As a seasoned crypto investor with battle scars from the 2017 bull run and the subsequent bear market, I’ve learned to never take the market’s twists and turns for granted. XRP‘s recent surge past $1.62 has my attention, and I can’t help but feel a sense of déjà vu. The meteoric rise in less than 30 days, reminiscent of the infamous parabolic rises we’ve seen before, has sparked both excitement and caution within me.

As an analyst, I’m observing a significant surge in XRP, breaking through the $1.62 barrier and nearing the critical $2 threshold, which represents just under 5% of the distance left. This impressive rally has been unfolding since last Tuesday, garnering the focus of both investors and fellow analysts alike. The bullish trend indicates a potential continuation of this upward trajectory, driven by increasing optimism and robust market sentiment. However, it’s essential to acknowledge that such rapid gains may also introduce potential risks, particularly in unstable market conditions.

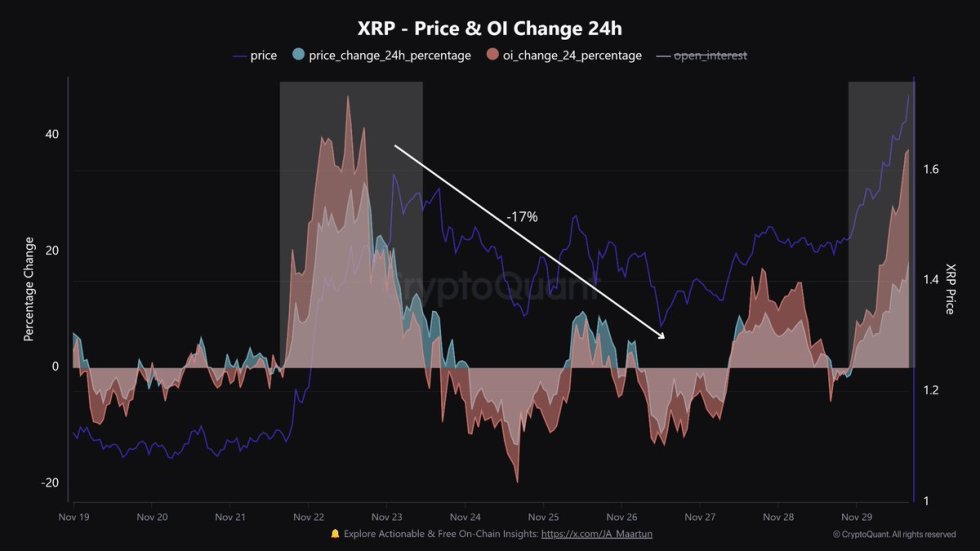

According to CryptoQuant analyst Maartunn’s analysis, it appears that XRP’s recent rise in value might be more due to speculative trading using leveraged positions rather than genuine demand growth. This situation, known as a Leverage-Driven Surge, signifies increased speculation, which could result in significant drops if the momentum falters. As the price of XRP nears record highs set over several years, investors should exercise caution, managing their excitement with an understanding of potential downside risks.

In the upcoming period, XRP is poised for significant developments as it approaches the psychologically important $2 price point. If it manages to surpass this threshold, it could strengthen the bullish argument, potentially leading to fresh record highs. However, if it struggles to hold its current position, we may witness heightened volatility and potential reversals. Currently, XRP is a crypto asset that’s under intense scrutiny, as everyone eagerly waits for its next move in the market.

Can XRP Bulls Sustain This Pace?

The extraordinary increase of XRP, soaring more than 285% within just 30 days, has ignited discussions among investors. Some are pondering if the current momentum can be maintained given the intense demand necessary to drive prices higher still. While this surge has renewed enthusiasm in the market, critics propose that it might result in a steep upward trend (parabolic bull run) or serve as a plan for large investors to cash out (whale exit strategy).

In the world of cryptocurrencies, “exit liquidity” signifies individual investors who jump on a rapidly increasing asset, often fueled by excitement or hype, enabling initial investors or large-scale traders (whales) to cash out their holdings at inflated prices. This phenomenon stirs up questions about the longevity of XRP’s surge, especially if genuine demand doesn’t match the pace set by speculative interest.

Martunn offered an engaging viewpoint on XRP’s recent market trends. By examining both price fluctuations and Open Interest (OI) figures, he classified the surge as a Leverage-Fueled Price Spike. During this timeframe, OI increased by 37%, suggesting a significant uptick in leveraged trading activities.

Using leverage can increase potential profits, but it also brings higher volatility and risk. As a reminder from Maartunn, a similar occurrence previously led to a 17% loss, so investors should exercise caution.

Moving forward, as XRP nears significant milestones, the ensuing decisions could be pivotal. Investors should consider the prospect of further advancement while also taking into account the dangers posed by potential higher borrowing and the possibility of large-scale sell-offs orchestrated by influential traders (whales).

Price Action: Key Levels To Watch

The current price of XRP is at $1.92, surpassing the crucial barrier at $1.60 and reaching yet another high point. It’s currently approaching the previous peak at $1.96, a level that carries both psychological and technical significance. This surge in price has sparked optimism among investors, who are anticipating the $2 mark as evidence of XRP’s robust bullish trend in the long term.

A jump past $2 would strengthen the bullish outlook for Ripple (XRP), signifying an essential achievement in its current surge. Such an increase might open doors for more optimistic price predictions as investor confidence grows. Nevertheless, traders are mindful of the possibility of a pullback. If XRP is unable to maintain momentum above $2, a reversal may push prices back towards crucial support areas, notably around $1.60, where substantial demand has been noted.

Over the coming days, we’ll see if the price continues to rise or experiences a brief dip due to its crucial momentum. As XRP gets closer to the significant $2 price point, it’s essential for investors to monitor trading activity and market opinion, as they will probably influence XRP’s immediate future movements.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- POL PREDICTION. POL cryptocurrency

- Brent Oil Forecast

- BTC PREDICTION. BTC cryptocurrency

- XDC PREDICTION. XDC cryptocurrency

- Hunter x Hunter: Togashi Reveals the Rarest Nen Type In The Series

- EUR ZAR PREDICTION

- HBOs The Last of Us Used Heavy Make-up To Cover One Characters Real-Life Injury

- ZIG PREDICTION. ZIG cryptocurrency

- EUR CNY PREDICTION

2024-12-01 04:12