As a seasoned crypto investor with over a decade of experience, I’ve witnessed my fair share of market fluctuations and trends. The current Bitcoin rally, which has surpassed all previous highs, is nothing short of extraordinary. While I’m cautiously optimistic about BTC‘s future price action, the recent miner selling activity can’t be ignored.

From my perspective as an analyst, it’s clear that Bitcoin has embarked on a journey of price exploration, repeatedly shattering previous record highs in the last week. In less than ten days, the price skyrocketed by an impressive 38%, underscoring the intense bullish enthusiasm sweeping through the market. At the moment, BTC is holding steady just below the $93,400 level, with traders and investors eagerly waiting to see its next strategic move.

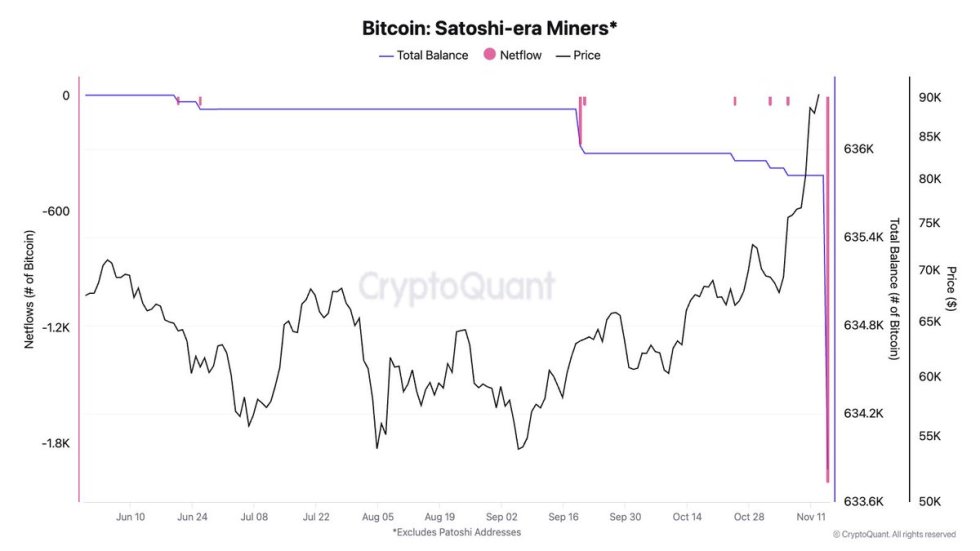

Information from CryptoQuant suggests an intriguing pattern: Miners, including one from the Satoshi era, are offloading substantial amounts of Bitcoin. Specifically, around 2,000 BTC were transferred, part of which went to exchanges, indicating that miners are actively cashing out their profits.

Such actions indicate that although there’s continuous high demand for Bitcoin, the growing output from miners might temporarily obstruct its progress, possibly causing the price to stay beneath its latest peaks.

Should this sales pattern hold steady, it’s likely that the price will keep hovering near its present value, possibly preparing for another surge. Yet, the overall market outlook is optimistic, fueled by robust institutional investment and positive economic indicators on a larger scale.

Mining activities introduce an extra dimension to Bitcoin’s price fluctuations, yet they simultaneously demonstrate the cryptocurrency’s robustness in handling selling force during its significant upward trend. Traders are keenly watching these events unfold as Bitcoin embarks on its next stage of valuation exploration.

Bitcoin Supply Holding The Price (For Now)

In simpler terms, Bitcoin’s strong upward price trend has temporarily slowed due to some investors and miners cashing in their profits. However, the general positive sentiment towards Bitcoin appears to be continuing. The market experienced a brief pause after an intense buying spree, but it seems the bullish trend is still alive and well.

According to information provided by Julio Moreno, the head of research at CryptoQuant, it’s apparent that Bitcoin miners have persistently sold off their holdings during this period. Notably, a miner active since the inception of Bitcoin (referred to as a Satoshi-era miner) recently moved 2,000 BTC that had been mined back in 2010 and hadn’t been touched before. It appears some of these coins were sent to exchanges, suggesting they were being offloaded for profit.

This action implies that even though Bitcoin’s value might experience temporary decreases due to miners selling, it could actually be a beneficial period of consolidation instead of a sign of vulnerability. Selling for profits is often seen after prolonged surges and may cause the price to stay near its current level for a brief span.

On the other hand, the overall inclination stays positive because the interest from institutional investors, particularly those utilizing Bitcoin ETFs, is escalating. Moreover, long-term investors, who have demonstrated tenacity during past market fluctuations, seem unlikely to offload at the present prices, offering robust backing instead.

If the current dominance of positive factors over miner selling persists, Bitcoin might swiftly resume its climb upward. Even though there might be a brief pause due to this cooling-off period, the underlying demand indicators seem to suggest that Bitcoin is poised to reach new peaks once the profit-taking phase ends.

BTC Consolidates Below ATH

The current price of Bitcoin is $89,400, which is a 7% decrease from its latest record high of $93,483. Following an intense surge in price exploration, the cost has now stabilized just below this peak. This period of stability will help decide if Bitcoin will maintain its upward trend or encounter a more significant correction.

If Bitcoin maintains its position above $85,000 in the near future, we might witness a rise towards fresh record highs, with $90,000 serving as the next potential barrier. The overall market outlook remains optimistic, and robust support at $85,000 could serve as a catalyst for an attempt to surpass the earlier all-time high (ATH).

If Bitcoin can’t regain the $90,000 mark and falls below its current support at $85,000, the price might dip into the demand zones around $82,000. At this point, there may be an increase in buying interest. A fall below $82,000 could hint at a more significant correction, but as long as Bitcoin maintains its support at $85,000, the bullish trend remains strong. Short-term direction will be closely watched by traders based on these key levels.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- POL PREDICTION. POL cryptocurrency

- Brent Oil Forecast

- EUR CNY PREDICTION

- HBOs The Last of Us Used Heavy Make-up To Cover One Characters Real-Life Injury

- EUR ZAR PREDICTION

- OKB PREDICTION. OKB cryptocurrency

- Hunter x Hunter: Togashi Reveals the Rarest Nen Type In The Series

- EUR AUD PREDICTION

- BTC PREDICTION. BTC cryptocurrency

2024-11-16 15:42