Well, folks, brace yourselves – Zebec Network, or ZBCN for short (because, really, who has time for long names?), has decided to go parabolic. Yes, you read that right. This token has been on a non-stop rollercoaster, with demand skyrocketing to levels that can only be described as, well, “extremely overbought.”

Now, let’s talk numbers. Zebec (ZBCN), the self-proclaimed savior of payment utility on the Solana (SOL) network, has managed to climb for an entire nine days without even taking a breather. It reached an eye-watering record high of $0.0055. That’s a 600% jump from its monthly low – and no, we’re not making this up. With a market cap now above $410 million, it’s practically bursting at the seams.

And where’s all this happening, you ask? Well, futures open interest has surged to an all-time high, crossing the $12.27 million mark. Just a few weeks ago, we were all in a cozy little $2.43 million world. The action’s mostly happening on Bybit, MEXC, and Gate – because why not, right?

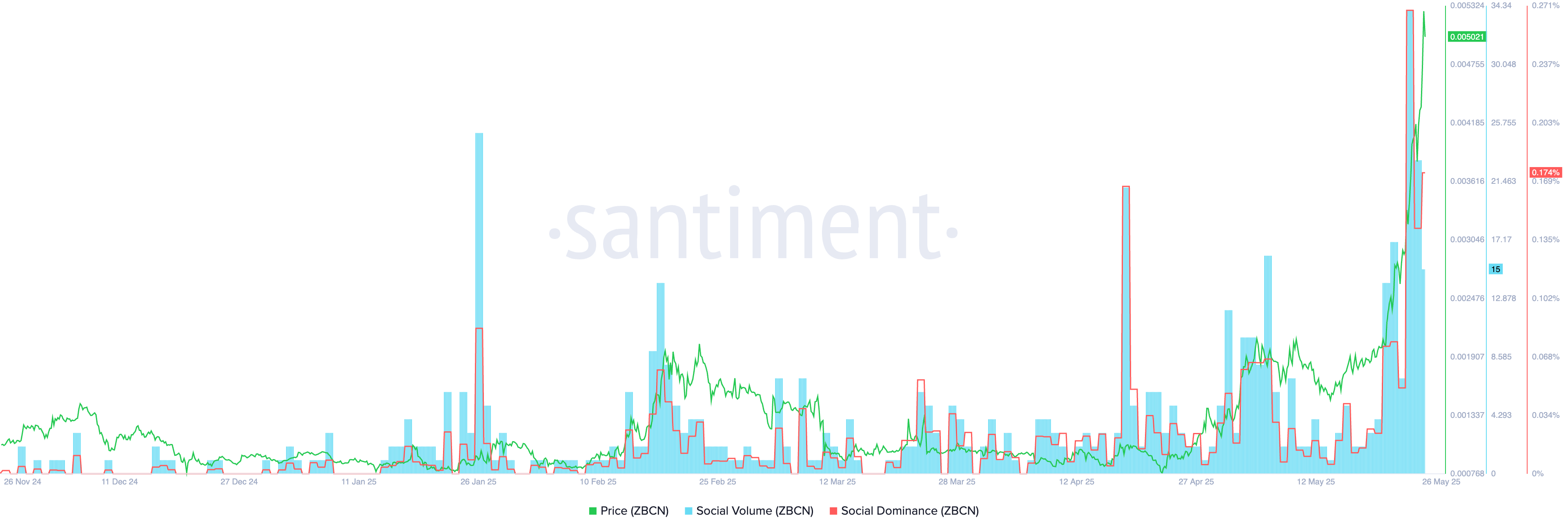

Now, before you start buying up the ZBCN token like it’s the latest must-have gadget, let’s put on our skeptical hats. Rising open interest? Sure, it could be a bullish signal – or it could just be a sign that we’re all trapped in a FOMO-induced haze. And speaking of FOMO, the social media activity surrounding ZBCN has skyrocketed like a teenager’s first TikTok video – reaching an all-time high of 7. Yes, 7. Because apparently, social dominance is a thing now.

In case you were wondering, this FOMO is doing wonders for the number of holders. We’re now at 58,776 holders, up from under 50,000 just a few weeks ago. It’s like a VIP club, and everyone wants in. But let’s be real – are we sure we’re not just chasing the tail end of a bubble?

So, what exactly is Zebec Network, besides being the latest token to capture everyone’s attention? It’s a payment platform with flashy features like a Mastercard-enabled debit card and cross-border remittance tools. The company claims to serve over 50,000 monthly users in 138 countries. And if that wasn’t enough, they’ve also been busy acquiring Paybridge, which means Zebec now helps more than 250 partner companies streamline their payroll services. How exciting, right?

Zebec Network price analysis

Looking at the chart, it’s pretty clear that ZBCN has gone full-on parabolic in recent sessions. It’s broken above a key resistance level at $0.002137 (the upper boundary of a classic cup-and-handle pattern). Of course, the target price was $0.0035, but who’s keeping track of targets when things are flying this high?

Here’s where it gets fun, though. The risk? Oh, just that ZBCN has entered the dreaded overbought territory. With a Relative Strength Index (RSI) sitting comfortably at 90, it’s hard to ignore the possibility that we might be in for a little crash landing. The Stochastic Oscillator and momentum indicators are both on elevated levels. So, yeah, it’s not all sunshine and rainbows.

And if that wasn’t enough, let’s talk about Zebec’s funding rate, which has been negative since May 21. This suggests that investors are expecting a pullback – because when the funding rate turns red, things don’t usually stay in the green for long. The most likely scenario now? A short-term dip, followed by a “break-and-retest” pattern. In other words, a little dip before the rocket continues its journey to the moon. Or maybe not. Who knows?

Read More

- Best Awakened Hollyberry Build In Cookie Run Kingdom

- AI16Z PREDICTION. AI16Z cryptocurrency

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Nintendo Offers Higher Margins to Japanese Retailers in Switch 2 Push

- Nintendo Switch 2 Confirms Important Child Safety Feature

- Nintendo May Be Struggling to Meet Switch 2 Demand in Japan

- Top 8 UFC 5 Perks Every Fighter Should Use

- Nintendo Dismisses Report On Switch 2 Retailer Profit Margins

- Nvidia Reports Record Q1 Revenue

2025-05-26 17:15