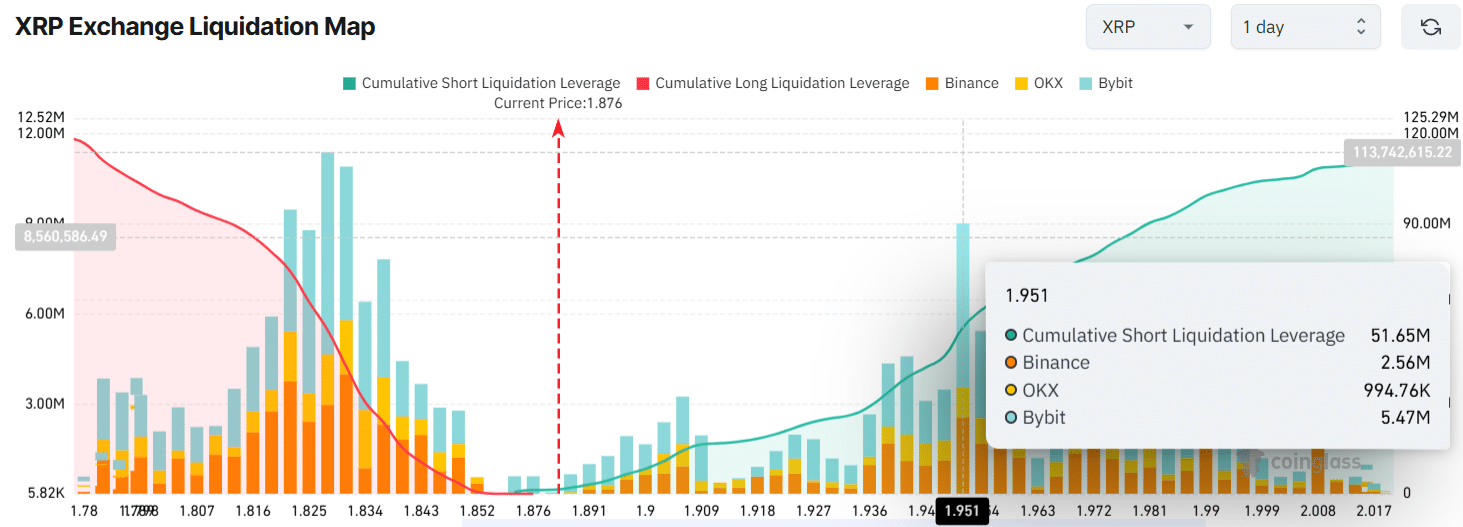

- Traders, in their infinite wisdom, have piled into over-leveraged positions at $1.828 (support) and $1.951 (resistance).

- Short positions worth a staggering $51.65 million have been placed at the $1.951 level, as if the market were a roulette wheel and everyone’s betting on black. 🎰

XRP, Ripple’s darling token, seems to be on a one-way trip to the abyss, much like the hopes of its investors.

The market sentiment is as bearish as a grizzly in a bad mood, and the tariff wars—those delightful geopolitical spats—are only adding fuel to the fire. 🔥

Current price momentum

At the time of writing, XRP was hovering around $1.85, having managed a modest 6.50% surge in the last 24 hours.

However, trading volume dropped by 10%, suggesting that even the most optimistic traders are starting to lose interest. 🥱

