Uniswap (UNI) took a nosedive upward last Tuesday, like a startled cat on a trampoline, after Hayden Adams, the Uniswap Labs founder, unveiled a governance proposal called “UNIfication.” It’s the crypto equivalent of a circus act where protocol fees are tossed into a flaming hoop of token burns. According to Ki Young Ju of CryptoQuant, this could trigger a supply shock so severe, even the ghost of Satoshi Nakamoto might need an umbrella. Or a life jacket.

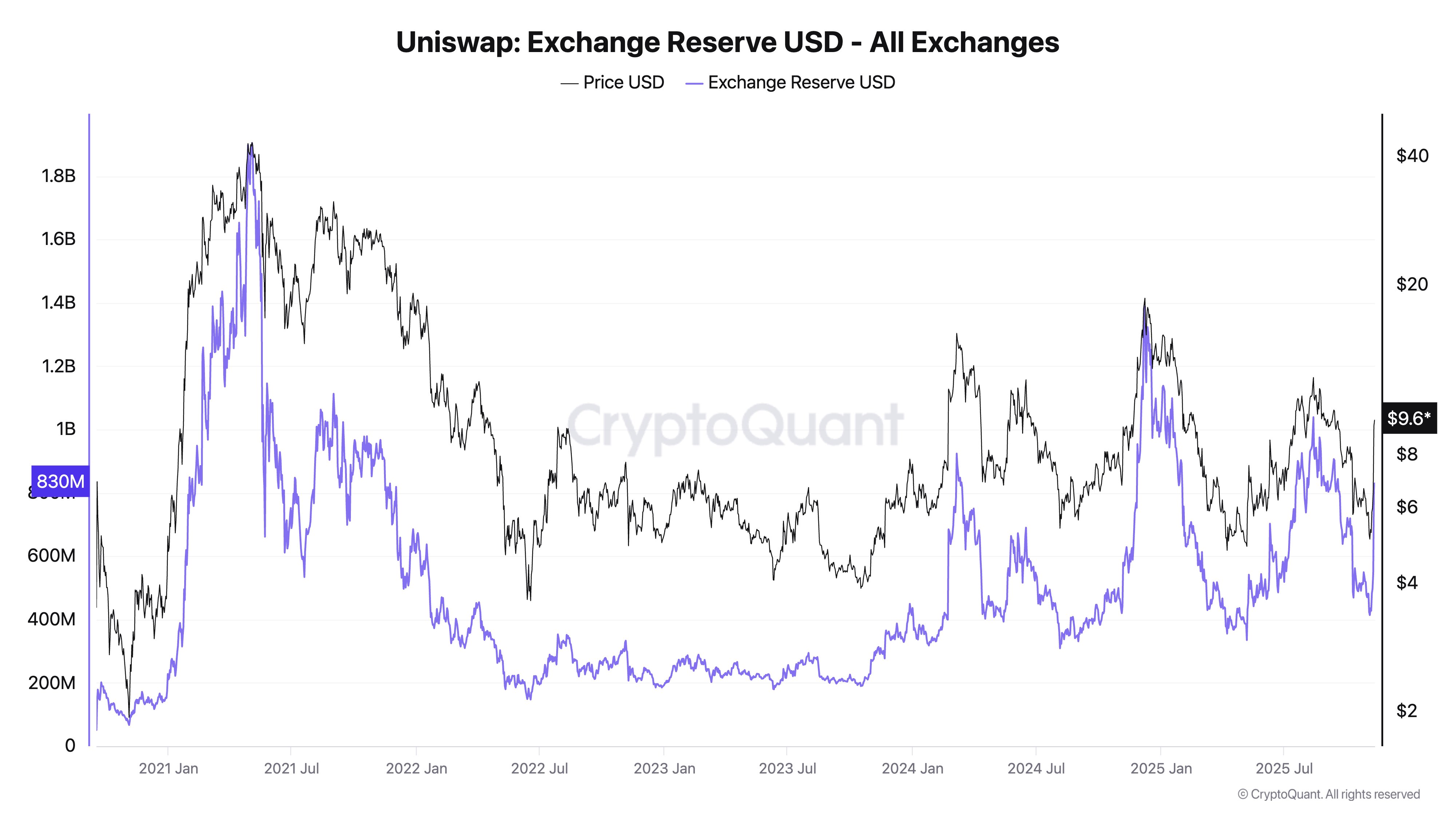

“If the fee switch activates, UNI could go parabolic,” Ki wrote, “like a rocket built by people who’ve never seen a launchpad. Annual burns could hit $500M if volume holds, and exchanges are holding $830M in UNI. Even with unlocks, a supply shock seems inevitable. Unless the universe suddenly decides to play nice.”

Hayden Adams, in a thread that could be described as “enthusiastic” if “enthusiastic” meant “typing in all caps while juggling flaming torches,” announced the proposal as the end of a five-year legal saga. “Labs couldn’t govern Uniswap before,” he wrote, “but now we’re free! Like a dragon finally allowed to hoard gold without being asked to balance the kingdom’s budget.”

The plan? Burn UNI tokens left and right. Protocol fees become a pyre for tokens, the treasury incinerates 100 million UNI retroactively, and sequencer revenue joins the bonfire. It’s like a medieval village burning witches, but the witches are tokens, and everyone’s wearing NFT robes.

Adams also introduced “fee discount auctions” to make liquidity providers feel less like pawns and more like kings with tiny hammers. And v4’s “aggregator hooks” let the protocol siphon fees from external liquidity, like a vampire squid with a PhD in economics.

