- Solana’s $127 price point: A battleground fiercer than a cat fight over the last slice of pizza.

- Breaking through could send SOL moon-bound, but it’s no walk in the park.

Behold the $127 price level, a notorious threshold for Solana [SOL], acting as both its shield and nemesis in this never-ending market tango. 🕺💃

To conquer this hurdle and aim for the stars (or at least $140 and $150), Solana must channel its inner Hercules. 💪

However, the road is riddled with thorns. Weak DeFi activity, limper than a wet noodle, lingers below pre-election vigor, hinting that on-chain engagement is still snoozing. 😴

And let’s not forget the traders, unstaking SOL like it’s going out of fashion, adding to the potential avalanche of sell orders. A whale recently dumped60,298 SOL at $127, marking it as a supply zone thicker than a bowl of oatmeal. 🐳🥣

The RSI, meanwhile, is on a downward spiral but hasn’t hit rock bottom yet. This means the selling spree could very well continue unless the market gets a fresh cash injection. Hence, Solana stands on shaky ground, ripe for another tumble. 📉

Key levels to watch for Solana’s next dip

Solana’s metrics are throwing more red flags than a bullfighter, suggesting the local bottom is yet to grace us with its presence. 🚩

Ironically, this comes after BlackRock’s jaw-dropping $1.7 billion investment in Solana’s BUIDL initiative, proving that even bullish news can’t always light a fire under the market. 💰🔥

To add insult to injury, the SOL/BTC pair has plummeted to a two-year low on the daily chart. The relentless march of lower lows is like a sad trombone playing in the background, signaling that investors are flocking elsewhere. 🎺

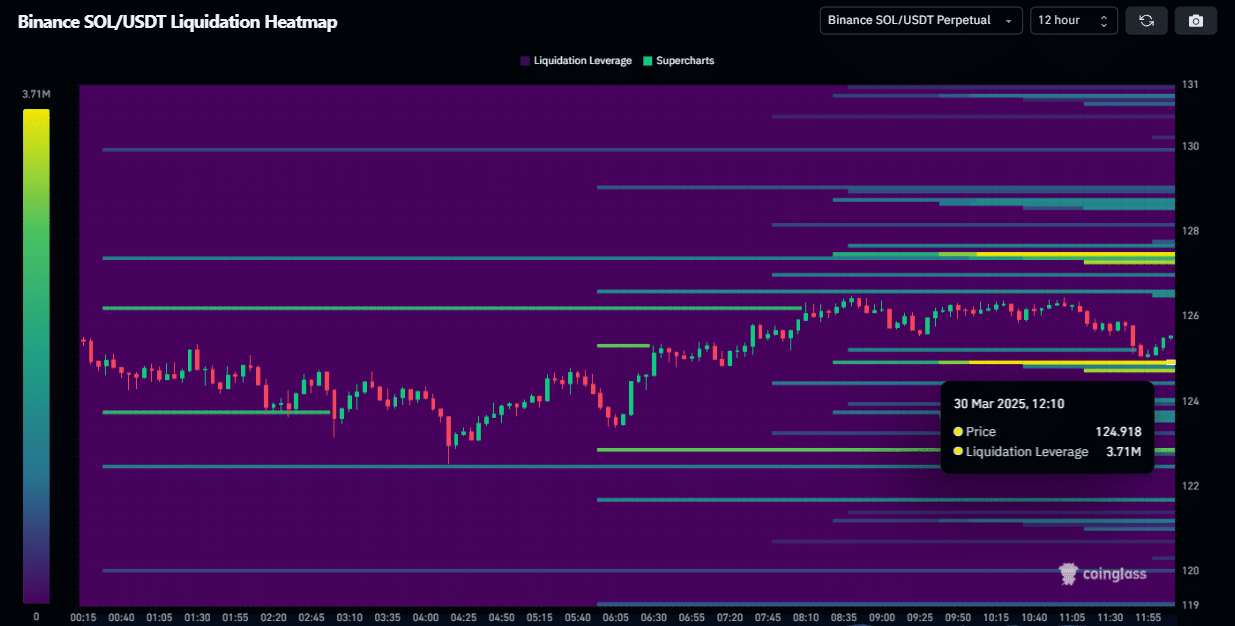

With bullish momentum as scarce as hen’s teeth, the3.71 million in leveraged positions on the12-hour derivatives chart are sitting ducks for liquidation should SOL flirt with the $124.91 support level. 🦆💥

A32.54% nosedive in Solana’s trading volume to $2.05 billion further dims the hope for a robust bullish defense, amplifying the downside risks. 📉

To top it all off, risk-off sentiment reigns supreme as markets hold their breath for this week’s high-stakes tariff decisions, adding a dash of macroeconomic uncertainty to the mix. 🌪️

As Q2 unfurls amidst heightened volatility, a retreat towards the $110–$115 demand zone seems more likely than finding a unicorn in your backyard. Solana traders, tread lightly! 🦄🚧

Read More

- Top 8 UFC 5 Perks Every Fighter Should Use

- Unlock the Magic: New Arcane Blind Box Collection from POP MART and Riot Games!

- Unaware Atelier Master: New Trailer Reveals April 2025 Fantasy Adventure!

- How to Reach 80,000M in Dead Rails

- Unlock Roslit Bay’s Bestiary: Fisch Fishing Guide

- Unlock the Best Ending in Lost Records: Bloom & Rage by Calming Autumn’s Breakdown!

- How to Unlock the Mines in Cookie Run: Kingdom

- REPO: How To Fix Client Timeout

- Toei Animation’s Controversial Change to Sanji’s Fight in One Piece Episode 1124

- Unleash Hell: Top10 Most Demanding Bosses in The First Berserker: Khazan

2025-03-30 14:19