As a seasoned analyst with years of experience in both traditional and crypto markets, I’ve learned to never underestimate the unpredictable nature of these dynamic landscapes. The recent 24-hour period in the crypto world was no exception, with the mysterious transfer of over $103 million worth of Bitcoin from BitGo to an unknown wallet.

While most conventional financial markets typically observe rest on Saturdays and Sundays, the cryptocurrency sphere remains active, particularly during weekends. Consequently, the past 24 hours have been marked by a sequence of market occurrences and backstage events – within the realm of blockchain transactions.

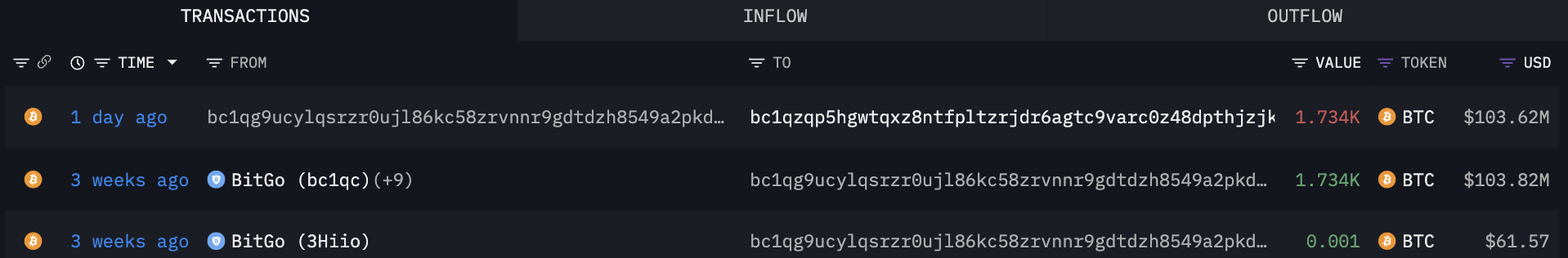

Among these occurrences, there was a swift transfer of approximately 1,734 Bitcoin, valued at around $103.62 million, from the prominent exchange BitGo to an unidentified wallet labeled “bc1qzqp5.” As reported by Arkham Intelligence, this wallet is a brand-new entity with no prior transaction history on record.

Currently, there’s a mystery whale who holds a substantial amount of Bitcoin, valued at seven figures. It’s worth noting that this Bitcoin was previously stored in another wallet identified as “bc1qg9ucy”, which received it from BitGo about three weeks ago. However, it’s not entirely impossible that these two addresses could be linked to the exchange itself.

Yet, there appears to be no available data concerning this topic, which may seem inconsequential. Nevertheless, what truly holds significance is the understanding and interpretation of this development by market players themselves.

According to common understanding, taking funds out from exchanges is considered a positive or bullish action. What makes it even more intriguing is that this action seems to be happening in advance of the Federal Reserve’s interest rate decision due next Wednesday.

This choice carries significant weight since it might mark the initial reduction in interest rates in quite some time, following a prolonged period of restrictive monetary policies. At present, there’s speculation among market players about whether the decrease will be a significant 0.5% (50 basis points) or a more moderate 0.25% (25 basis points).

All of these factors and speculations are causing volatility in the crypto market. If this whale is indeed a buyer, then its bias is probably toward the bullish consequences of the Fed’s rate decision.

Read More

- SOL PREDICTION. SOL cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- ENA PREDICTION. ENA cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- USD ZAR PREDICTION

- USD PHP PREDICTION

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- USD COP PREDICTION

- Top gainers and losers

2024-09-15 19:52