As a researcher who has been closely following the evolving landscape of cryptocurrencies and their taxation in India, I find the ITAT’s decision to be a significant step towards bringing clarity and fairness to the system. Being an early adopter myself, I can appreciate the relief this decision offers to those who took the leap into the digital asset world before April 1, 2022.

Today, the Income Tax Appellate Tribunal (ITAT) based in Jodhpur, India, has provided clarity on how crypto transactions made prior to the current financial year (2022-2023) are taxed. As per this ruling, any profits derived from these transactions will be classified as capital gains.

ITAT Gives Clarity On Pre-2022 Crypto Taxation

In a significant decision affecting India’s digital asset market, the Income Tax Appellate Tribunal (ITAT) determined that cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and others were classified as capital assets prior to April 1, 2022. As a result, any profits generated from their sale during this period should be categorized as capital gains rather than income from other sources.

For those not familiar, India’s current taxation system for virtual assets started on April 1, 2022, as part of the Virtual Digital Assets (VDA) regulations. Under these rules, all crypto gains are subject to a flat 30% tax rate, and there is no option for taxpayers to offset losses with gains. Furthermore, a 1% tax is deducted at the source (TDS) for every crypto transaction.

Conversely, the decision made by ITAT provides some alleviation for early adopters of cryptocurrencies in India. This is because they will now be charged a lower tax rate compared to the existing flat rate of 30%. To break it down, prior to April 1, 2022, short-term capital gains were subjected to a tax of 15%, while long-term capital gains were levied at 10%.

The ITAT’s decision came while hearing a case involving an individual who had purchased BTC worth $6,478 in FY 2015-16 and sold it for $78,803 in FY 2020-21. The individual argued that the proceeds from the sale should be taxed as long-term capital gains since the asset was held for more than three years. However, the assessing tax officer disagreed, contending that digital assets assets, lacking intrinsic value, could not be classified as property.

As a researcher, I’d like to highlight a key point from my recent findings. Contrasting opinions were presented, but the Income Tax Appellate Tribunal (ITAT) rejected the tax officer’s viewpoint. They based their decision on Section 2(14) of the Income Tax Act, which classifies cryptocurrency as property. The ITAT further elaborated that any form of property owned by a taxpayer, be it a tangible asset or a claim or right over an asset, conforms to the definition of a capital asset under this act.

India’s Regulatory Gap In Digital Assets

In contrast to leading the world in crypto adoption, India is falling behind when it comes to establishing a favorable legal environment for digital currencies. This lack of regulatory support has prompted many virtual asset companies to establish their headquarters in more welcoming crypto-oriented countries like the United Arab Emirates or Singapore instead.

India’s hefty tax regime, with taxes up to 30% on earnings and 1% Tax Deducted at Source (TDS) on transactions, has frequently faced criticism. The previous CEO of WazirX digital assets exchange forecasted last year that the existing tax structure would likely persist for another two years before any substantial changes could be expected.

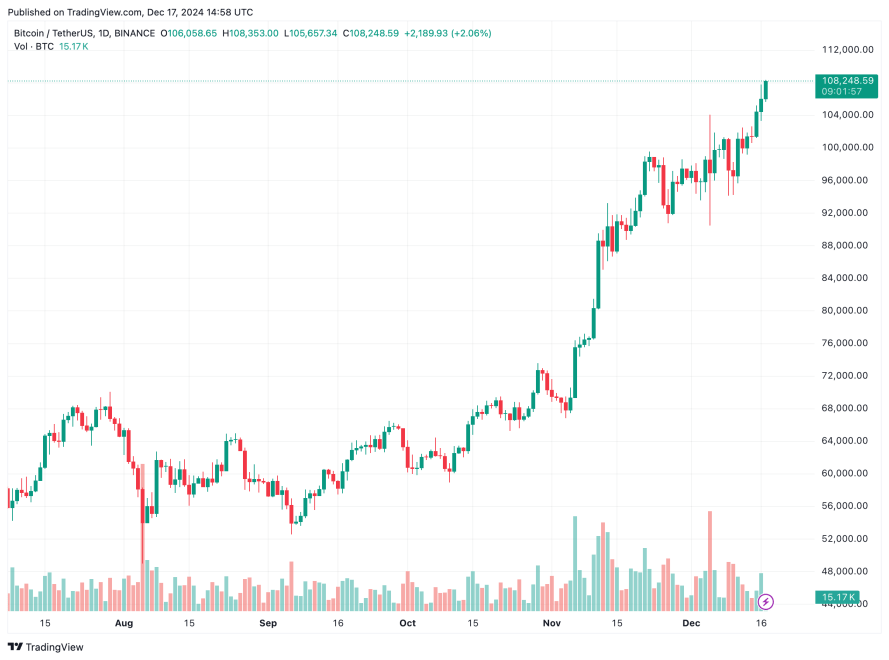

The Indian administration is looking into discussions with professionals from the industry to create a fair and well-balanced legal structure for digital currencies like Bitcoin, which currently stands at approximately $108,248 per coin and has seen a 2.5% increase in value over the last day.

Read More

- USD PHP PREDICTION

- POL PREDICTION. POL cryptocurrency

- Hunter x Hunter: Togashi Reveals the Rarest Nen Type In The Series

- Brent Oil Forecast

- HBOs The Last of Us Used Heavy Make-up To Cover One Characters Real-Life Injury

- ZIG PREDICTION. ZIG cryptocurrency

- Pokemon Is Collaborating With Dua Lipa

- Final Fantasy 7 Gets Switch Update

- EUR ZAR PREDICTION

- Bitcoin (BTC) on Verge of Losing $60,000, Is Shiba Inu (SHIB) Ready for It? Solana (SOL) Forms Reversal Pattern

2024-12-18 05:41