As an analyst with over a decade of experience in the crypto market, I have seen my fair share of bull runs and bear markets. The recent dip in XRP‘s price has been no exception, but after careful analysis of the current trends and fundamentals, I am optimistic about its potential rebound.

Having closely followed Ripple Labs’ growth over the years, I can attest to their commitment to expanding their ecosystem. The release of the RLUSD stablecoin and the increasing number of dApps on the XRP Ledger are testaments to their dedication to driving adoption in the XRP market.

I have learned that a coin’s price movement should never be judged solely by short-term fluctuations, but rather by its underlying potential. With the current boost in volume and open interest, I believe XRP has formed a support at the $2 price mark, with an initial target to reclaim the $2.25 resistance zone.

Investors looking for long-term gains might find it worthwhile to consider buying and holding XRP, especially given the positive prospects of an XRP ETF product in the future. As always, it’s important to remember that investing in crypto is like navigating a rollercoaster ride – exciting, unpredictable, and full of ups and downs. But as the saying goes, “The best time to invest was yesterday, the second-best time is today.”

In jest, I would add: Just remember, if you can’t stand the heat, stay out of the kitchen – or in this case, the crypto market!

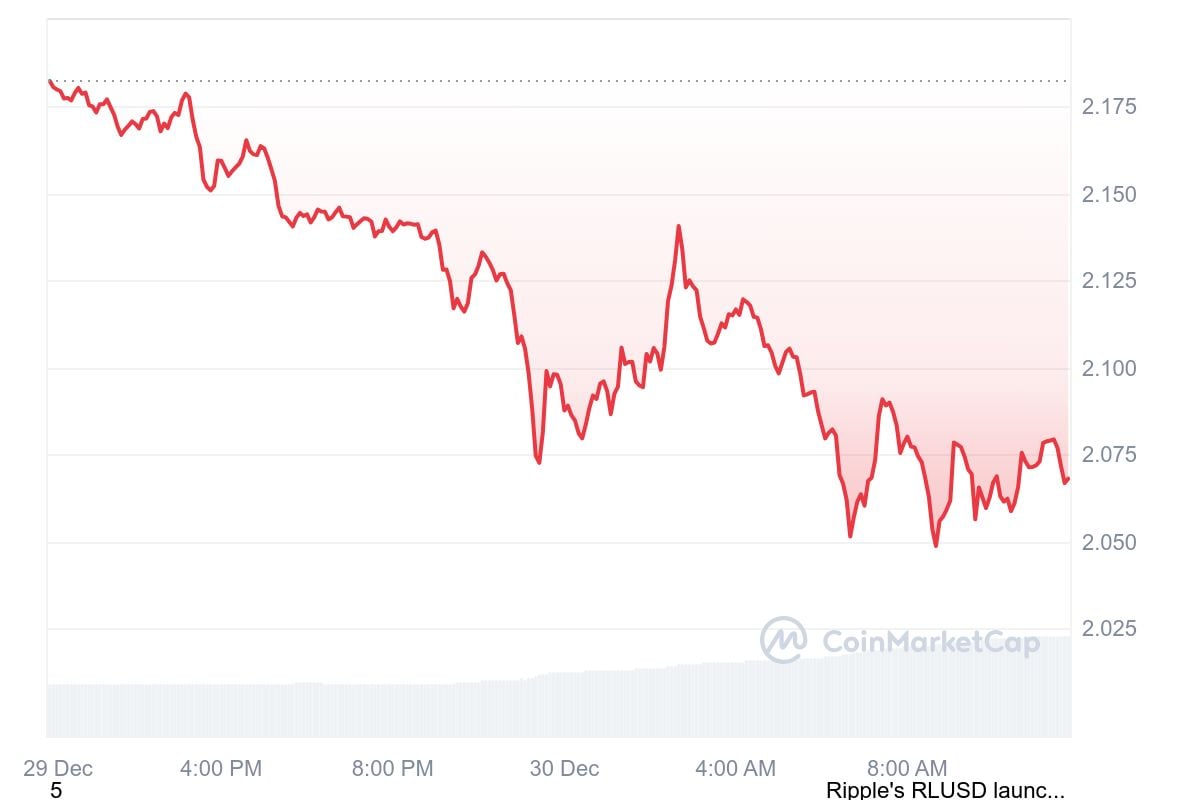

The cost of XRP is starting to indicate a recovery following a seven-day decline that led to a drop of over 6%. As I write this, information from CoinMarketCap indicates that the trading volume for the past 24 hours has increased by 87% to $4.57 billion. This surge in XRP liquidity provides it with the foundation to meet any changes in demand.

XRP price due for rebound

Following the peak of XRP’s value at around $2.86 on December 3rd, it has shown a significant decline, similar to an icy slope. Although there have been occasional rises to less optimistic peaks, overall, the mood over the past week has been predominantly negative.

In my analysis, it appears that the situation is shifting for the better, as I previously identified a substantial support mechanism within the XRP ecosystem. This potential boost in volume could trigger the anticipated recovery we’ve been waiting for. At the moment, the price of XRP stands at $2.08, having decreased by 4.86% over the past 24 hours. This current level suggests a narrowing of the coin’s significant loss position.

As an analyst, I’ve noticed a potential sign of XRP recovering some of its market losses. The Open Interest for XRP, as displayed by CoinGlass, has seen a 2.66% increase, with over 950 million XRP being committed to futures trading on exchanges. This suggests that traders are showing renewed interest in XRP and could potentially contribute to its market recovery.

As a crypto investor, I’m optimistic that the recent downturn might have found a solid base for XRP around the $2 price point. My immediate hope is that we can push beyond the $2.25 resistance level and start climbing higher again.

Fundamentals still count

With even greater justification, investors are finding compelling reasons to acquire and hold onto XRP. The expansion of the Ripple Labs ecosystem is ongoing, marked by the launch of the RLUSD stablecoin. As confirmed by the company’s leaders, XRP and RLUSD will work harmoniously in terms of liquidity provisioning, enhancing their value together.

Additionally, it’s worth noting that the XRP Ledger is continually advancing, fostering a fresh wave of decentralized applications (dApps). This development could potentially boost interest in the XRP market.

Although the coin’s growth may seem limited for now, the potential for an XRP Exchange-Traded Fund (ETF) brings a sense of long-term positivity.

Read More

- 6 Best Mechs for Beginners in Mecha Break to Dominate Matches!

- One Piece 1142 Spoilers: Loki Unleashes Chaos While Holy Knights Strike!

- How to Reach 80,000M in Dead Rails

- Unlock the Ultimate Armor Sets in Kingdom Come: Deliverance 2!

- Top 5 Swords in Kingdom Come Deliverance 2

- REPO: All Guns & How To Get Them

- Unleash Willow’s Power: The Ultimate Build for Reverse: 1999!

- LUNC PREDICTION. LUNC cryptocurrency

- All Balatro Cheats (Developer Debug Menu)

- REPO: How To Play Online With Friends

2024-12-30 15:23