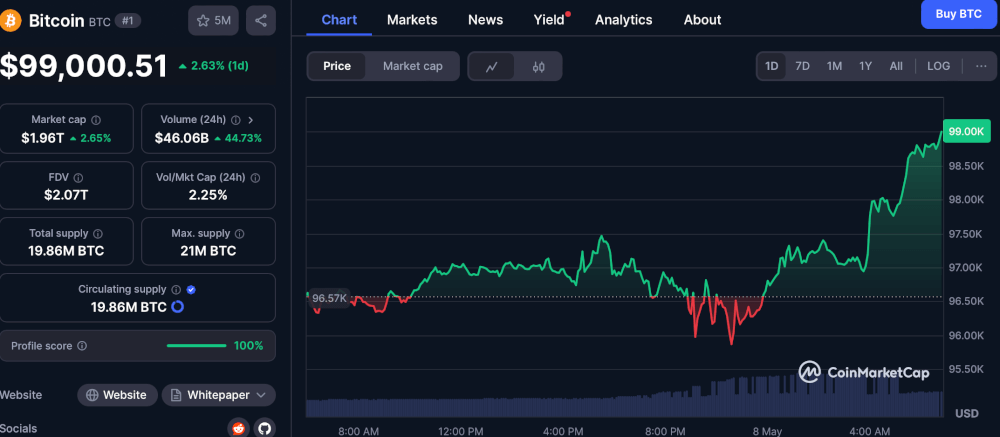

The latest data from CoinMarketCap resembles the morning after the Drones Club summer ball: utterly chaotic, shockingly exuberant, and headline-worthy. Trading volumes have erupted like Aunt Agatha upon discovering a missing silver tureen — over $46 billion exchanged hands in the past day, a 44.73% leap, perhaps suggesting the butlers from hedge funds have snuck in for a late-night flutter.

This mighty leap has propelled Bitcoin’s market cap to a stonking $1.96 trillion, give or take the odd shilling. Meanwhile, its fully diluted valuation (which, one suspects, means all the gin poured in) is tipping the scales at $2.07 trillion. And with 19.86 million BTC now circulating—goodness, nearly all out of a crisp 21 million—the air of scarcity is thicker than the fog over the Thames on Boat Race Day. Supply-and-demand, old bean, always the trick to sending values into the stratosphere 🚀.

The current theatrical performance comes just as Bitcoin confronts the fabled $100K level, that psychological wall where nerves jangle like teaspoons in the vicar’s best bone-china. The analysts are lined up on both sides: some predicting a heroic breakthrough and ticker-tape parades, others sensing an imminent stampede for the exits, profits snugly in waistcoat pockets.

As for today’s chart, it displays a spectacle not unlike Bertie Wooster’s bathtub overflow: straight up from the $96.5K rung in the wee hours of May 8, with nary a sign of seller fatigue nor a wet sponge in sight. The buyers have seized the wheel and seem in no mood to hand it back. Toodle-oo to the bears, at least for the moment! 🥂

Read More

- Invincible’s Strongest Female Characters

- Top 8 Weapon Enchantments in Oblivion Remastered, Ranked

- MHA’s Back: Horikoshi Drops New Chapter in ‘Ultra Age’ Fanbook – See What’s Inside!

- Nine Sols: 6 Best Jin Farming Methods

- Fix Oblivion Remastered Crashing & GPU Fatal Errors with These Simple Tricks!

- Top 8 UFC 5 Perks Every Fighter Should Use

- How to Reach 80,000M in Dead Rails

- Gold Rate Forecast

- USD ILS PREDICTION

- Master Conjuration Spells in Oblivion Remastered: Your Ultimate Guide

2025-05-08 07:38