Solana’s DEX volume, like a wind that sweeps across forgotten steppes, has reached the formidable height of $806.8 billion in 2025. Yes, my friend, that is billions, not merely the humble sums murmured by landowners over their evening tea. And Jupiter—no, not the great gas giant, but a protocol—continues its stately promenade at the head of the column.

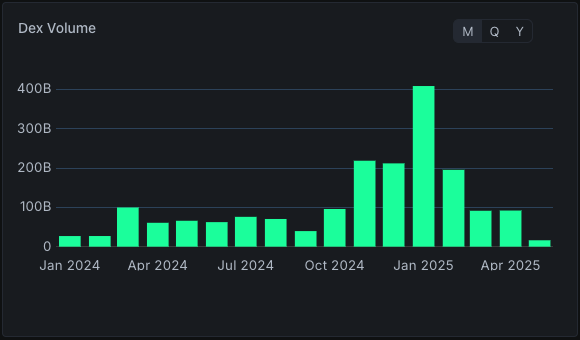

It must be said, with a sigh mingled of disbelief and irony, that the Solana ecosystem has at last struck a mighty bell. On the seventh of May—it is always May in stories of progress, is it not?—the wizards at Top Ledger (may the quill of their accountants never run dry) declared to the world: “Behold, here is activity!” Volume had shot up almost 400% since this same span last year, having then wallowed at the piddling sum of $201 billion, a figure now only fit for the jokes of idle uncles at a Russian dacha.

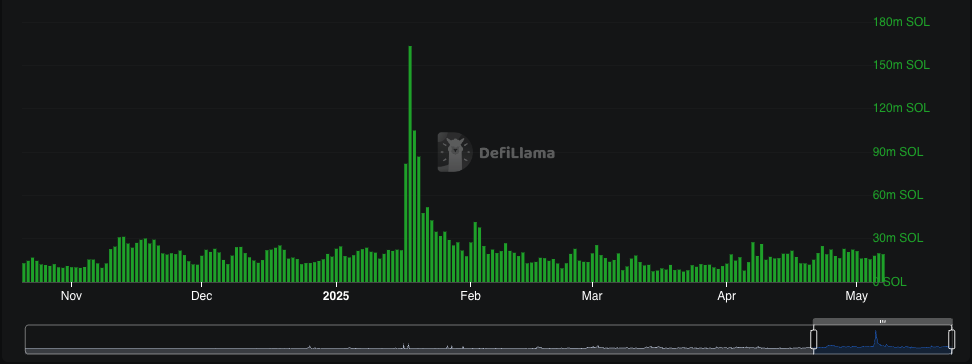

January, ever the show-off, boasted more than half of 2025’s DEX volume—$408 billion—much as a plump landowner brags of his harvest at a neighbor’s soirée. It seems the crypto rally that began in November grew so heated that even snowdrifts of skepticism melted by New Year. Alas, the thrifty months that followed saw prices and volumes alike shuffle quietly back to their quarters, their temporary madness spent. SOL-denominated volumes performed an energetic dance around January 20th, twirling, whirling, then, breathless, flopping back onto the divan of normalcy.

Jupiter’s Conquest: DEX Volume Under the Banner of Aggregation 🚀

Through it all, Jupiter, an aggregator not at all celestial in origin but certainly in ambition, dominated the exchange, with $334.6 billion in volume—an imperial 55% of the DEX traffic. OKX, perhaps lost in contemplation of its philosophical insignificance, managed a modest $32.2 billion (5.21%). As for the memecoin launchpad Pump.fun—one can only imagine the sober expressions of Turgenev’s gentry hearing that it facilitated a livid $22.3 billion in volume. Perhaps a glass would be dropped; certainly a monocle or two.

Raydium, with the posture of a land baron unfazed by frenetic newcomers, led the execution layer proudly with $352.8 billion. Meteora followed at a genteel distance ($113.7 billion, 14.17%), its name belying its terrestrial ranking. Orca, who surely delights in aquatic metaphors, made for third place with $103.9 billion (12.95%), pursued closely by SolFi’s $97.9 billion (12.20%).

And so, as 2025 ambles along like a peasant with pockets full of rubles, we see DEX volume swelling alongside the adoption of Solana’s ecosystem. In the first quarter, Solana sat comfortably at number two, content to let Ethereum keep the samovar warm with its own 30% of DEX volume. Solana claimed a worthy 23% for itself—proof, perhaps, that the upstart can indeed dance at the ball without stepping on too many toes. 🍸

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- AI16Z PREDICTION. AI16Z cryptocurrency

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Nvidia Reports Record Q1 Revenue

2025-05-07 20:45