Meanwhile, Uniswap Labs vowed to stop charging fees on its tools, which is either altruism or a masterclass in psychological manipulation. The Foundation’s staff are now under Labs, all funded by the treasury. It’s a corporate coup disguised as teamwork, like when a librarian takes over the zoo.

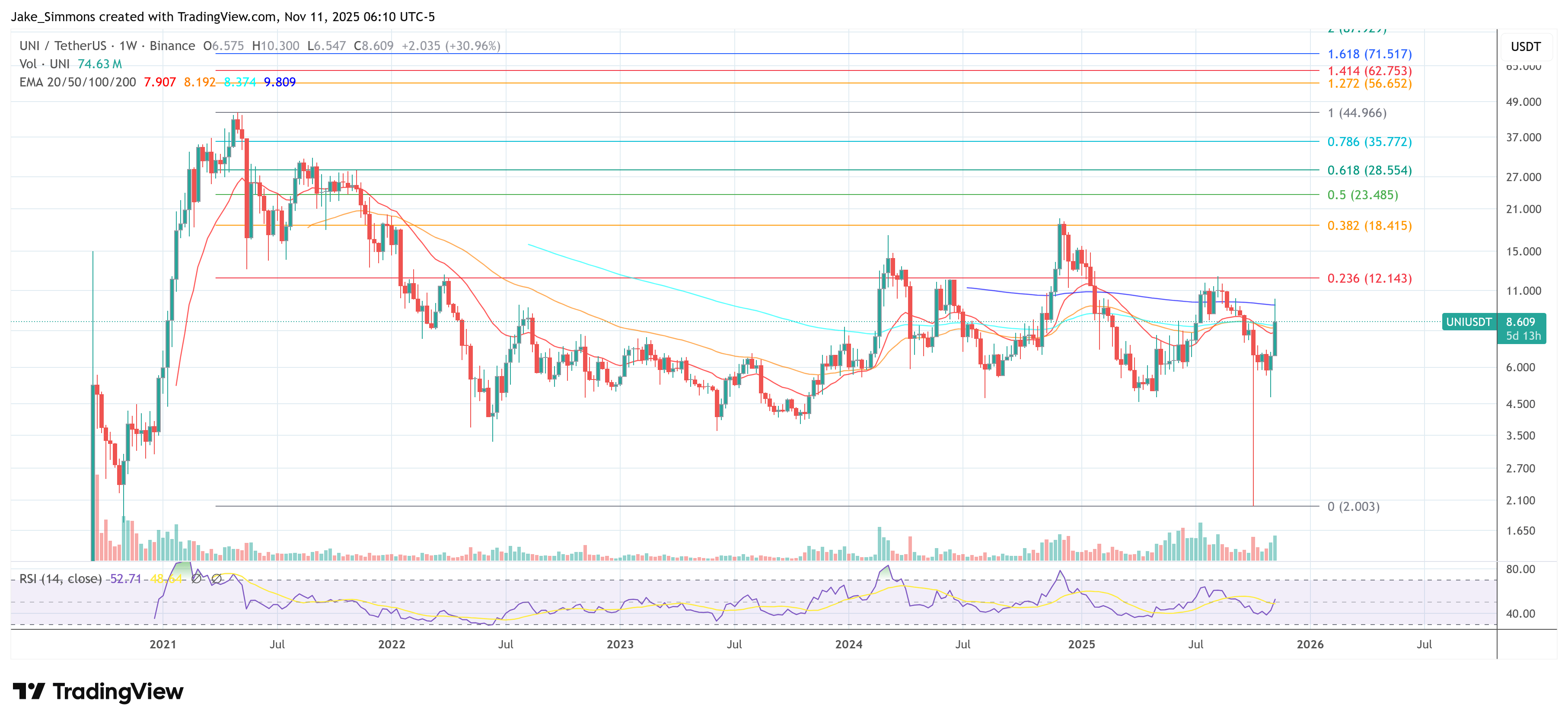

UNI’s price spiked 30% overnight, leaving other cryptos watching from the sidelines like awkward guests at a party they weren’t invited to. Ki Young Ju’s “supply shock” theory suddenly felt less like a hypothesis and more like a warning label.

But here’s the catch: Can this economic flywheel keep spinning without trampling liquidity providers? History shows Uniswap’s governance has wrestled with fee switches like a toddler with a Rubik’s Cube. But Adams insists this time it’s different because tokens get burned instead of handed out like participation trophies. “It’s a value concentrator,” he said, “like a black hole for your savings, but with better customer service.”

If BREAD of MegaETH Labs is correct, a tweaked 0.3% fee could send $38M monthly into buybacks, making Uniswap’s treasury richer than a disco DJ in 1979. Still, it’s a long way from HYPE’s $95M pace, which is like comparing a bicycle to a rocket ship-both go forward, but one might need a helmet.

As the world waits for governance to rubber-stamp the chaos, UNI trades at $8.609, which is either a rounding error or a prelude to madness. Either way, it’s definitely more exciting than your average Tuesday.

Read More

- The Winter Floating Festival Event Puzzles In DDV

- Best JRPGs With Great Replay Value

- Jujutsu Kaisen: Why Megumi Might Be The Strongest Modern Sorcerer After Gojo

- Sword Slasher Loot Codes for Roblox

- Jujutsu Kaisen: Yuta and Maki’s Ending, Explained

- One Piece: Oda Confirms The Next Strongest Pirate In History After Joy Boy And Davy Jones

- Roblox Idle Defense Codes

- All Crusade Map Icons in Cult of the Lamb

- USD COP PREDICTION

- Dungeons and Dragons Level 12 Class Tier List

2025-11-11 21:12