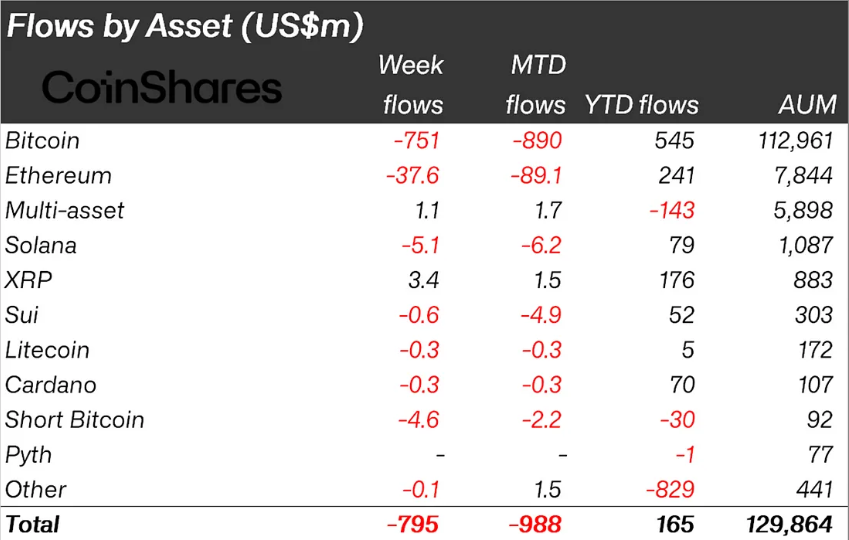

Oh, the sweet, sweet chaos! According to the latest CoinShares research, crypto outflows hit a staggering $795 million last week. That’s right, folks, the third consecutive week of negative flows. Seems like financial uncertainty is a persistent party guest that just won’t leave. 🍸

Now, if you thought things couldn’t get any worse, hold onto your hats—Bitcoin ETF outflows were up by a jaw-dropping 314%! That’s $713 million in outflows, up from $172.69 million the week before. Someone call a medic, because this is a market crash party, and it’s *really* getting out of hand.

Crypto Outflows Reach $795 Million—It’s Getting Ugly!

CoinShares’ very own James Butterfill, who’s clearly on a mission to keep us all informed, spills the tea: Bitcoin was leading the charge, with $751 million in outflows. But don’t worry, it wasn’t *all* bad news—some altcoins like XRP, Ondo Finance (ONDO), Algorand (ALGO), and Avalanche (AVAX) managed to stay afloat, swimming in positive flows while the big dog Bitcoin struggled to keep its head above water. 🏊♂️

Looks like investors are suddenly turning to altcoins as the global economy plays its role as the villain in this financial drama. Oh, the suspense! Will Bitcoin recover? Stay tuned… 📉

“…recent tariff activity continues to weigh on sentiment towards the asset class,” wrote Butterfill. You don’t say? 🧐

This story is becoming old hat, my friends. Altcoins have been outperforming Bitcoin in terms of flow metrics for a while now. Just two weeks ago, they broke a five-week streak of negative flows, shooting crypto inflows to $226 million. I mean, someone hand these altcoins a trophy already!

And speaking of those tariffs, Trump’s lovely trade chaos continues to have its claws deep in the crypto market. For the week ending April 7, crypto outflows hit a cool $240 million, courtesy of none other than Trump himself. Thanks, Trump. 🙄

After Trump’s little tariff pause—talk about a plot twist—investor sentiment took a nosedive. The US-China trade war was back on, and it felt like the entire market went into a collective panic attack. Markets, both traditional and digital, screamed in terror, with China’s retaliatory moves adding fuel to the fire. Talk about a drama-filled series!

But not all was doom and gloom. Trump’s temporary rollback of tariffs did manage to lift assets under management (AuM) by 8%, pushing it to $130 billion. Not bad for a guy who just loves stirring the pot, huh? 🏦

“…a late-week price rebound helped lift total AuM from their lowest point on April 8 (the lowest since early November 2024) to $130 billion, marking an 8% increase following President Trump’s temporary reversal of the economic calamitous tariffs,” Butterfill added. So, *maybe* the story isn’t over just yet? 🤔

Bitcoin Bleeds, ETF Flows Confirm the Woes

As expected, Bitcoin took a beating last week, with outflows rising like a balloon at a birthday party—314% to be exact. The ETF outflows followed suit, signaling that institutional interest is definitely cooling off, especially in the US. Ouch, Bitcoin, that’s gotta hurt. 😬

And let’s not forget the short-Bitcoin products—those poor souls saw $4.6 million in outflows, too. It seems traders may be pulling back altogether, choosing the safe side rather than betting on Bitcoin’s downfall. Smart move, or just the fear talking? 😱

CoinShares pointed out that the outflows weren’t just confined to one region or product provider. Nope, this bearish sentiment is global, baby! It’s like a worldwide recession, but with more crypto! 🌍

Trump’s wild tariff game has reintroduced an element of uncertainty to an already fragile global economy. The crypto market, especially the institutional side, is feeling the heat with a broad withdrawal of capital. Oh, the drama of it all! 🍿

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Nvidia Reports Record Q1 Revenue

- Switch 2 Sales Soar to Historic Levels

2025-04-14 15:06