As an experienced analyst, I’ve seen my fair share of market trends come and go. But this recent surge in XRP-focused investment products is particularly noteworthy. According to the latest report from CoinShares, inflows into XRP ETPs soared past $400,000 last week, bringing the total to over $18.4 million since the beginning of the year. That’s a significant increase and puts XRP at the top of the charts alongside Solana, Polkadot, and Litecoin.

Last week, there was a significant surge in investments flowing into XRP-focused products, as indicated in a recent report by CoinShares. The data reveals that over $400,000 was added to XRP Exchange-Traded Products (ETPs) last week, bringing the grand total to over $18.4 million since the start of the year.

As a crypto investor, I’ve noticed an impressive rise in XRP‘s value lately, which has catapulted XRP-related investment vehicles to the forefront of the crypto market. Joining XRP at the top are Solana, Polkadot, and Litecoin, each displaying significant growth as well.

As a researcher, I’m excited to share that last week marked the addition of another Ripple-backed Exchange Traded Product (ETP) to the list. Specifically, the new Virtune XRP ETP made its debut on Nasdaq Stockholm. This joins an existing roster of five other Ripple XRP ETPs: 21Shares Ripple XRP ETP (AXRP), CoinShares Physical XRP ETP, ETC Group Physical XRP, and Valour Ripple (XRP).

Altcoins take over

The changing perspective of investors towards XRP and other alternative coins indicates a significant market trend. It seems that more and more investors are beginning to see current prices as promising opportunities for potential profits in the future.

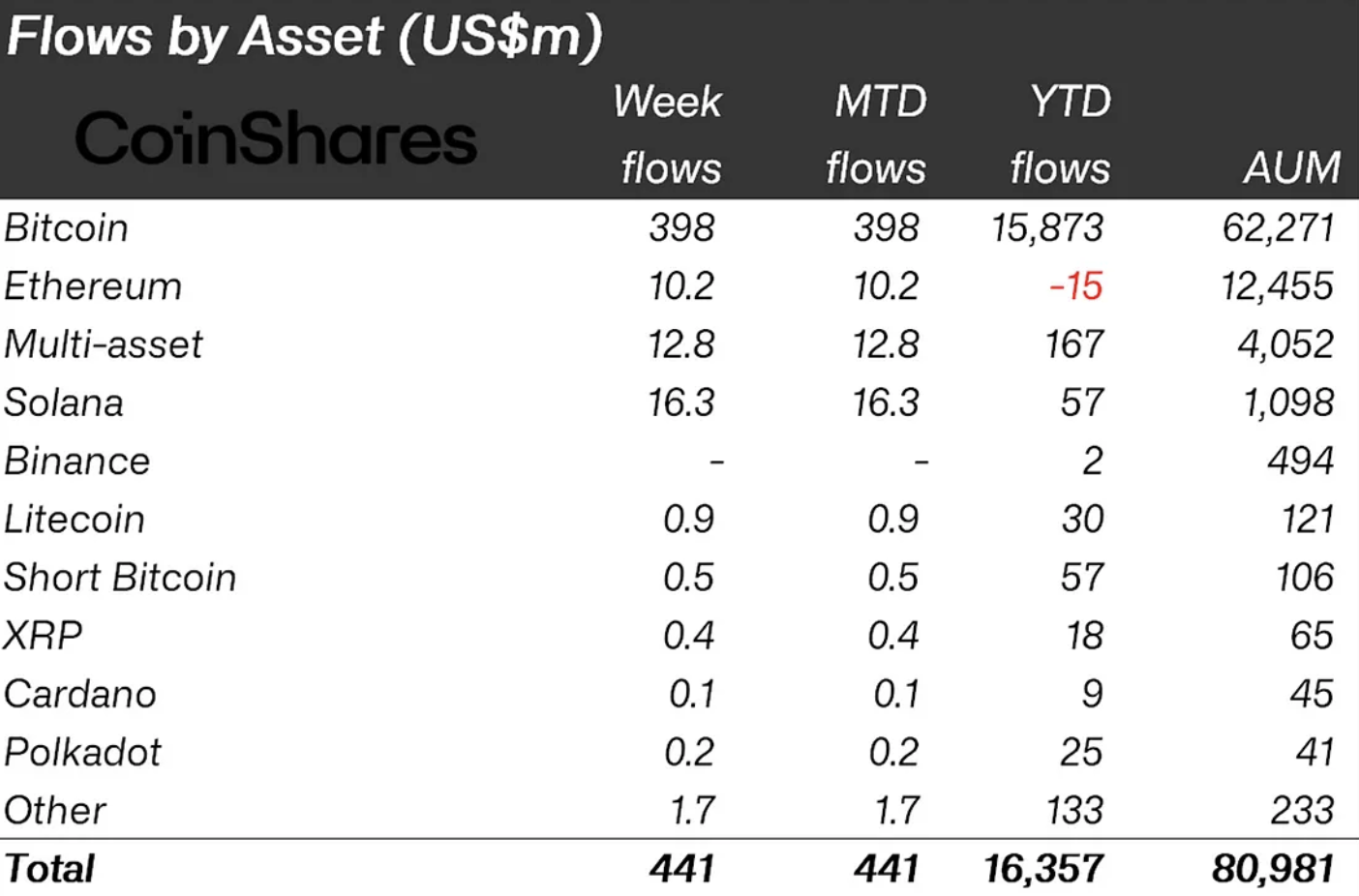

As a crypto investor, I’ve noticed that despite the recent market downturn caused by selling pressure from Mt. Gox and the German government, digital asset investment products still managed to attract a total of $441 million in inflows during the period.

Bitcoin took the lead with a significant investment of $398 million. However, it made up just 90% of the overall investment, an unusual occurrence as investors opted to spread their funds among a wider selection of alternative coins.

As an analyst, I’ve observed some noteworthy developments in the inflow trends of various cryptocurrency investment products last week. Specifically, Solana ETPs attracted approximately $16 million worth of investments, adding to their year-to-date total of $57 million. This places Solana as the top-performing altcoin so far this year regarding inflows. In contrast, Ethereum saw a comparatively smaller inflow of around $10 million recently, yet it remains the only crypto investment product with a net outflow during the year-to-date period.

Read More

- ENA PREDICTION. ENA cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- USD PHP PREDICTION

- BTC PREDICTION. BTC cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- USD COP PREDICTION

- USD ZAR PREDICTION

- VINU/USD

- WIF PREDICTION. WIF cryptocurrency

- EUL PREDICTION. EUL cryptocurrency

2024-07-08 15:15