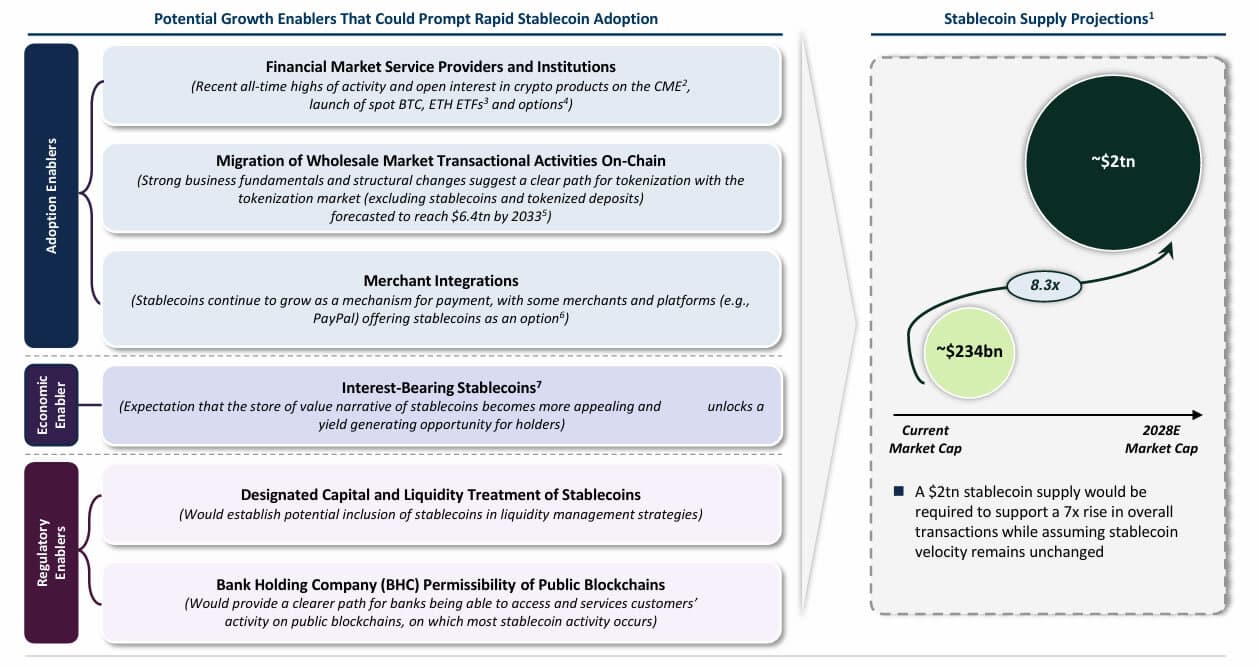

Oh, the sweet, sweet magic of money! As the world twirls into the future of digital assets, it seems like the stablecoin market is ready to take a giant leap, just like a kangaroo on a trampoline! According to the US Treasury’s report, released with all the excitement of a grand parade on April 30, this market could zoom from a modest $234 billion in 2025 to a jaw-dropping $2 trillion by 2028. No biggie, right?

Now, if you’re wondering how such a thing could happen, well, the Treasury’s crystal ball (aka research) suggests an 8.3x increase in stablecoin’s market cap by 2028. It’s like a magic trick where the coins just keep multiplying—except there’s no magician, just good ol’ market dynamics and some very clever regulations!

“Evolving market dynamics have the potential to accelerate stablecoins’ trajectory to reach $2 trillion in market cap by 2028,” the Treasury confidently declared. Well, we certainly hope they’re not just making it all up!

Big Predictions for the Future: Buckle Up!

So, what’s the secret sauce here? It’s the GENIUS Act, of course. No, that’s not a new reality show on Netflix—it’s the Guiding and Establishing National Innovation for US Stablecoins Act. The government has a knack for naming things, doesn’t it? This act is supposed to bring clarity and confidence to the market, making people trust stablecoins more than they trust their old, rusty coin collections.

The GENIUS Act would label “payment stablecoins” as digital assets pegged to the mighty US dollar, but with one small catch: they don’t earn interest. No free lunch here! And let’s not forget the reserve rules for issuers—because who doesn’t love a little bit of financial bureaucracy?

And wait—there’s more! The US House Financial Services Committee decided, in all its wisdom, to pass the STABLE Act (ah yes, more clever acronyms). This act gives the Office of the Comptroller of the Currency (OCC) the power to approve and supervise “federally qualified nonbank payment stablecoin issuers.” Sounds thrilling, doesn’t it?

Now, you might wonder: how does all this affect US Treasuries? Well, according to the Treasury’s prediction, stablecoin issuers could hold around $1 trillion in T-bills by 2028. That’s right, folks—a trillion with a T!

Let’s not forget the dizzying number of stablecoin transactions. Hold onto your hat! It’s projected that monthly stablecoin transactions could leap from around $700 billion today to a whopping $6 trillion by 2028. That’s about 10% of global forex spot transactions. Do I hear a collective gasp?

And if everything goes according to plan, stablecoins could become the shiny new financial tool not only for crypto nerds but also for traditional finance, corporate treasury departments, and maybe even sovereign wealth funds. It’s the kind of thing you’d expect to see in a Hollywood blockbuster, but with more spreadsheets and less action.

Oh, and for our friends in emerging markets, stablecoins are like a shortcut to the mighty US dollar without having to set foot in a US bank. This, of course, only strengthens the US dollar’s grip on the world. Take that, global economy!

The Wild World of Stablecoin Ecosystem

Right now, the stablecoin market cap sits at a cozy $244.5 billion, making up about 8% of the entire crypto market, which is a huge $3 trillion, according to Coingecko. I mean, that’s like having a giant pizza and only taking one slice. But don’t worry, the slice is growing!

The big daddy of the stablecoin market? Tether, with a dominating 61% share and a staggering $149 billion in circulation. Then we’ve got Circle, the plucky sidekick, holding 25% of the market with its USDC. And don’t forget USDS (formerly DAI), which still manages to hang on with a modest 3% of the pie.

And what’s this? PayPal, that old money titan, is making a move with its PYUSD stablecoin. However, it’s like a little mouse in a room full of lions, holding less than 0.36% of the market share. But hey, it recently teamed up with Coinbase to try and spice things up. Maybe it’s time for PayPal to shine!

Read More

- AI16Z PREDICTION. AI16Z cryptocurrency

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- USD ILS PREDICTION

- Tainted Grail: How To Find Robbie’s Grave

- Top 8 UFC 5 Perks Every Fighter Should Use

- Slormancer Huntress: God-Tier Builds REVEALED!

- Hands-On Preview: Trainfort

- LUNC PREDICTION. LUNC cryptocurrency

- Delta Force: K437 Guide (Best Build & How to Unlock)

2025-05-03 02:43