As an analyst with years of experience tracking the cryptocurrency market, I’ve seen my fair share of bull runs and bear markets. However, the current surge in Chainlink (LINK) has caught my attention for several reasons.

In recent days, Chainlink has shown exceptional performance compared to other sectors, surging significantly. The reasons behind this upward trend, as suggested by on-chain analysis, are as follows.

Chainlink Price Has Been Sharply Moving Up Recently

Over the past few weeks, investing in LINK has been highly profitable, with its value nearly tripling since early November. However, at the beginning of this current week, there was a minor dip, yet the strong upward trend appears to have quickly picked up again over the last few days.

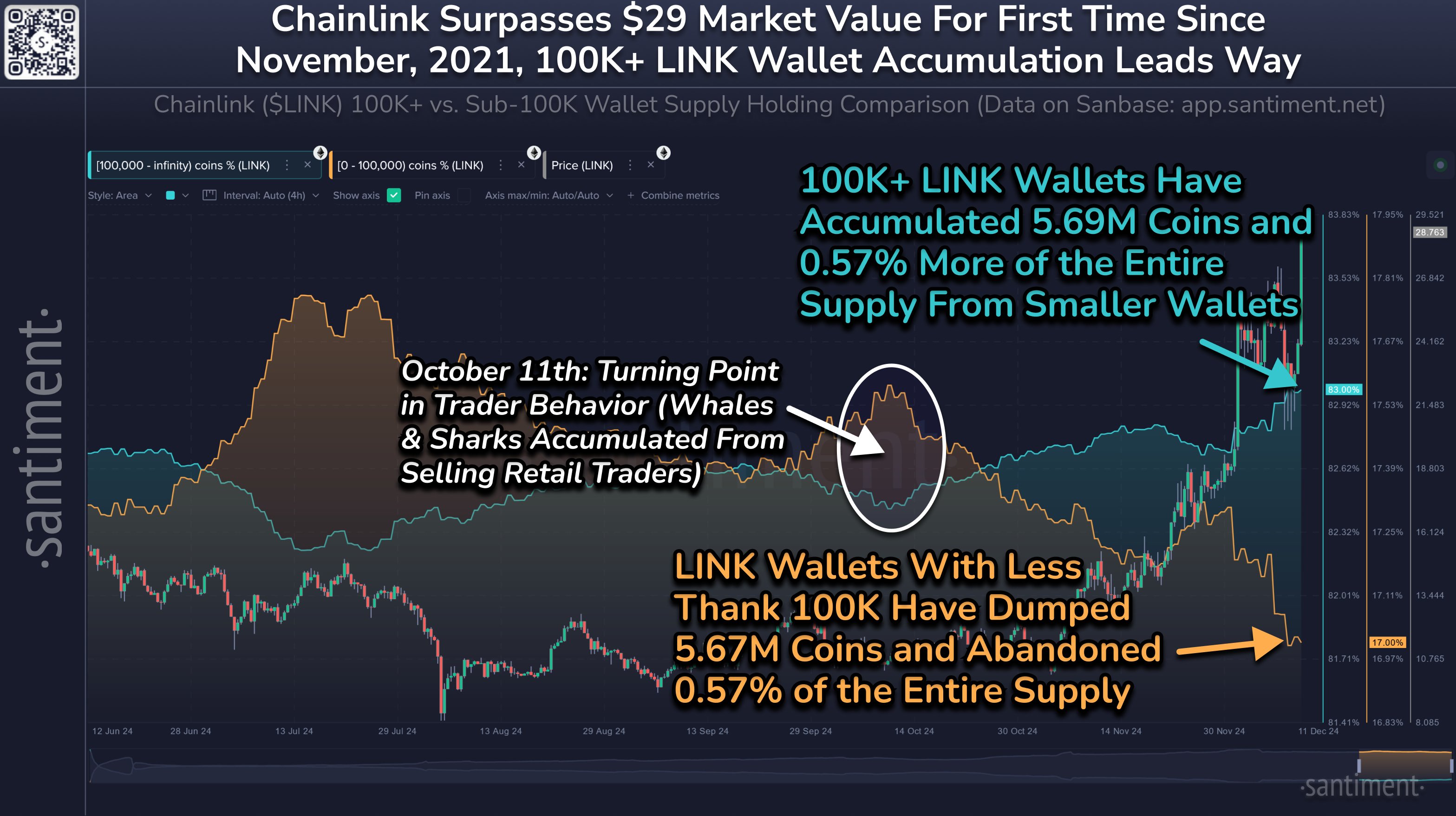

Below is a chart that shows what LINK’s performance has been like over the last few months:

Based on the chart’s data, it’s clear that after experiencing a surge of approximately 47% from its bottom earlier this week, Chainlink has successfully surpassed the $28 threshold. Currently, this asset is enjoying weekly returns exceeding 22%, positioning it as the top performer among the leading cryptocurrencies in terms of market capitalization.

Regarding market capitalization, Chainlink (LINK) currently ranks 12th among its peers. It surpasses Shiba Inu (SHIB) slightly in this category.

From the table presented, it’s clear that Avalanche (AVAX) currently appears poised to surpass Chainlink (LINK) in value. However, with AVAX’s market cap being $3.5 billion greater than LINK’s at present, a flip could take some time. This assumption holds true if the current bullish trend persists and doesn’t fizzle out prematurely.

Could it be that on-chain data might offer some clues about the reasons behind the rise in this digital currency?

LINK Sharks & Whales Have Been Busy With Their Accumulation

In their latest update on platform X, Santiment, an on-chain analytics company, has delved into the varying behaviors observed between small and large entities within the LINK network recently. A key metric they’ve focused on is “Supply Distribution,” which monitors the current holdings of Chainlink tokens by different wallet groups at present.

In the present discussion, we’re focusing on two categories of coin amounts: those ranging from 0 to 100,000 coins and those with 100,000 or more coins. At the current exchange rate, this boundary between the two categories translates approximately to $2.8 million.

Investors with amounts surpassing this specific threshold are often referred to as major players in the market, commonly known as “sharks” and “whales.” Consequently, the distribution of supply within this elite group reflects the investing patterns of these significant investors.

Here’s a graph provided by the analytics company, which illustrates how this specific indicator varies among sharks (large-scale investors), whales (very large-scale investors), and ordinary investors.

According to the graph presented earlier, it appears that smaller Chainlink investors have been offloading their assets over the past few months. This could be due to their belief that LINK might not recover.

The sharks and whales, however, smelled the opportunity and bought a total of 5.69 million coins from this group. As Santiment explains,

Historically, when big cryptocurrency wallets buy coins from anxious or rushed individual investors, it often leads to an increase in market capitalization.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- XDC PREDICTION. XDC cryptocurrency

- POL PREDICTION. POL cryptocurrency

- Brent Oil Forecast

- BTC PREDICTION. BTC cryptocurrency

- HBOs The Last of Us Used Heavy Make-up To Cover One Characters Real-Life Injury

- EUR ZAR PREDICTION

- Hunter x Hunter: Togashi Reveals the Rarest Nen Type In The Series

- OKB PREDICTION. OKB cryptocurrency

- ZIG PREDICTION. ZIG cryptocurrency

2024-12-14 14:11