As a seasoned crypto investor with a decade-long journey through the digital asset landscape, I must say this latest market turmoil feels like a rollercoaster ride without the fun part. The $1 billion loss in just one day is a stark reminder of the volatile nature of this industry, and it’s hard not to feel a pang of déjà vu.

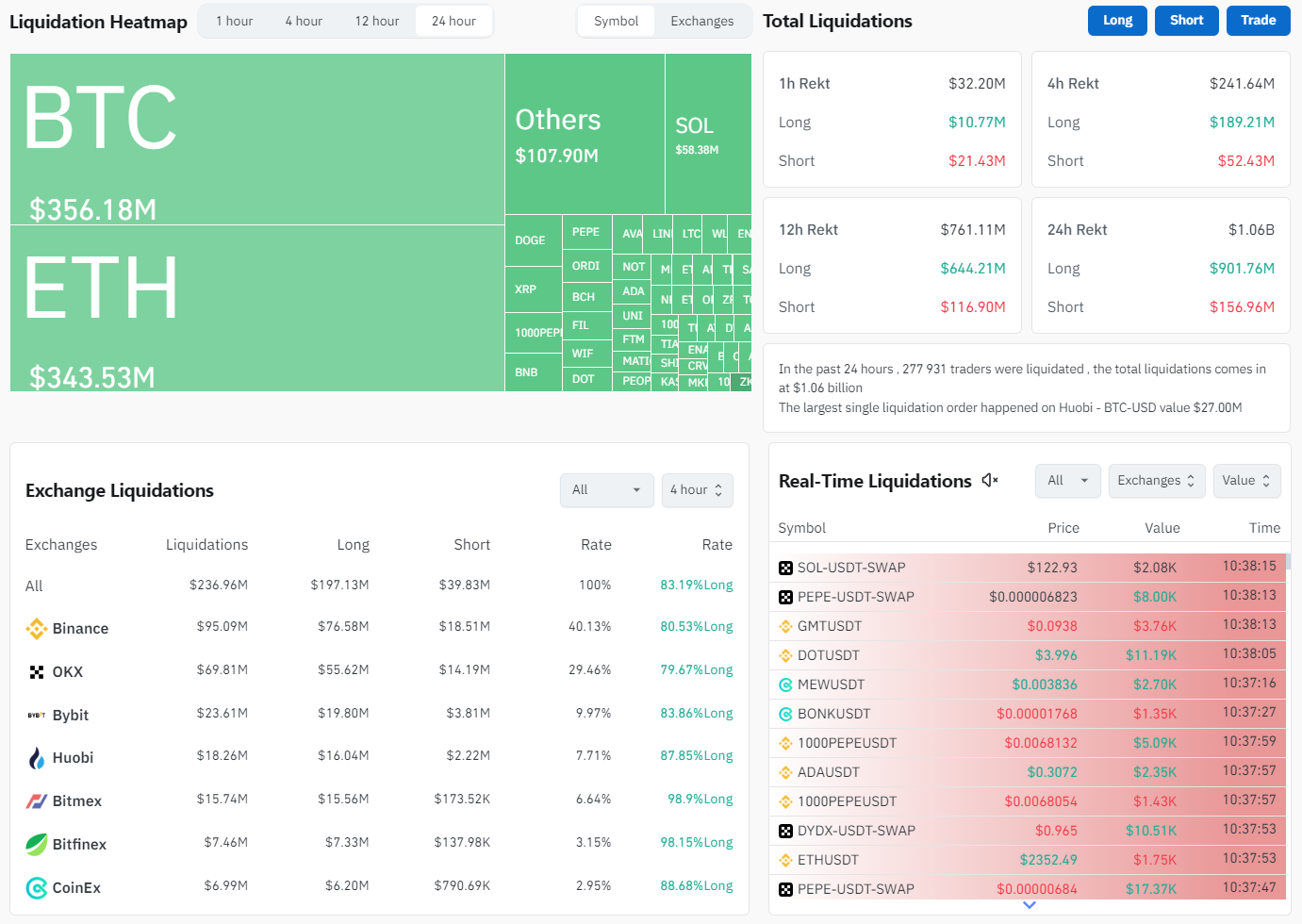

Today marks a disastrous day for financial markets, with staggering losses amounting to $1 billion. The turmoil can be attributed to several crucial factors. Specifically, an astounding 74,729 cryptocurrency traders faced liquidation yesterday, cumulatively leading to liquidations worth $1.04 billion.

1. The market is experiencing intense selling due to widespread liquidations, intensifying the decline. For Bitcoin and Ethereum alone, liquidation amounts amounting to $356 million and $343 million have been reported. Warren Buffett’s rapid selling of stocks, fueled by a frenzy, has further amplified the turmoil.

Investors have grown quite concerned due to Buffett’s recent actions. He has significantly altered his investment strategy and appears uncertain about the market condition, as demonstrated by his whopping $277 billion cash reserves. An unexpected decision that sent shockwaves through the market was Buffett divesting from Apple, a globally renowned tech giant.

The challenges encountered in the cryptocurrency sector aren’t exclusive; they mirror broader instability in the financial markets. For instance, the NASDAQ, a major stock market index, has plummeted by almost 6.5%. This downward trend suggests a more significant turmoil across financial markets. The situation is even grimmer in Japan, where the Nikkei 225 index has dipped over 10%, hinting at one of the largest declines in over eight years for Japanese stocks. This underscores the magnitude of the sudden market crash that started just a few days ago, resulting in some of the steepest losses since the FTX incident.

Currently trading between $50,000 and $60,000, Bitcoin is clinging to the significant support point at $50,000, which it has previously breached. This break indicates that the bullish trend might be nearing its end, a fact that raises concerns given the minimal returns observed during this market cycle. Meanwhile, Ethereum is encountering similar troubles due to institutional investors offloading vast amounts of their ETH assets.

Read More

- SOL PREDICTION. SOL cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD COP PREDICTION

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- USD ZAR PREDICTION

- CAKE PREDICTION. CAKE cryptocurrency

- Top gainers and losers

- USD PHP PREDICTION

2024-08-05 12:46