As a seasoned crypto investor with a few battle scars from past market volatility, I’ve learned to be cautiously optimistic when it comes to market trends. The recent report on net inflows into Bitcoin investment products is certainly encouraging, especially considering the prolonged period of outflows we’ve seen.

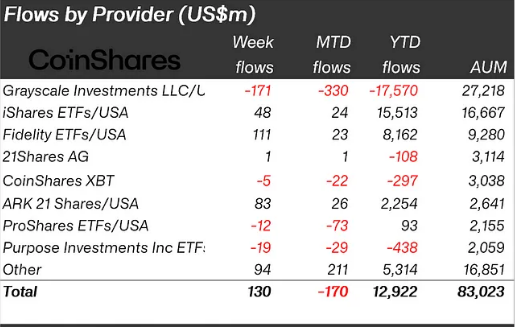

After a five-week absence from the digital asset market, investors are tentatively returning, with Bitcoin (BTC) being the most sought-after option. A recent study by CoinShares indicates a net investment inflow of $130 million into crypto products, signaling a possible shift following continuous outflows.

US Investors Lead The Charge

The United States has taken the lead in this transition, providing a significant proportion of the inflows. This development can be traced back, in part, to a decrease in selling pressure from Grayscale, the largest global manager of digital currency assets. The Grayscale Bitcoin Investment Trust (GBTC) experienced its smallest weekly redemptions in over five months, adding to the optimism among investors.

Hong Kong Joins The Inflow Party

As a researcher studying the global trends in Bitcoin investment, I’ve observed that the US has been leading the way in terms of net inflows into Bitcoin markets. However, I’ve also noticed an emerging interest in Bitcoin among investors in Hong Kong. Hong Kong-based Exchange Traded Funds (ETFs) focusing on Bitcoin attracted approximately $20 million, indicating a growing regional appetite for the cryptocurrency. Nevertheless, it is important to note that these inflows represent only a fraction of the significant investments made through Wall Street offerings. These Wall Street products, which totaled over $130 million in investments across various Bitcoin-focused funds, continue to dominate the market.

ETP Trading Volume Hints At Investor Caution

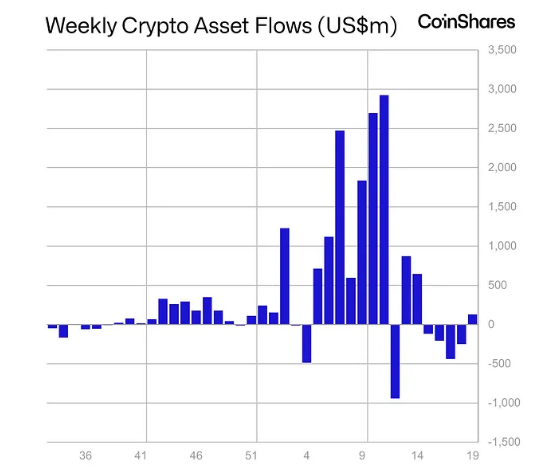

Although there is good news with increased net inflows, the report reveals a troubling development: a noticeable decrease in total trading activity for Exchange Traded Products (ETPs).

In contrast to the previous month’s weekly average of $17 billion, the current volume of $8 billion indicates a more prudent stance by investors. This observation is perceived by analysts as evidence that some investors are tentatively re-entering the market, while many others are still holding back, preferring to wait for greater market clarity before making significant moves.

Bitcoin Sentiment Rebounds, Ethereum Outflows Persist

As an analyst, I’ve noticed that the crypto market’s price fluctuations have resulted in contrasting reactions from investors regarding Bitcoin and Ethereum (ETH) recently. While Bitcoin experienced a significant outflow of investments earlier in May due to its falling prices, it now seems to be attracting investor interest once again with the recent inflows.

Ethereum’s narrative contrasts with Bitcoin’s. While Bitcoin saw inflows last week, Ethereum recorded an outflow of approximately $14 million.

Regulatory Uncertainty Clouds Ethereum’s Future

As an analyst, I’d observe that the persistent regulatory uncertainty surrounding Ethereum ETFs in the US is a significant factor driving recent outflows. The Securities and Exchange Commission (SEC) has yet to give its approval for spot Ethereum ETFs, leaving investors uncertain about the future of these investment vehicles. This prolonged delay has fueled skepticism among market participants, causing some to question whether regulatory approval will ever be granted.

The belief in the significance of these entities within the Ethereum network has been reinforced by the recent regulatory crackdowns targeting Consensys, Uniswap, and Robinhood.

Light At The End Of The Regulatory Tunnel?

The SEC’s position on the issue remains unclear at this time, but there is a possible solution emerging from Capitol Hill. Legislation and plans under consideration in Congress may provide long-awaited clarity about the regulatory agency that will govern the crypto sector. A clear-cut framework could substantially influence future market behaviors and boost investor trust.

Read More

- SOL PREDICTION. SOL cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD COP PREDICTION

- TON PREDICTION. TON cryptocurrency

- USD PHP PREDICTION

- USD ZAR PREDICTION

- ENA PREDICTION. ENA cryptocurrency

- Top gainers and losers

- EUR USD PREDICTION

2024-05-14 11:11