Ah, the crypto world, a stage upon which fortunes are made and lost with the capricious whimsy of a debutante’s affections. It appears Coinbase’s BASE has found itself in a rather awkward position, rather like a gentleman caught in the compromising embrace of a meme token gone spectacularly wrong. The entire affair has, naturally, stirred up a hornet’s nest of indignation, prompting tedious debates on ethics, and whispers of that most scandalous of accusations: insider trading. How utterly dreadful! 🎭

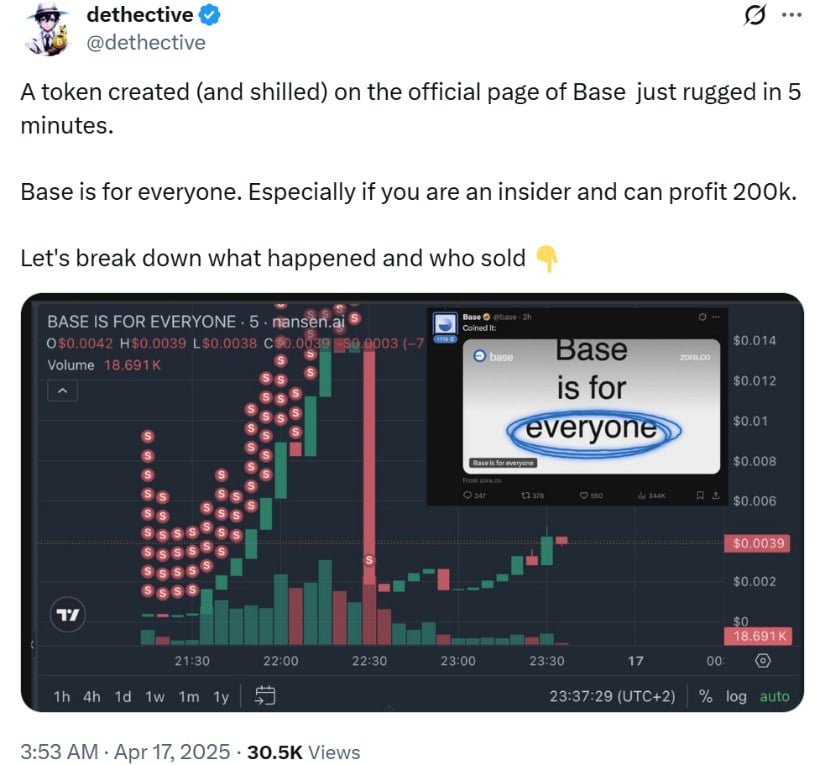

Launched with the fanfare one might expect from a society wedding – on April 16th via the on-chain platform Zora, no less – the token was brazenly promoted on Base’s official X account, accompanied by the rather egalitarian pronouncement, “Base is for everyone.” One might have thought they were offering crumpets and tea to the masses. Alas, the token’s value, spurred on by those eager traders who interpreted the post as a royal endorsement, soared to dizzying heights. However, like a soufflé left too long in the oven, the euphoria collapsed a mere 20 minutes later, leaving a rather unpalatable $15 million-sized hole in the pockets of the unfortunate. 💸

Insider Activity Raises Eyebrows (and Monocles)

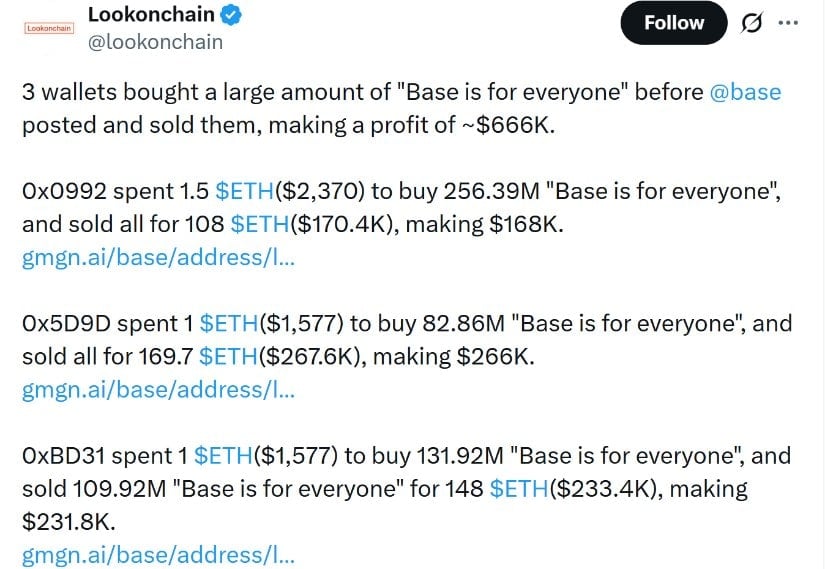

The eagle-eyed sleuths at Lookonchain, an on-chain analytics platform, have sniffed out three wallets that indulged in a spot of pre-emptive token acquisition, buying up vast quantities before Base’s oh-so-public announcement. Later, they divested themselves of their holdings, pocketing a combined profit of approximately $666,000. One wallet, with the audacity of a seasoned gambler, transformed a paltry $1,577 investment into a staggering $267,000. Such brazen behavior has, predictably, aroused suspicions of insider activity, leading to cries that the token’s launch was about as transparent as a London fog and as fair as a game of croquet played with hedgehogs. 🦔

