The U.S. Securities and Exchange Commission has been busy, and the crypto market is buzzing like a hive of bees with a new honey pot to chase. 🐝💰 With approval odds soaring and institutional interest on the rise, traders are positioning themselves for a potentially explosive price reaction-like a powder keg waiting for a spark. 🔥

ETF Filings Build Institutional Momentum

As of September 25, 2025, there are 13 active XRP ETF filings with the U.S. Securities and Exchange Commission, including proposals from major issuers like Grayscale Investments and Franklin Templeton. Several of these filings are scheduled for review between October 18 and October 25, marking a crucial period for the XRP ETF approval process. It’s like a poker game where everyone’s holding their breath, hoping the dealer won’t fold. 🃏

A spot XRP ETF would allow investors to gain exposure to XRP through regulated financial products without directly holding the cryptocurrency. Unlike futures-based products, spot ETFs are tied to the actual price of XRP, potentially broadening access for both retail and institutional participants. It’s the financial world’s version of a “buy one, get one free” deal-except the free item is a regulatory stamp of approval. 🎁

Market watchers see this as more than just another product launch. It represents a broader test case for how U.S. regulators intend to handle spot crypto ETFs moving forward-particularly after the resolved SEC v. Ripple Labs lawsuit that shaped much of XRP’s regulatory history. The SEC is playing a high-stakes game of chess, and the board is made of legal jargon and investor hopes. 🏰

SEC Deadlines Collide with Shutdown Delays

The timeline for XRP ETF decisions coincides with an unprecedented U.S. government shutdown, now lasting over 40 days. The SEC, with limited staffing and paused reviews, has been forced to delay several ETF evaluations, including XRP-focused filings. Analysts note that these delays have temporarily lowered the probability of immediate approvals, despite market data indicating an 81% predicted chance of a decision in 2025. It’s like trying to schedule a meeting with a ghost-everyone’s busy, but no one’s actually there. 👻

Legal analysts emphasize that while some ETFs can take effect automatically under the Investment Company Act, spot crypto ETFs-such as those tied to XRP-require active approval under the Securities Act of 1933. This means final decisions are directly dependent on the SEC’s operational capacity. The SEC is like a librarian with a broken catalog, trying to find a book that doesn’t exist. 📚

Still, experts anticipate that once the government reopens, the agency may fast-track pending crypto ETF filings to clear the regulatory backlog. It’s the financial equivalent of a “rush hour” for paperwork-only with more caffeine and fewer smiles. ☕

Investor Sentiment Remains Resilient

Despite delays, investor interest in XRP has surged. Crypto platforms and forums show growing speculation about post-approval price reactions, with some predicting potential surges toward $4-$8. Recent whale accumulation patterns and institutional positioning further reflect confidence in a bullish outcome. It’s like a crowd cheering for a football game, even when the team’s quarterback is injured. ⚽

Brokerage data from Charles Schwab Corporation shows a 90% year-over-year increase in crypto portal traffic, with roughly 20% of clients already holding U.S.-listed crypto ETFs. This suggests that even in a regulatory freeze, interest in crypto exposure is climbing steadily. It’s the financial world’s version of a snowball rolling down a hill-getting bigger and faster with every step. 🧊

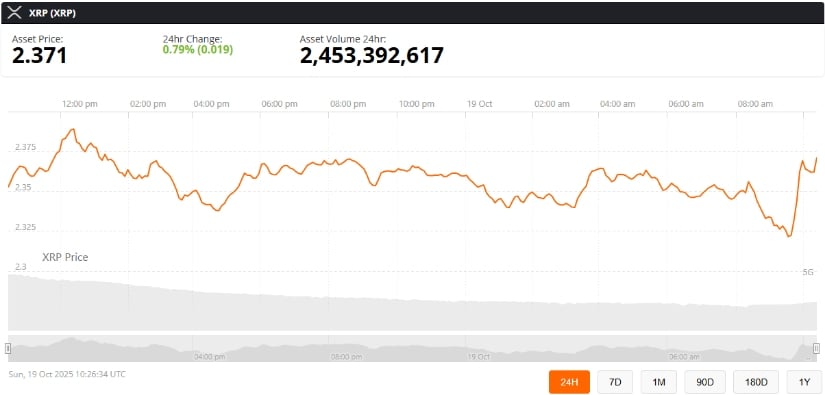

The current XRP price sits near $2.25, hovering below the 20- and 50-day exponential moving averages. The RSI at 35 indicates oversold conditions, hinting at potential for an upward breakout if macro and regulatory catalysts align. It’s like a pendulum swinging between hope and despair, with the SEC holding the strings. 🕰️

Path to $5 Hinges on Market Structure

For XRP to reach the $5 mark, analysts estimate it would require a market capitalization of approximately $300 billion. That milestone would likely depend on a mix of factors: ETF-driven liquidity inflows, favorable macroeconomic trends, and sustained demand from institutional and retail investors. It’s like trying to build a skyscraper with a stick of dynamite-requires precision, luck, and a few miracles. 🏗️

Ripple’s $1 billion treasury buy and restored exchange listings following its legal victory against the SEC have reinforced long-term bullish narratives. However, experts caution that a strong structural base-not short-term hype-will be key to sustaining any rally. It’s like a magician’s trick: the illusion is impressive, but the real magic is in the preparation. 🎩

Beyond XRP: A Broader Regulatory Turning Point

The SEC’s decision on the Grayscale XRP ETF is viewed as more than just a milestone for Ripple. A positive outcome could set a precedent for other spot cryptocurrency ETFs, potentially unlocking fresh capital inflows across the digital asset sector. Conversely, a rejection may simply delay-not derail-the inevitable march toward broader ETF integration. It’s the financial world’s version of a “wait and see” approach, with everyone holding their breath. 🤭

Regardless of the outcome, this regulatory chapter signals a turning point in how digital assets are absorbed into traditional finance. For XRP holders and broader crypto market participants, the coming days could define the next phase of XRP price prediction 2025 narratives. It’s like the climax of a novel-every page turns with anticipation. 📖

Final Thoughts

The countdown to SEC deadlines has placed XRP squarely in the spotlight once again. With institutional interest surging, retail optimism climbing, and the regulatory clock ticking, the market is bracing for potential volatility. Whether XRP breaks higher or consolidates further will depend on how these pivotal decisions unfold in the coming weeks. It’s a high-stakes game of chicken, with the SEC as the driver. 🚗

For now, investors are watching the XRP price chart closely, awaiting the moment when regulatory clarity could finally meet market momentum. It’s like waiting for a storm to pass-hopeful, but not entirely sure if the calm will last. ⛈️

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- God Of War: Sons Of Sparta – Interactive Map

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Who Is the Information Broker in The Sims 4?

- 8 One Piece Characters Who Deserved Better Endings

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Engineering Power Puzzle Solution in Poppy Playtime: Chapter 5

2025-10-19 22:33