As a seasoned analyst with over two decades of experience in the financial markets, I find the recent rebound in Bitcoin Mining Hashrate quite intriguing. It’s reminiscent of the “gold rush” days, where miners are scrambling to expand their operations once again, indicating an optimistic outlook towards the network’s future.

On-chain data shows that the Bitcoin Mining Hashrate has bounced recently, suggesting miners are back to expanding their facilities.

Bitcoin Mining Hashrate Has Rebounded From Its Recent Lows

As a crypto investor, I understand that “Mining Hashrate” is a vital metric that monitors the total computational strength linked to the Bitcoin network at any given moment. This power is calculated in terms of terahashes per second, or TH/s.

As the metric’s value increases, current miners expand their operations, and new miners enter the network. This pattern suggests that miners find the network appealing or beneficial.

Alternatively, when the indicator decreases, it could mean that some miners chose to withdraw from the blockchain network, possibly due to the fact that they find mining less financially rewarding at present.

Currently, I’d like to share a graph illustrating the recent trend in the 7-day moving average (average over the past week) of Bitcoin mining Power (Hashrate) throughout the last year.

Based on the graph, the 7-day moving average for Bitcoin Mining Hashrate decreased to approximately 610 million terahashes per second (TH/s) earlier in the month compared to its all-time high of 667 million TH/s in late July. This decrease could be attributed to the bearish trend BTC experienced during that timeframe.

As a researcher delving into the world of cryptocurrencies, I’ve noticed that miners primarily derive their income from block subsidies, which are distributed at a consistent Bitcoin rate and regular time intervals. The sole factor influencing these rewards is the USD value of the digital currency. The initial dip in the asset’s value significantly impacted miner finances, highlighting the importance of understanding such fluctuations.

Bitcoin plummeted to less than $50,000 during this downturn, but it’s since bounced back a bit. However, it’s currently still a long way off from its $70,000 peak that it reached towards the end of last month.

Over the past week, it’s worth noting that the 7-day Moving Average of Mining Hashrate has surprisingly surged, reaching approximately 650 Terahashes per second (TH/s) two days ago. This suggests that some miners might be optimistic about a potential improvement in the asset’s performance in the near future.

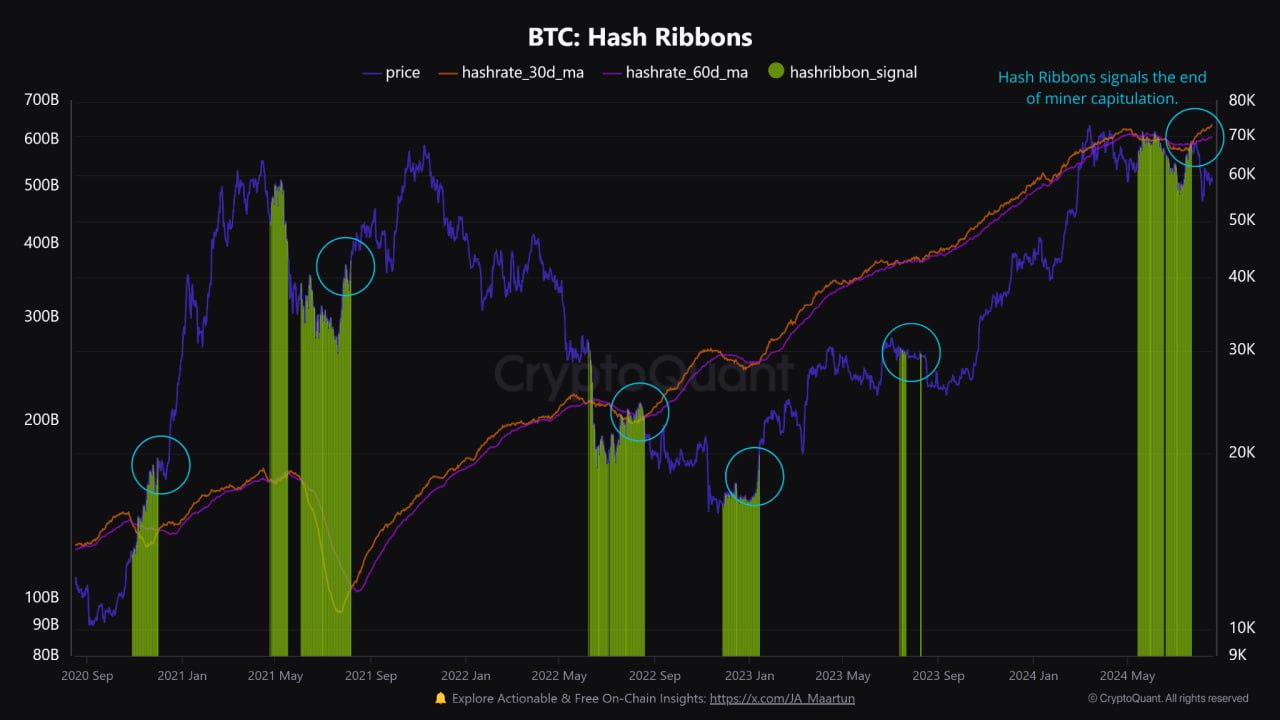

A popular indicator used to keep track of the BTC miners’ situation based on the Hashrate is the “Hash Ribbons.” The ribbons here refer to the 30-day and 60-day MAs of the Hashrate.

When one cryptocurrency (the former) falls below another (the latter), it often signals a period of miner capitulation, during which miners are hastily shutting down their mining operations. Historically, Bitcoin (BTC) has typically reached a low point when miners have experienced distress.

In a recent update on their platform, the blockchain analysis company, CryptoQuant, has shared insights about the current trend in this specific metric.

The graph indicates that the Bitcoin Hash Ribbons previously signaled a phase of selling exhaustion or capitulation, but over the last month, the 30-day moving average has climbed above the 60-day, suggesting a potential change in trend.

According to CryptoQuant, even though this indicator doesn’t specifically predict the exact lowest price, it tends to come before increased prices because it indicates a decrease in mining-related selling pressure.

BTC Price

At the time of writing, Bitcoin is trading at around $58,800, down 4% over the past week.

Read More

- SOL PREDICTION. SOL cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- TON PREDICTION. TON cryptocurrency

- USD COP PREDICTION

- USD ZAR PREDICTION

- USD PHP PREDICTION

- ENA PREDICTION. ENA cryptocurrency

- Top gainers and losers

- PHB PREDICTION. PHB cryptocurrency

2024-08-21 10:42