Abhishek Pawa, CEO of Web3 advisory firm AP Collective, took to X to pronounce, “The top three holders dumped almost immediately. This wasn’t just an experiment gone wrong—it was a breach of trust.” A sentiment as cutting as a well-tailored suit, wouldn’t you agree? 👔

Base Responds: “This Was an Experiment” (Or So They Say…)

//bravenewcoin.com/wp-content/uploads/2025/04/Bnc-Apr-17-19.jpg”/>

Base has attempted to paint this debacle as a “creative experiment” to test the burgeoning concept of “content coins” – tokens that, with a touch of the absurd, represent digital content such as memes, art, or fleeting cultural moments. The intention, they claim, was to explore how content can be brought on-chain for artistic and cultural expression, rather than for the vulgar pursuit of speculative trading. How very high-minded! 😇

“There is a significant risk of losing all funds spent on them,” the token’s description on Zora cautions, advising that purchases should be made solely for entertainment purposes. A rather expensive form of entertainment, wouldn’t you say? 🎭

A Recovering Market, But Lingering Doubts (Like a Bad Perfume)

Despite the initial calamitous plunge, the token has, with the resilience of a seasoned socialite, recovered much of its lost value. As of press time, its market cap hovers around $16–17 million, with trading volumes exceeding $39 million. However, the crypto community, ever the cynics, remains largely unconvinced by Base’s rather elaborate explanations. 🤨

Critics argue that the team’s messaging was as tardy as a guest arriving late to a funeral. X user @Clark10x lamented, “You should have posted this before or immediately after under the buy link and this anger would be, for the most part, voided.” Others deemed the move irresponsible, given Base’s prominence and its association with the publicly traded Coinbase. Oh, the scandal! 😱

Pump.fun co-founder Alon Cohen weighed in with the gravitas of a judge passing sentence, saying, “If you launch a coin AND have social influence, that comes with responsibility.” Quite right, old chap! 🧐

The Content Coin Debate (A Tempest in a Teacup?)

Base creator Jesse Pollak and contributors like Nkechi have doubled down on the concept of content coins, proclaiming these tokens to be about “vibes, not value.” Nkechi, with the fervor of a true believer, wrote, “Content coins are not built on speculation. They’re built on meaning. It’s expression onchain, not expectation.” How very… avant-garde. 🤪

While the notion of tokenizing culture possesses a certain undeniable allure in the whimsical world of Web3, the execution has been met with criticism, deemed as poorly communicated and utterly tone-deaf to the harsh realities of today’s trading environment. Some have branded it a rushed experiment that confused speculation with artistic expression, leaving retail investors nursing rather severe burns. 🔥

What’s Next for Base? (Only Time Will Tell, Darling)

This rather unfortunate episode has ignited a broader discussion about the responsibilities of blockchain networks—particularly those with the considerable clout of Base and Coinbase—in promoting and experimenting with on-chain assets. Although the project insists it will never stoop to selling the tokens or profiting from them, the incident serves as a cautionary tale, highlighting the imperative for improved communication, disclaimers, and safeguards when one attempts to blend the ephemeral nature of internet culture with the potentially ruinous world of crypto. 🧐

As Base continues its valiant attempt to turn content into coins, the crypto community, ever the watchful audience, will be observing with bated breath. The experiment may well have birthed a new category of on-chain assets, but it has also left in its wake a cautionary tale, as bitter as a cup of unsweetened tea. ☕

Read More

- AI16Z PREDICTION. AI16Z cryptocurrency

- Tainted Grail the Fall of Avalon: Should You Turn in Vidar?

- Best Mage Skills in Tainted Grail: The Fall of Avalon

- Tainted Grail: How To Find Robbie’s Grave

- Top 8 UFC 5 Perks Every Fighter Should Use

- USD ILS PREDICTION

- Hands-On Preview: Trainfort

- Slormancer Huntress: God-Tier Builds REVEALED!

- LUNC PREDICTION. LUNC cryptocurrency

- Delta Force: 10 Best Gun Loadouts Ranked

2025-04-17 20:10