As a seasoned analyst with over two decades of experience in the dynamic world of finance and technology, I find myself intrigued by the recent surge of XRP, the digital asset associated with Ripple Labs. This decoupling from Bitcoin (BTC) and its remarkable price growth is a testament to the resilience and potential of this cryptocurrency.

In a notable development, the value of XRP, which is connected to Ripple Labs, has surged independently of Bitcoin (BTC). While Bitcoin saw a minor growth of 0.40% in the last day, XRP has skyrocketed by more than 10%, indicating its ability to stand on its own in the cryptocurrency market.

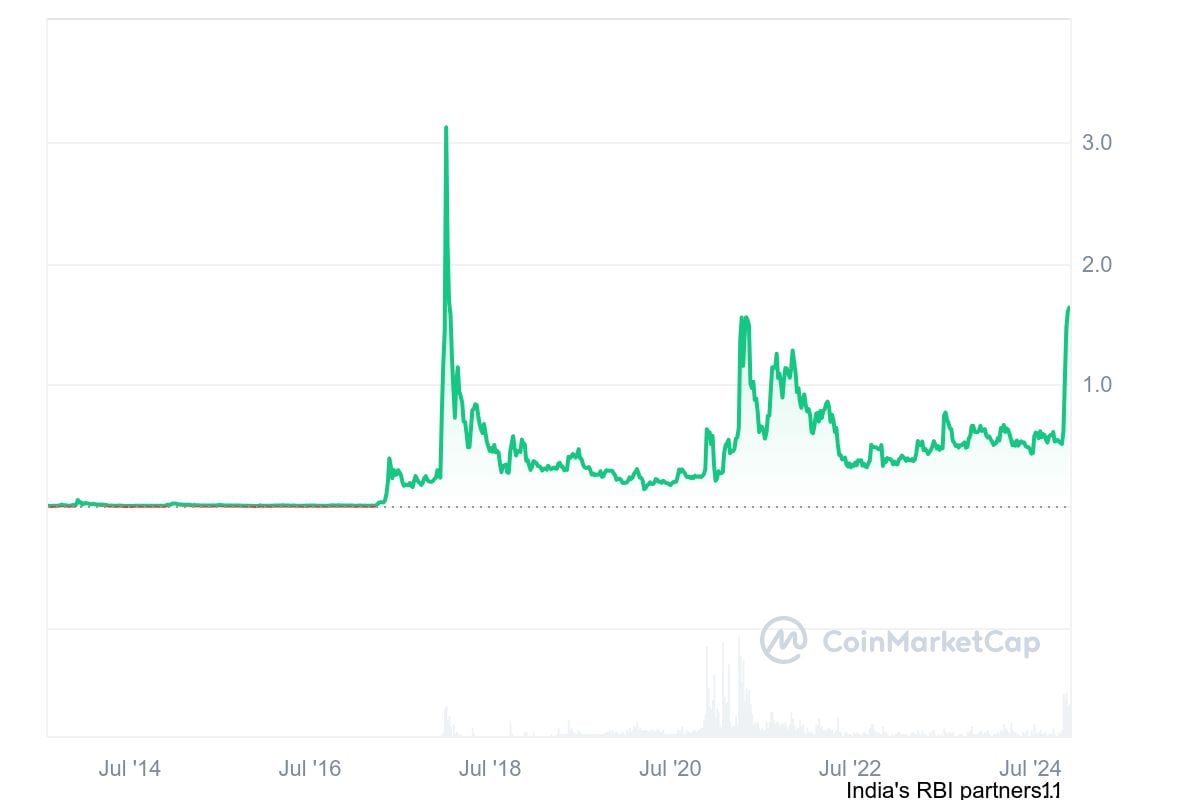

XRP hits six-year high

Based on information from CoinMarketCap, XRP experienced a significant increase of around 10.05% over the past day, reaching a value of $1.62. This latest price point marks a substantial milestone for XRP, representing its highest recorded value since the year 2018.

Additionally, it illustrates XRP’s ability to bounce back even amidst a general market downturn due to its own price inversion and continuous legal disputes with the U.S. Securities and Exchange Commission (SEC).

As a crypto investor, I noticed that XRP bounced back from yesterday’s low of $1.44, peaking at an intraday high of $1.61 before stabilizing at its present value. The surge in trading volume, now standing at $8.4 billion, indicates a strong intent among investors to amass the coin, signaling potential growth in the future.

Currently, the overall cryptocurrency market is exhibiting a blend of optimism and pessimism. To illustrate this, Ethereum (ETH) and SUI have dropped by 1.6% and 7.03% over the past 24 hours. Conversely, the prices for Solana (SOL), BNB, and Avalanche (AVAX) have increased during the same period, with gains of 2.09%, 0.12%, and 1.18% respectively.

Renewed optimism toward XRP

The newfound enthusiasm for XRP stems from the possibility of changes in the U.S. regulatory environment regarding cryptocurrencies.

The impending departure of Gary Gensler as chair of the U.S. Securities and Exchange Commission (SEC) has sparked optimism among the community, as they anticipate potential reforms. With a new, more crypto-friendly chairman at the helm of the SEC, it’s possible that the ongoing legal dispute between Ripple and the SEC could see resolution in the near future.

Furthermore, there’s a positive outlook on potential approvals of XRP-related Exchange-Traded Funds (ETFs) within the U.S. The approval could stimulate institutional investment in XRP, potentially resulting in more favorable price trends.

According to a report by U.Today, Bitwise has revamped their XRP-based Exchange-Traded Product (ETP) to the Bitwise Physically-Backed XRP ETP. Other financial firms such as Canary Capital and 21Shares are also actively working on the creation of an XRP Exchange-Traded Fund (ETF).

Read More

- FIS PREDICTION. FIS cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- Tips For Running A Gothic Horror Campaign In D&D

- EUR CAD PREDICTION

- XRP PREDICTION. XRP cryptocurrency

- DCU: Who is Jason Momoa’s Lobo?

- OSRS: Best Tasks to Block

- Luma Island: All Mountain Offering Crystal Locations

- EUR ARS PREDICTION

- INR RUB PREDICTION

2024-11-29 13:05