As a seasoned researcher with a knack for deciphering market trends and an unwavering interest in cryptocurrencies, I found myself intrigued by the recent surge of XRP. The 5.5% jump on New Year’s Eve was more than just a festive gift; it was a stark reminder of the power dynamics at play in this fascinating world of digital assets.

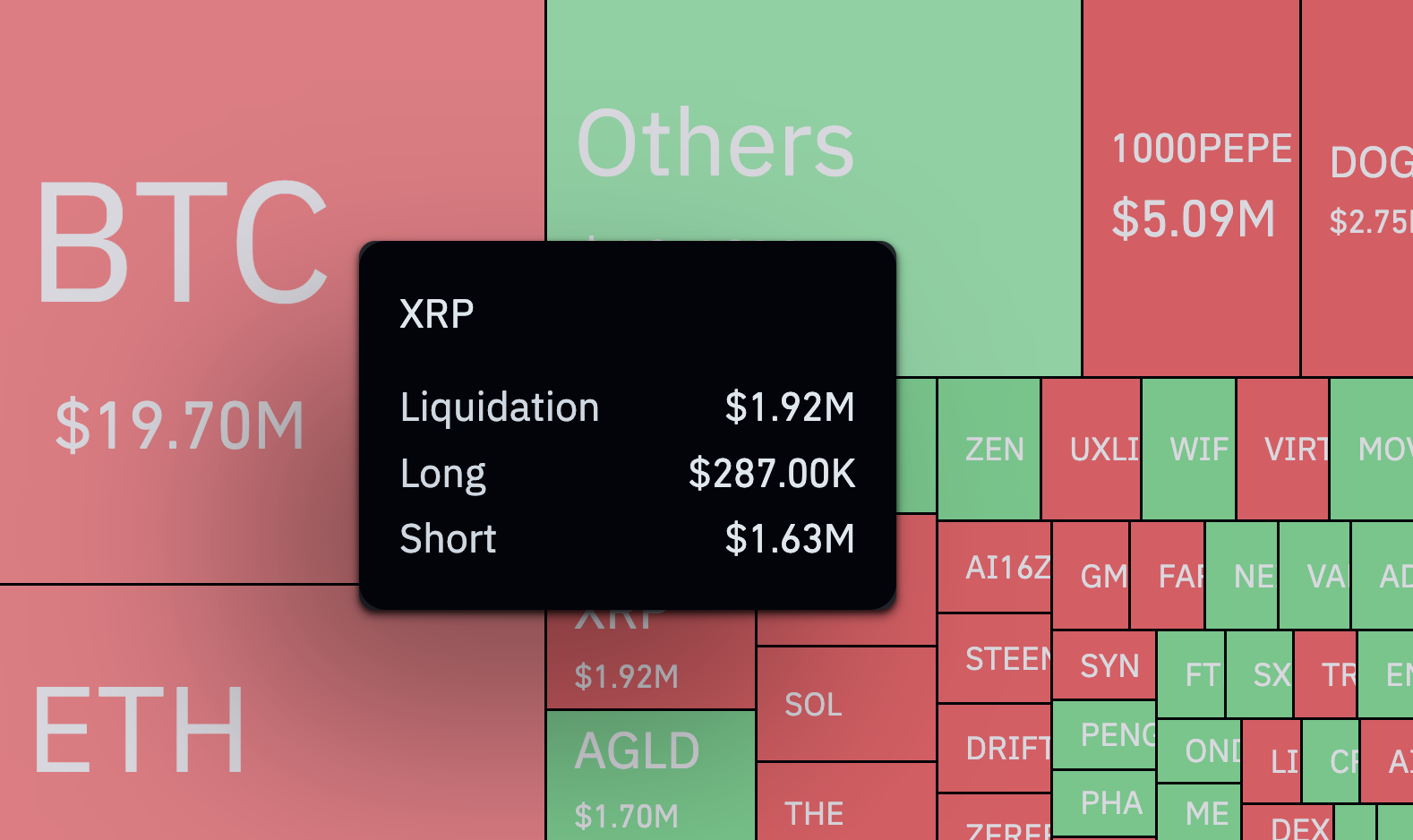

Analyzing the data from CoinGlass, I could not help but notice the epic liquidation imbalance caused by the recent pump. The fact that 84.89% of the positions worth $1.92 million were shorts being liquidated while only a small fraction, $287,000, were longs, was quite telling. To put it simply, the bears got crushed in this instance, with a staggering 567% more pain experienced by those who bet against XRP’s rise.

This trend wasn’t isolated to XRP, as out of the total liquidations on the crypto market worth $84.48 million in the period under review, 65.75% were shorts. The imbalance in XRP trading was almost 10 times higher, which speaks volumes about the short-term sentiment toward the popular cryptocurrency.

As we look ahead to 2025, the question remains whether this bullish trend will persist. Personally, I have learned not to underestimate the resilience of the market and the unpredictability of its twists and turns. But if I were to make a witty prediction, I’d say that XRP is poised to bid farewell to the bears with a “thanks for playing” message on New Year’s Eve and continue into 2025 with a “bull green” on its price chart – unless, of course, the market decides to throw us a curveball or two. After all, that’s half the fun!

And to lighten the mood, I’d like to add that it seems XRP has found its own version of the Grinch who stole Christmas – only this time, it was the bears who got their hearts three sizes too small. Happy New Year!

As the year 2024 draws to a close and welcomes 2025, the well-known cryptocurrency XRP has chosen to bring some good news to its market participants by showing an increase of up to 5.5% on its price graph today.

Instead of focusing on XRP’s price fluctuations, this piece discusses the impact of receiving such a late holiday gift from the well-known cryptocurrency. This impact is primarily demonstrated through the significant imbalance in liquidations due to the recent surge.

Consequently, it was discovered from CoinGlass data that over the past 12 positions, a total of $1.92 million in derivatives trading involving popular cryptocurrencies were liquidated. Interestingly, just about a quarter ($287,000) of this amount consisted of long positions, while an overwhelming majority of 84.89% were short positions.

Currently, the level of pain endured by bears (those who bet against an increase) was significantly higher than that of bulls (those who bet on an increase), amounting to 567%. This could explain why the rise in XRP’s price was so swift, as it seemingly squashed those who had wagered on its decrease.

During the examined timeframe, it wasn’t just XRP that was involved in this local trend; in fact, a significant portion of the overall liquidations across the cryptocurrency market, amounting to $84.48 million, were short positions, accounting for approximately 65.75%.

Looking at it another way, the disparity in XRP trading is about ten times greater, illustrating the temporary enthusiasm surrounding this well-known cryptocurrency. In other words, on New Year’s Eve, XRP effectively said goodbye to the bears with a “thanks for playing” gesture, and as we move into 2025, its price chart appears to be adorned with a “bullish green.

Whether this trend will continue into next year is an open question.

Read More

- 6 Best Mechs for Beginners in Mecha Break to Dominate Matches!

- One Piece 1142 Spoilers: Loki Unleashes Chaos While Holy Knights Strike!

- How to Reach 80,000M in Dead Rails

- Unlock the Ultimate Armor Sets in Kingdom Come: Deliverance 2!

- REPO: All Guns & How To Get Them

- Top 5 Swords in Kingdom Come Deliverance 2

- Unleash Willow’s Power: The Ultimate Build for Reverse: 1999!

- LUNC PREDICTION. LUNC cryptocurrency

- All Balatro Cheats (Developer Debug Menu)

- BTC PREDICTION. BTC cryptocurrency

2024-12-31 19:09