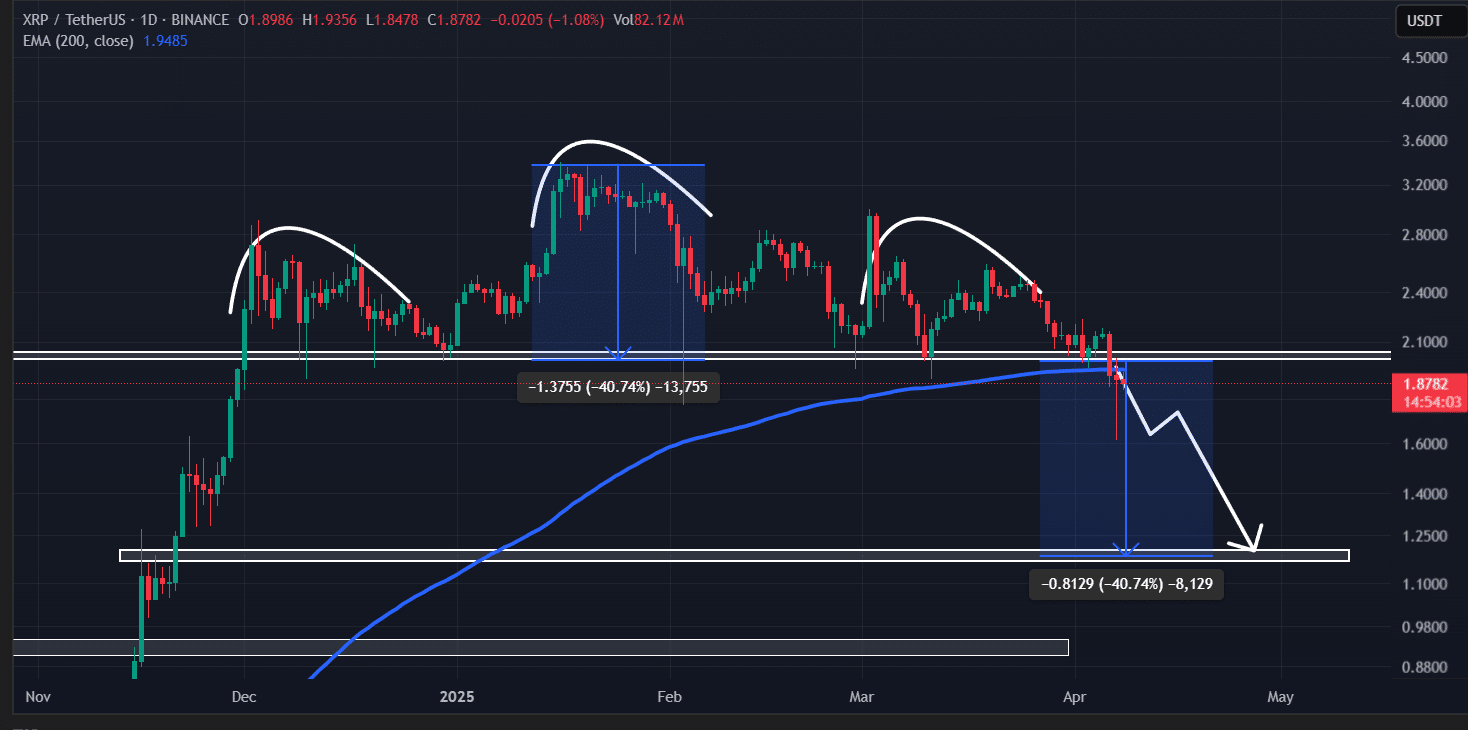

Despite this fleeting moment of glory, XRP remains firmly in the bear’s grip. AMBCrypto’s technical analysis reveals that the asset has broken out of a bearish head and shoulders pattern on the daily timeframe.

To add insult to injury, XRP closed its daily candle below the neckline at $1.95, all but confirming that the downward spiral is far from over. 📉

Can a 35% crash happen?

This neckline, once a bastion of support, has been breached, much like the walls of a poorly defended castle. 🏰

Historically, XRP has bounced back whenever it reached this level, but this time, it seems the magic has worn off.

Based on recent price action and historical patterns, the break of this key level has opened the door to a potential 35% crash, with XRP possibly plummeting to the $1.20 level. 💥

Adding to the gloom, XRP has failed to hold above the 200 Exponential Moving Average (EMA) on the daily timeframe.

Trading below the 200 EMA is a clear sign that the bears are in charge, and sellers are having a field day. 🐻

In such scenarios, traders and investors are more likely to look for shorting opportunities, as if they were vultures circling a wounded animal. 🦅

Bearish on-chain metrics

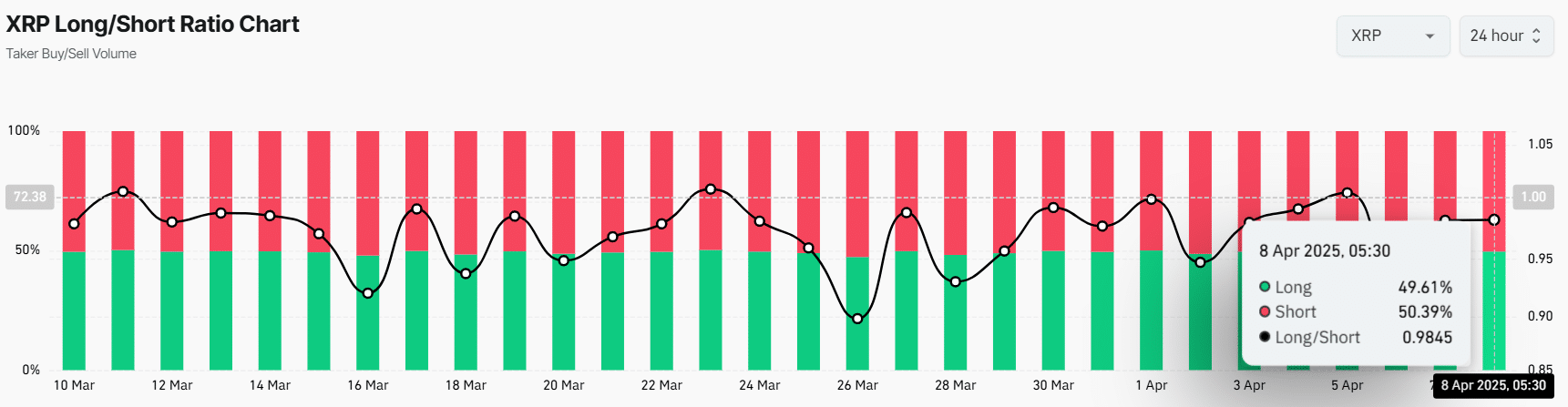

On-chain analytics firm Coinglass confirms that traders are firmly in the bearish camp.

XRP’s Long/Short Ratio stood at 0.98 at press time, indicating that more traders are betting on a decline than a rise. 📊

$51.65 million worth of bearish bets

Coinglass data further reveals that traders are over-leveraged at $1.828 (support) and $1.951 (resistance), with $22.50 million and $51.65 million worth of long and short positions built, respectively.

These liquidation levels and trader positions are a stark reflection of the current market sentiment. 🎭

These liquidation levels and trader positions are likely to be triggered if the XRP price moves in either direction, much like a house of cards waiting for a gust of wind. 🃏

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Nvidia Reports Record Q1 Revenue

- Switch 2 Sales Soar to Historic Levels

2025-04-08 20:12