As a seasoned researcher with a knack for deciphering market trends, I find myself constantly intrigued by the ever-evolving landscape of Bitcoin (BTC). The latest dip in BTC’s price, following a 15% retrace from recent highs, has piqued my interest.

Bitcoin (BTC) is at a crucial level after a sharp 15% retrace from recent local highs. While traders and enthusiasts speculate about the causes of this downturn, the consensus is clear: demand is weakening.

As an analyst delving into the current state of the crypto market, I’ve drawn upon crucial market indicators and data to decipher the ongoing transformation, following the insights of CryptoQuant’s Head of Research, Julio Moreno.

Based on his assessment, decreasing interest seems to be playing a significant role in Bitcoin’s current price fluctuations. In this challenging phase for the cryptocurrency market, apprehension is mounting, which makes it tough for investors to predict the upcoming major shift.

As uncertainty grows amongst traders, the coming days may significantly impact Bitcoin’s future price trend, with bulls and bears clashing at crucial points. Will Bitcoin rebound, or will it continue to fall? The focus is on discerning any indicators that might suggest the direction of the market’s movement. Investors are keeping a keen eye for signals of what lies ahead.

Bitcoin Demand Is Declining Right Now

Right now, Bitcoin (BTC) is experiencing a considerable amount of selling as its demand growth has dropped noticeably. As per Julio Moreno, the head of research at CryptoQuant, this decrease in demand can be observed across various assessment indicators that have remained in a negative trend.

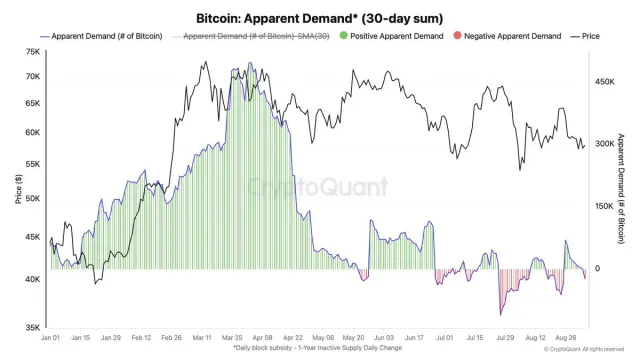

A key sign to consider is the increased supply of Bitcoin (over the past 30 days), which has dipped below demand levels, indicating a lack of strong buying interest. Moreno has pointed out in his analysis on X that the most alarming signs have been appearing since July, coinciding with a significant drop in the demand for Bitcoin.

The main factor causing Bitcoin’s difficulty in regaining its value and starting a new upward trend is the slow growth in demand. Although Bitcoin showed signs of recovery earlier this year, the lack of additional interest has prevented it from maintaining elevated prices.

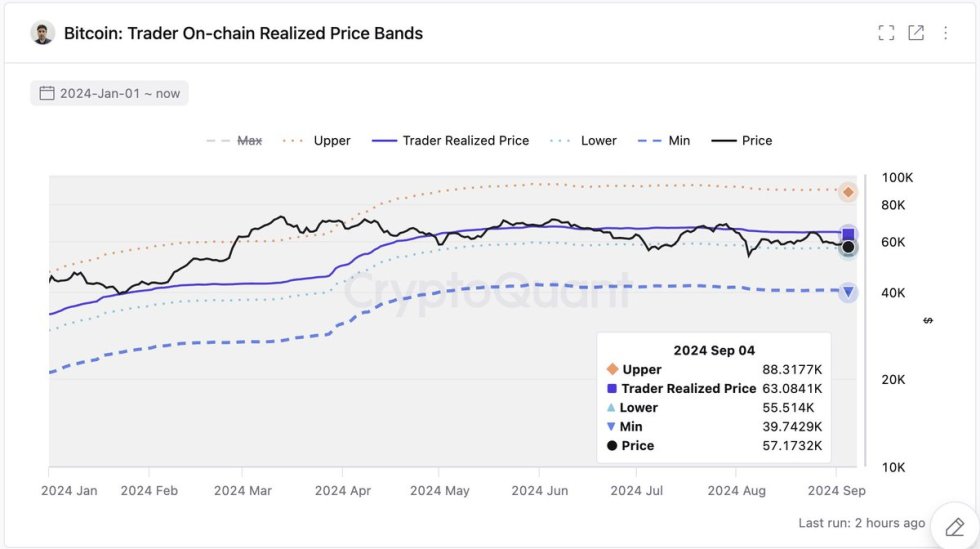

Moreno additionally noted that $55,500 serves as a significant benchmark for observation, reflecting the lower realized price that traders are finding on the blockchain. If the market fails to recover this level, it may indicate ongoing difficulties in attracting fresh buyers and suggest potential challenges ahead. Investors closely scrutinize these figures to decide whether the market will regain strength or if a continued decline is imminent.

BTC Price Action

Currently, Bitcoin (BTC) is being traded around $56,087, barely staying above the crucial threshold of $55,000 following a series of sluggish drops and uneventful market activity. The current Bitcoin price plateau indicates a potential dip to the less actively demanded zone at approximately $54,500.

As a crypto investor, if Bitcoin maintains its value above $55,000, it’s essential for us to regain the 4-hour 200 moving average, which currently stands at roughly $59,373. Once we surpass this mark and break through the significant psychological barrier of $60,000, it will pave the way for a renewed bullish trend and provide us with momentum.

If Bitcoin doesn’t manage to maintain its support at $54,500, there might be a significant drop in price, possibly reaching as low as $49,000 or even lower. Such a decline would suggest a bearish trend emerging, contradicting the current optimistic market view and putting Bitcoin’s recent growth to the test.

Keep a close eye on these crucial points, because dipping below $54,500 might intensify the ongoing slump, whereas bouncing back above $60,000 could rekindle optimistic sentiments among traders.

Read More

- SOL PREDICTION. SOL cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- USD ZAR PREDICTION

- USD COP PREDICTION

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- Top gainers and losers

- USD PHP PREDICTION

- CAKE PREDICTION. CAKE cryptocurrency

2024-09-07 07:11