As a seasoned financial analyst with extensive experience in the cryptocurrency market, I have closely monitored OKX’s monthly proof-of-reserves reports for several months now. The recent report revealing a decrease in user assets on the exchange, particularly in XRP, piqued my interest.

“One of the world’s leading cryptocurrency trading platforms, OKX, has recently published its monthly transparency report. This document offers details about the current status of customer assets, the exchange’s own reserves, and the resulting coverage ratio.”

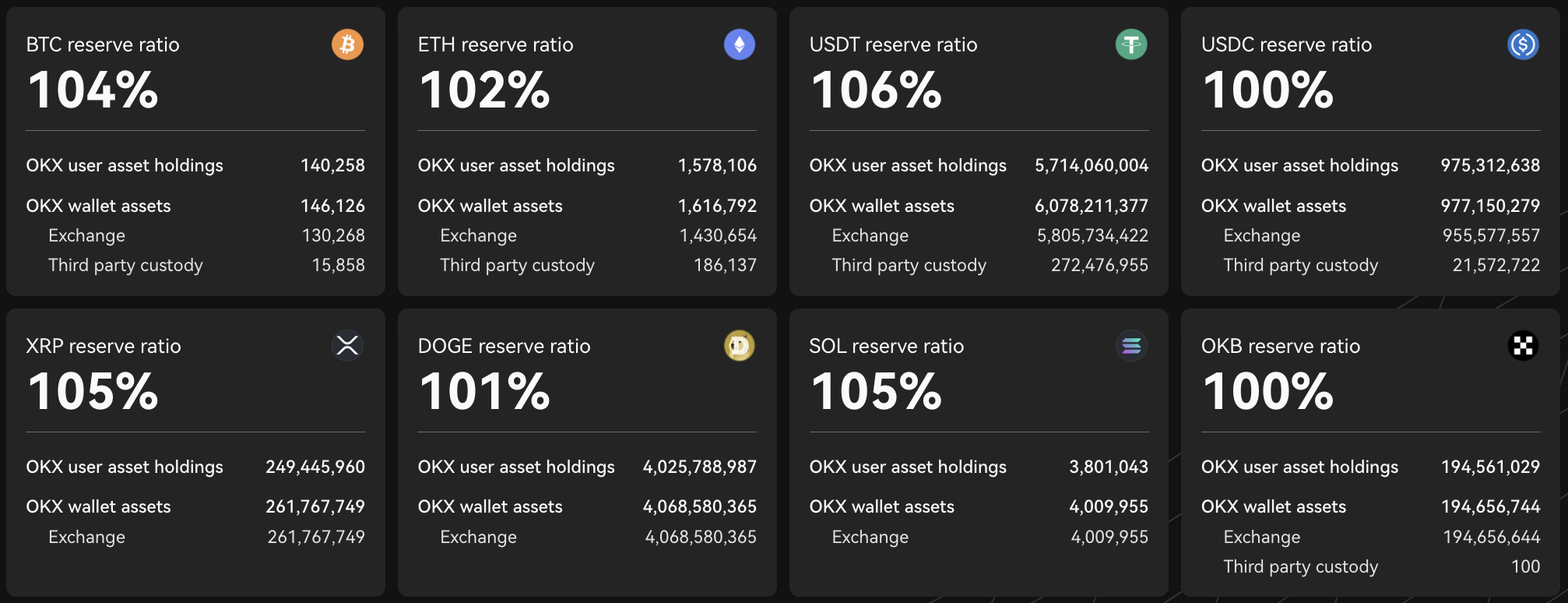

Based on the latest figures, OKX currently manages approximately $19.8 billion in funds and cryptocurrencies – a drop from the previous total of $22.4 billion reported just last month. This decline suggests that less capital is now being held on the platform for users.

A notable finding from the report is the 10% decline in user assets in one particularly popular cryptocurrency, XRP. User assets dropped from 271.39 million to 249.45 million tokens, a reduction of 21.94 million XRP, valued at $13.16 million at the current price. Despite this decline, the coverage ratio for the token has increased by 3%, now standing at 105%, with reserves of 261.76 million XRP.

For the past three months, the number of XRP users on OKX has decreased, indicating a downward trend. Yet, the data hints that these users may not be withdrawing their funds from the platform, but rather shifting them to other investments instead.

All money in, no money out

Since the end of June, there has been a 2.3% increase in USDT reserves. Furthermore, USDC reserves in Circle have seen significant growth, rising from $783.74 million to $977.15 million between June and July. These reserves now fully cover user funds and even provide a surplus.

The drop in XRP‘s value isn’t unique. Other significant cryptocurrencies, such as Bitcoin (BTC) and Ethereum (ETH), are exhibiting comparable trends. This phenomenon could imply that investors are moving their assets from centralized exchanges or shifting their funds to other investments, resulting in a buildup of “crypto reserves.”

Read More

- SOL PREDICTION. SOL cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD ZAR PREDICTION

- CKB PREDICTION. CKB cryptocurrency

- USD COP PREDICTION

- LUNC PREDICTION. LUNC cryptocurrency

- EUR ILS PREDICTION

- MDT PREDICTION. MDT cryptocurrency

- UFO PREDICTION. UFO cryptocurrency

- WELSH PREDICTION. WELSH cryptocurrency

2024-07-25 16:40