Bitcoin, that brisk modern contraption of decimal virtue, was advertised as digital gold-a decentralised sanctuary for wealth against inflation, debasement, and the dollar’s unblinking monocle. Yet the market, with its customary sly humour, seems to be delivering a different sermon: de-dollarisation strides forward, investors seek shelter from geopolitics and price pressures, and gold hogs the lion’s share of capital while Bitcoin plays the part of a rather expensive curiosity.

Is Bitcoin Still A Store Of Value Or A Risk Asset?

Himanshu Sinha, writing on X, insists that Bitcoin was meant to be digital gold, a project for de-dollarisation. But the ledger keeps score differently: gold and silver are winning the trade. Over the past year, gold is up about 55%, silver around 150%, while BTC has stood still-like a professor at a lecture on a windy day.

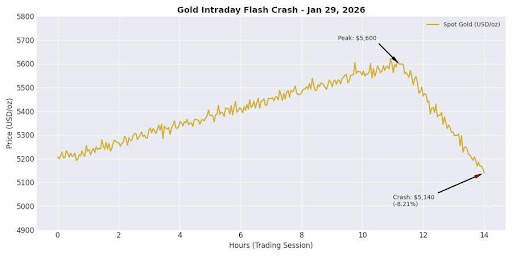

The central banks are the stage managers; they do not want volatility they cannot staff the exits for, nor an asset that dances in lockstep with the Nasdaq. They crave a controllable monetary infrastructure and are buying gold at the fastest pace in history. Just hours ago, gold flirted with 5,600 dollars, then promptly collapsed by about 8.21% to 5,140-a textbook margin liquidation staged as if by a perfumed siren.

And then Microsoft-tidy, solemn Microsoft-fell 11.7% as tech sectors sold their most reliable asset in a desperate cash call. The liquidity contagion, dear reader, is a cousin to the old crypto fever, merely wearing a suit this time.

According to Sinha, gold cannot be sanctioned in a bar. As the West weaponises the dollar through sanctions and controls, the rest of the world looks for a neutral exit. In the end, BTC endures as a speculative instrument, while gold bears the label of the more reliable replacement.

Why Gold Is Likely To Keep Outperforming Bitcoin

A trader known as Doctor Profit reminded the faithful nearly a year ago of a Gold vs Bitcoin chart: when 0.02 BTC equalled 1 ounce of gold, the top was nigh; when 0.11 BTC equalled 1 ounce, the bottom came into view. He observed this in 2021 at Bitcoin’s peak and again in 2022 at the bottom.

As per Doctor Profit, the analysis proved its mettle this year by pinpointing the BTC top at around 125,000 dollars when 0.02 BTC equalled an ounce of gold. A rough arithmetic: if 1 BTC equalled 5,500 in gold terms and you divide by 0.11, you obtain about 50,000 dollars for BTC-matching the bottom targets of the current cycle, somewhere between 50k and 60k.

Yet the forecast unfolds in the expected manner. If you price gold at 7,000 dollars an ounce, the BTC bottom would land near 63,000 dollars, a figure that also squares with the bottom target. In Doctor Profit’s view, gold may continue to outpace BTC in the months to come.

Read More

- Gold Rate Forecast

- How to Unlock the Mines in Cookie Run: Kingdom

- How to Find & Evolve Cleffa in Pokemon Legends Z-A

- How To Upgrade Control Nexus & Unlock Growth Chamber In Arknights Endfield

- Gears of War: E-Day Returning Weapon Wish List

- Top 8 UFC 5 Perks Every Fighter Should Use

- USD RUB PREDICTION

- Most Underrated Loot Spots On Dam Battlegrounds In ARC Raiders

- Byler Confirmed? Mike and Will’s Relationship in Stranger Things Season 5

- Jujutsu: Zero Codes (December 2025)

2026-01-31 03:50