Oh, the sweet symphony of despair! 🎶 Two days of Wall Street wailing and gnashing of teeth have only added fuel to the fire of the looming recession—a fire that’s been burning brighter since the Great Tariff Unveiling of ’23 by none other than the maestro himself, President Donald Trump. 🎩✨

Trump’s Trade Tantrum 🤬 Causes Recession Rumors to Run Rampant

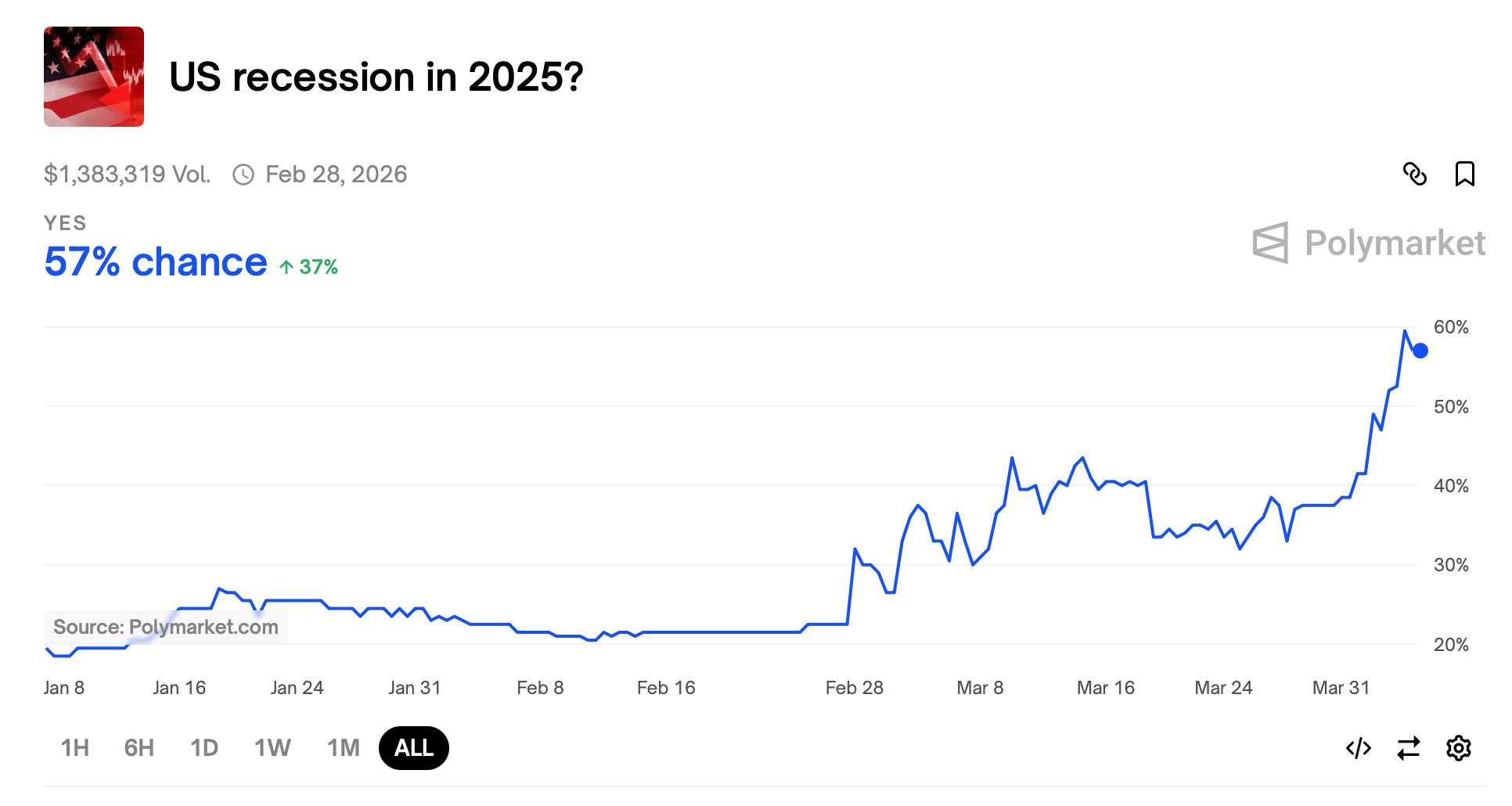

On the hallowed grounds of Polymarket, the blockchain behemoth of bets, the whispers of a recession have grown louder since we last spoke of this prophetic platform. Just a couple of days ago, when the “Liberation Day” tariffs were announced by the Commander-in-Chief, the probability of a 2025 recession stood at a mere 49%. Trading volume then was a paltry $1.1 million; now, it’s soared to $1.38 million, and the likelihood of a recession has crept up to 57%. 📈

Lo and behold, the probability on Polymarket is now eerily in sync with JPMorgan Chase’s gloomy forecast. The banking behemoth has officially raised its estimate for a U.S. recession to 60%, thanks to the economic earthquake caused by Trump’s tariff tempest. 🌪️ This makes JPMorgan the first major Wall Street player to predict a direct downturn for 2025, attributing it to the sheer ferocity of the trade tariffs. 💥

JPMorgan predicts a 0.3% shrinkage in the U.S. economy throughout 2025, with GDP taking a nosedive of 1% in Q3 and another 0.5% in Q4. The latest economic apocalypse has cast a shadow of doubt over the upcoming May 7 U.S. Federal Reserve meeting. Currently, there’s a 66.7% chance that interest rates will remain stagnant, while a 33.3% possibility lingers for a potential quarter-point cut. Polymarket mirrors these probabilities, but with its own peculiar spin. 🎢

Read More

- Nine Sols: 6 Best Jin Farming Methods

- How to Unlock the Mines in Cookie Run: Kingdom

- Top 8 UFC 5 Perks Every Fighter Should Use

- Invincible’s Strongest Female Characters

- Link Click Season 3 Confirmed for 2026—Meet the Mysterious New Character Jae Lee!

- Top 8 Weapon Enchantments in Oblivion Remastered, Ranked

- How to Get 100% Chameleon in Oblivion Remastered

- USD ILS PREDICTION

- MHA’s Back: Horikoshi Drops New Chapter in ‘Ultra Age’ Fanbook – See What’s Inside!

- How to Reach 80,000M in Dead Rails

2025-04-05 20:57