In a twist that would make a sock puppet weep, a former Monero lead developer found themselves in a tangle when a close friend, previously a crypto skeptic, confessed to wanting to buy XRP, convinced that banks would be obsolete in two years. ‘It’s like trying to explain gravity to a falling brick,’ muttered the developer, who was clearly not a fan of the concept of ‘disruption’ 🐧.

Igniting the XRP Debate: A Skeptic’s Inquiry (And a Slight Case of Cognitive Dissonance) 🕶️

Riccardo Spagni, former lead developer for Monero, revealed that a close friend, a self-proclaimed crypto skeptic, had expressed interest in buying XRP. This, of course, was the digital equivalent of a penguin wearing a top hat and monocle-unexpected, slightly alarming, and entirely unexplained. The friend’s belief that banks would be obsolete in two years was met with the same level of enthusiasm as a librarian reading a comic book 📚.

After years of legal entanglements that jeopardized issuer Ripple’s vision of establishing XRP as a key bridging currency, the company has seen a more favorable environment emerge under the Trump administration. For instance, the U.S. Securities and Exchange Commission (SEC) has since agreed to cease its legal action against Ripple, and President Donald Trump took the notable step of naming XRP as a potential candidate for the nation’s digital asset stockpile. Well, let’s just say the crypto world is as confused as a parrot in a library 🐦📚.

These events and many other positive developments for Ripple have raised XRP’s profile and attracted the interest of first-time cryptocurrency buyers. The increased interest has seen XRP jump from under $1 on Nov. 16, 2024, to more than $3.60 on July 22, 2025. Although the cryptocurrency subsequently reversed some of its gains, it is still one of the best-performing high-cap altcoins over a 12-month period. It’s the crypto equivalent of a magician pulling a rabbit out of a hat-except the rabbit is a blockchain, and the hat is a legal loophole 🎩🐇.

Furthermore, some pro- XRP analysts on the social media platform X are still projecting it to end the year around $4 or more, prompting new users like Spagni’s friend to seek exposure to the cryptocurrency.

“A close friend, who has always been skeptical of crypto and has never owned any, has just asked how he can get a wallet and an exchange account to buy…wait for it… XRP, because it’s revolutionary and the banks are all going to be gone in 18 months,” Spagni stated. The friend’s logic is as sound as a bridge built by a toddler with a ruler and a dream 🏗️👶.

Critics and Accusations 🙄

Reacting to Spagni’s post, some X users seemed taken aback by the fact that the developer was being asked about buying XRP and not Monero’s privacy coin XMR. It’s like asking a librarian for a pizza recipe 📚🍕.

Others, however, slammed the narrative that Ripple’s XRP, which is the number three digital asset by market capitalization, could replace banks, saying this shows proponents’ apparent lack of understanding of how the blockchain works.

“The idea of XRP and Ripple working out as banks has always boggled me so much. You have to have really iq below shoe level and 0 world understanding. What bank will want this, and why give power to a private company that outsources price to the open market. Then the entire risk and responsibility is in that one company. How? Doesn’t make sense in open permissionless blockchains to have a single point of failure like CEO and company structure. Brainrot,” one user wrote. A term so eloquent it deserves a Nobel Prize 🏅.

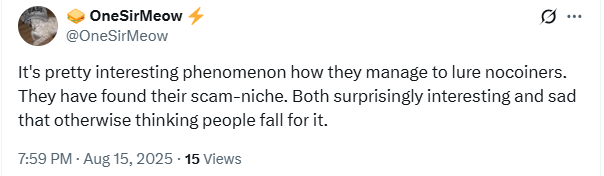

However, even the most vocal detractors seemed to agree that XRP’s promotional team knows how to make an impact. They point to the engagement levels of social media posts mentioning Ripple and XRP as well as number of new crypto enthusiasts inquiring about the digital asset. Still, not everyone is in admiration of the Ripple/ XRP marketing machine. It’s the crypto equivalent of a marketing campaign for a new type of cereal 🥣.

One user, Fish Catfish, suggested that the entirety of XRP’s market cap is based on misinformation about banks and the “false belief that being a ‘bridge currency’ makes a token valuable.” Catfish also seemed displeased by investigative journalists whom the user accused of failing to identify parties involved in what they called a misinformation campaign. “It’s unbelievable that investigative journalists haven’t dug down the rabbit hole to figure out where all the funding of these misinformation campaigns is coming from and where the money trail leads,” Catfish stated. Clearly, the rabbit hole is a legal document 🐇📄.

Read More

- Poppy Playtime Chapter 5: Engineering Workshop Locker Keypad Code Guide

- God Of War: Sons Of Sparta – Interactive Map

- Jujutsu Kaisen Modulo Chapter 23 Preview: Yuji And Maru End Cursed Spirits

- Poppy Playtime 5: Battery Locations & Locker Code for Huggy Escape Room

- Who Is the Information Broker in The Sims 4?

- Poppy Playtime Chapter 5: Emoji Keypad Code in Conditioning

- Someone Made a SNES-Like Version of Super Mario Bros. Wonder, and You Can Play it for Free

- Why Aave is Making Waves with $1B in Tokenized Assets – You Won’t Believe This!

- Pressure Hand Locker Code in Poppy Playtime: Chapter 5

- One Piece Chapter 1175 Preview, Release Date, And What To Expect

2025-08-18 06:59