As an experienced financial analyst, I’ve closely monitored the correlation between Bitcoin and Ethereum with traditional markets and commodities, and the data suggests that these cryptocurrencies have been forging their independent paths recently. The near-zero correlation coefficient between Bitcoin and Ethereum and the majority of traditional assets indicates that they have not been significantly influenced by external market factors over the past month.

As a researcher examining market trends, I’ve discovered that the relationship between Bitcoin and Ethereum prices, and those of traditional financial markets, is relatively weak. This finding implies that the cryptocurrency sector may be carving out its unique path forward.

Bitcoin & Ethereum Have Been The Master Of Their Fates Recently

As a researcher examining market trends, I’ve discovered some intriguing insights using the IntoTheBlock market intelligence platform. Specifically, I found that the relationship between Bitcoin (BTC) and Ethereum (ETH) with traditional markets and commodities has been relatively insignificant lately.

The term “correlation” in this context refers to the correlation coefficient (r) used in statistics, which measures the degree of relationship or connection between two variables throughout a specified timeframe.

If the metric value is more than zero for two specific assets, it signifies a positive connection between their price movements. In simpler terms, when this value is greater than zero, it suggests that the prices of these assets are influenced by similar factors and tend to move in the same direction. The nearer the value is to 1, the stronger and more synchronized their price fluctuations become.

From my perspective as an analyst, when the correlation indicator takes on a negative value, it implies that there exists a connection between the two assets. However, this relationship is of an inverse nature. In other words, the price fluctuations of one asset are mirrored by the opposite movements in the other asset. The extreme point of this strong inverse correlation is represented by the figure -1 on the correlation scale.

As a researcher studying the relationship between two assets, I would interpret a correlation coefficient close to zero as an indication of no significant connection between the variables. In statistical terms, we would describe the assets as being independent.

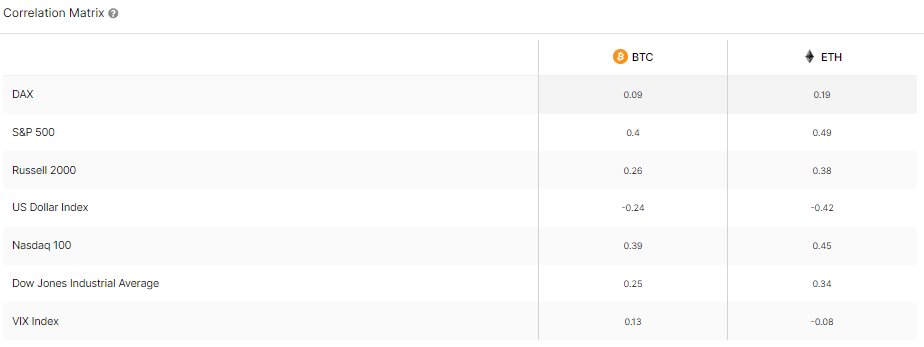

Here’s a table displaying the 30-day correlation between Bitcoin and Ethereum, the top two cryptocurrencies in terms of market capitalization, compared to some conventional assets:

Over the past month, Bitcoin and Ethereum have displayed relatively low correlation with other assets. Among these, they exhibit the strongest connection to the S&P 500 index, with correlation coefficients of 0.4 for Bitcoin and 0.49 for Ethereum.

In simpler terms, Ethereum (ETH) exhibits a slightly greater correlation with the S&P 500 and stronger relationships with other assets than Bitcoin (BTC). However, neither ETH nor BTC have strong correlations with these assets.

As a crypto investor, I’ve noticed that cryptocurrencies have shown a relatively low correlation with traditional markets over the past month. In simpler terms, their price movements haven’t closely followed those of stocks and bonds. Instead, they’ve been setting their own trends.

When considering new investments for their portfolio, investors should be aware of the correlation between different assets. Assets with strong correlations offer limited diversification benefits because they either perform similarly (positive correlation) or negate each other’s gains (negative correlation).

Because Bitcoin and Ethereum don’t have a strong connection to conventional markets or commodities, these cryptocurrencies could be potential assets for traditional investors to consider diversifying their portfolios with.

BTC Price

As a crypto investor, I’ve noticed that Bitcoin’s price has retreated from its previous gains and is now back around the $61,100 mark.

Read More

- USD PHP PREDICTION

- POL PREDICTION. POL cryptocurrency

- Hunter x Hunter: Togashi Reveals the Rarest Nen Type In The Series

- Brent Oil Forecast

- OKB PREDICTION. OKB cryptocurrency

- ZIG PREDICTION. ZIG cryptocurrency

- Final Fantasy 7 Gets Switch Update

- Bitcoin (BTC) on Verge of Losing $60,000, Is Shiba Inu (SHIB) Ready for It? Solana (SOL) Forms Reversal Pattern

- EUR ZAR PREDICTION

- HBOs The Last of Us Used Heavy Make-up To Cover One Characters Real-Life Injury

2024-05-10 04:11