In the bleak winter of 2025, as the world shivered through another crypto season, the XRP price prediction for January 2026 emerged like a glimmer of hope-or a mirage, depending on whom you ask. This blue-chip relic, once dismissed as a digital pawn, now stands tall, its fundamentals as unyielding as the Soviet bureaucracy. Time, that great equalizer, has turned skeptics into stoic observers, their wallets clutching XRP like a secret they dare not share. 😅

On-chain signals, those cryptic hieroglyphs of the blockchain age, whisper of a structural metamorphosis. Beneath the muted price action lies a tale of quiet rebellion: whale accumulations, ETF inflows, and derivatives positioning conspire to shift the market from distribution to compression. Or, as the old guard might say, “A camel’s back is proverbially close to breaking.” 🐪

Whale Accumulation: A Covert Ballet of Capital

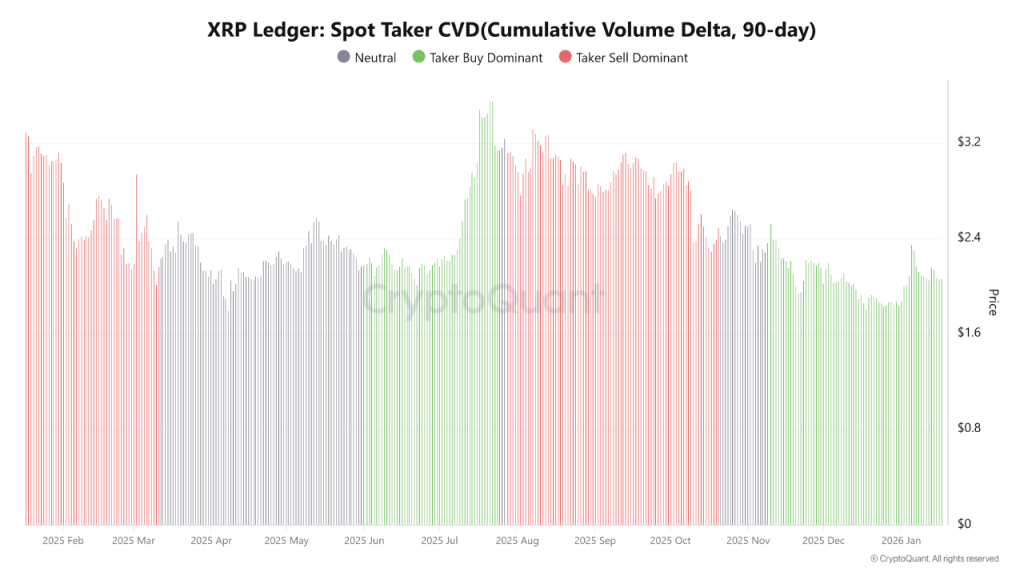

The daily chart, a relic of bygone optimism, clings to resistance near the 200-day EMA like a defector at the border. Yet on-chain indicators-those modern-day soothsayers-reveal a taker buy dominance that would make Lenin envious. For 90 days, market buys have drowned out sells in a symphony of absorption. Not speculation, no-this is supply hoarding with the subtlety of a hammer to the head. 💥

The 90-day Cumulative Volume Delta, now positively trending, is the financial equivalent of a Siberian thaw. History, that unreliable narrator, suggests such delta expansions precede volatility. One can only wonder what chaos awaits after this “extended consolidation”-a euphemism for “we’re all just guessing.” 🤷♂️

