As a seasoned crypto investor with a knack for spotting trends and a portfolio that spans the digital asset universe, I must say, the past week has been nothing short of exhilarating. The surge in XRP inflows, reaching an all-time high, is a testament to its growing appeal, especially with the buzz around U.S.-based ETFs.

Over the course of a tumultuous digital asset week, it was XRP that captured the limelight, amassing an impressive $95 million in investments, a new all-time high weekly inflow as reported by CoinShares for XRP-centric investment products. This staggering 621% surge from the previous week serves as a powerful testament to the growing interest in this token, with the ongoing discussions among financial market participants revolving increasingly around potential U.S.-based ETFs tied to XRP.

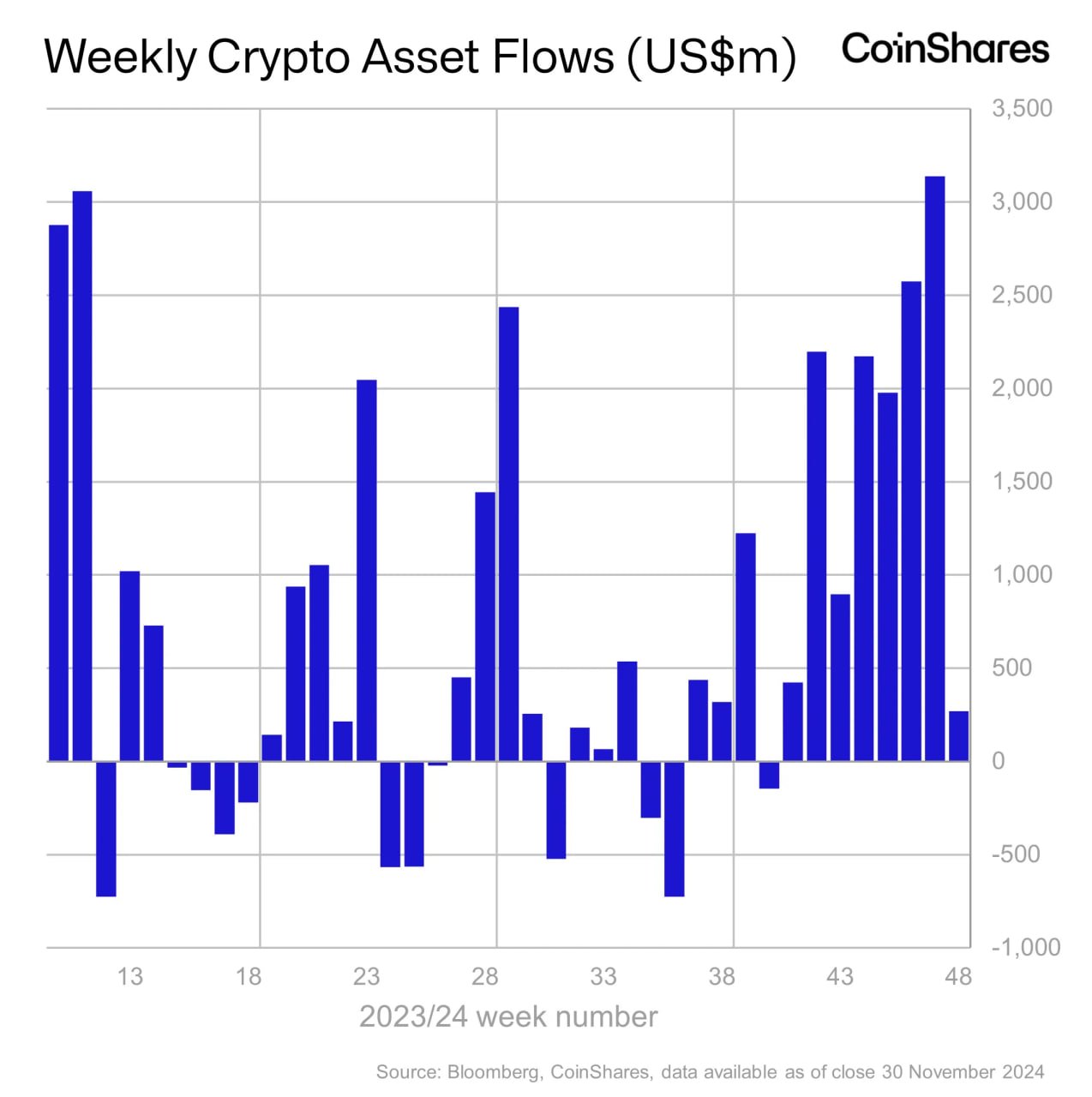

Last week saw an impressive $270 million flow into digital asset investment products, a significant figure considering the overall landscape of the cryptocurrency market.

What truly grabbed people’s focus was the impressive performance of XRP. Currently, it stands as the third most valuable digital currency with a market capitalization exceeding $135 billion. The value of an individual XRP token has risen to around $2.50, marking a significant increase of almost 400% since last month. This surge in value is further sparking widespread interest in the asset.

Bitcoin, although currently leading the pack, experienced a contradictory week, recording an outflow of approximately $457 million. This unexpected movement, according to financial analysts, can be attributed to investors cashing in their profits following Bitcoin’s surge to hit the significant $100,000 price mark.

Ethereum garnered attention as well by receiving $634 million in investments, bringing the year-to-date total to a record-breaking $2.2 billion and surpassing its 2021 high. Given these statistics, it’s even more striking how much interest XRP is generating among investors.

Speaking as a crypto investor myself, I can’t help but notice that a significant portion of the recent growth in our market can be linked to developments within the Exchange-Traded Fund (ETF) sector. Entities such as WisdomTree, 21Shares, and Canary Capital have submitted their proposals for an XRP ETF to the Securities and Exchange Commission (SEC). This move suggests that we might be on the brink of seeing this idea come to fruition, which could potentially bring more institutional investors into our space.

The submission by WisdomTree, managed by Bank of New York Mellon as the trustee, has caught attention. Furthermore, there’s a buzz surrounding crypto ETF proposals, such as the one from Bitwise, which might incorporate XRP along with leading cryptocurrencies.

Read More

- March 2025 PS Plus Dream Lineup: Hogwarts Legacy, Assassin’s Creed Mirage, Atomic Heart & More!

- Esil Radiru: The Demon Princess Who Betrayed Her Clan for Jinwoo!

- Unleash Willow’s Power: The Ultimate Build for Reverse: 1999!

- 6 Best Mechs for Beginners in Mecha Break to Dominate Matches!

- Top 5 Swords in Kingdom Come Deliverance 2

- XRD PREDICTION. XRD cryptocurrency

- Unlock the Secret of Dylan and Corey’s Love Lock in Lost Records: Bloom & Rage

- Unlock the Ultimate Armor Sets in Kingdom Come: Deliverance 2!

- USD DKK PREDICTION

- How to Get Every Title in Sol’s RNG

2024-12-02 19:01