Institutional Whispers and the ETF Mirage

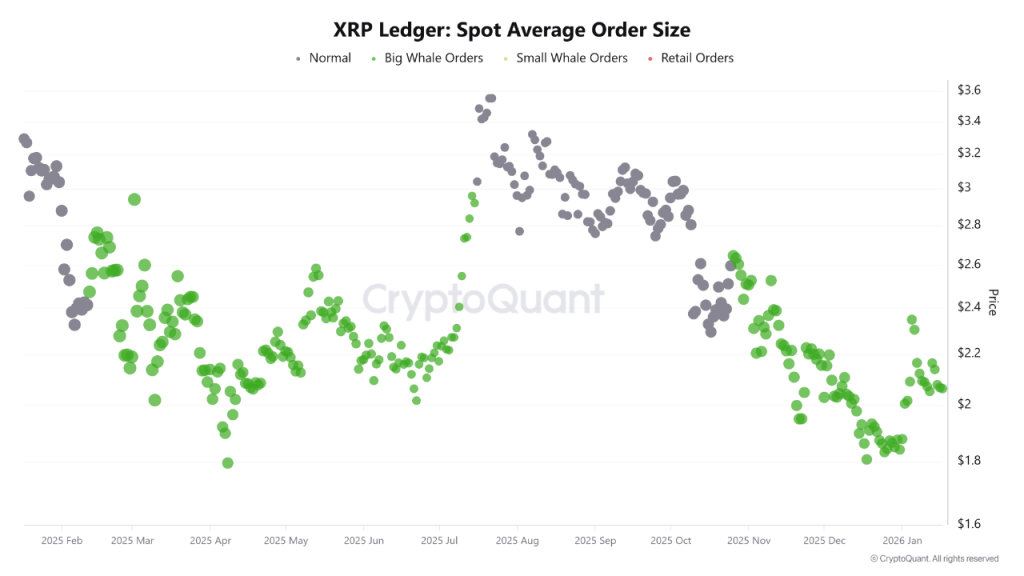

Average spot order sizes swell, revealing a plot twist only a Bond villain could love: whale dominance. These leviathans, with their shadowy trades, navigate the markets like KGB agents in a thriller. And let’s not forget the ETFs, those modern-day alchemists, turning XRP into a one-way bet since November. Inflows versus outflows? It’s a landslide, darling-a landslide! 🏗️

This “long-term allocation strategy” is as trustworthy as a politician’s promise, yet here we are, tightening supply like a vise. One can almost hear the market whisper, “This time it’s different,” while clutching its XRP like a talisman. 🧙♂️

Funding Rates: A Short-Sighted Symphony

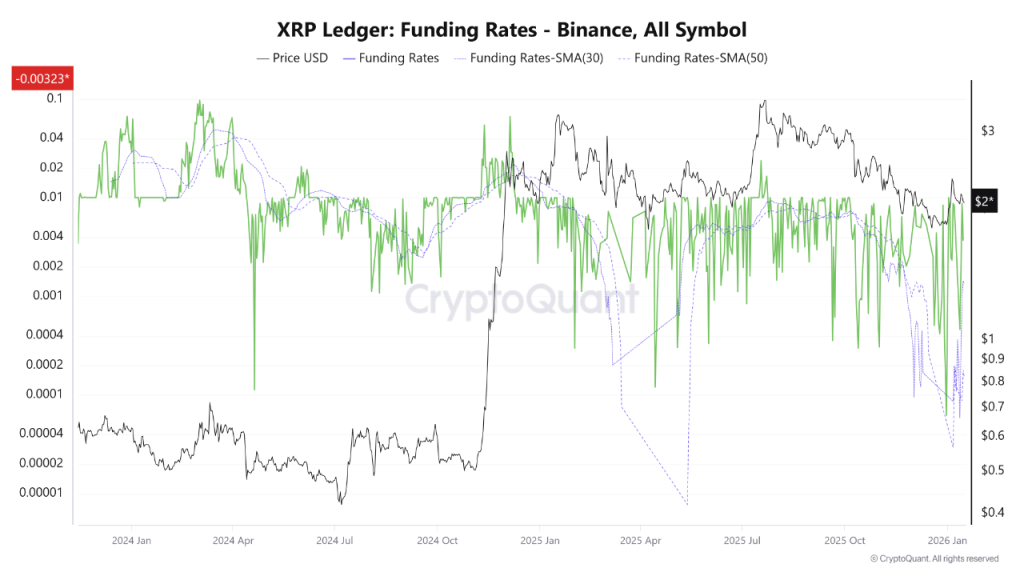

Derivatives data, that chaotic waltz of leverage, tells a tale of negative funding rates and short positioning. Pessimism reigns, but let’s not mistake this for despair-it’s just the market’s way of saying, “We’ve seen worse.” Historically, these “local bottoms” are as reliable as a weather forecast in Moscow. Shorts, overexposed and trembling, ensure the downside is as thrilling as a dacha without heat. ❄️

If funding rates normalize-or worse, turn positive-XRP’s price action may follow suit. But let’s not get ahead of ourselves; the market’s memory is shorter than a hare’s attention span. 🐇

Technical Compression: The Spring Before the Storm

Technically, XRP dances between $2.00 and $2.40, a range tighter than a corset at a Soviet gala. The 200-day EMA, that stubborn gatekeeper, rejects advances with the finality of a passport stamp. Yet on-chain data, ever the optimist, insists bullishness is just a breakout away. If $2.40 falls again, the path to $3.00 looms-a Promised Land for those brave (or foolish) enough to hold. 🌟

Should $2.00 falter, however, the bullish narrative crumbles like a poorly baked pie. But isn’t that the beauty of it all? A game of inches, played with billions. Or, as Solzhenitsyn might say, “The price of freedom is eternal vigilance-and a well-timed sell order.” 🚀

Read More

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Overwatch is Nerfing One of Its New Heroes From Reign of Talon Season 1

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Meet the Tarot Club’s Mightiest: Ranking Lord Of Mysteries’ Most Powerful Beyonders

- Bleach: Rebirth of Souls Shocks Fans With 8 Missing Icons!

- Who Is the Information Broker in The Sims 4?

2026-01-17 19:18