As a seasoned researcher with years of experience in the volatile world of cryptocurrency trading, I have seen my fair share of market fluctuations and anomalies. The recent events surrounding Dogecoin (DOGE) have caught my attention, not just because of its popularity as a meme currency, but due to the unusual activity in derivatives trading that has unfolded over the past 24 hours.

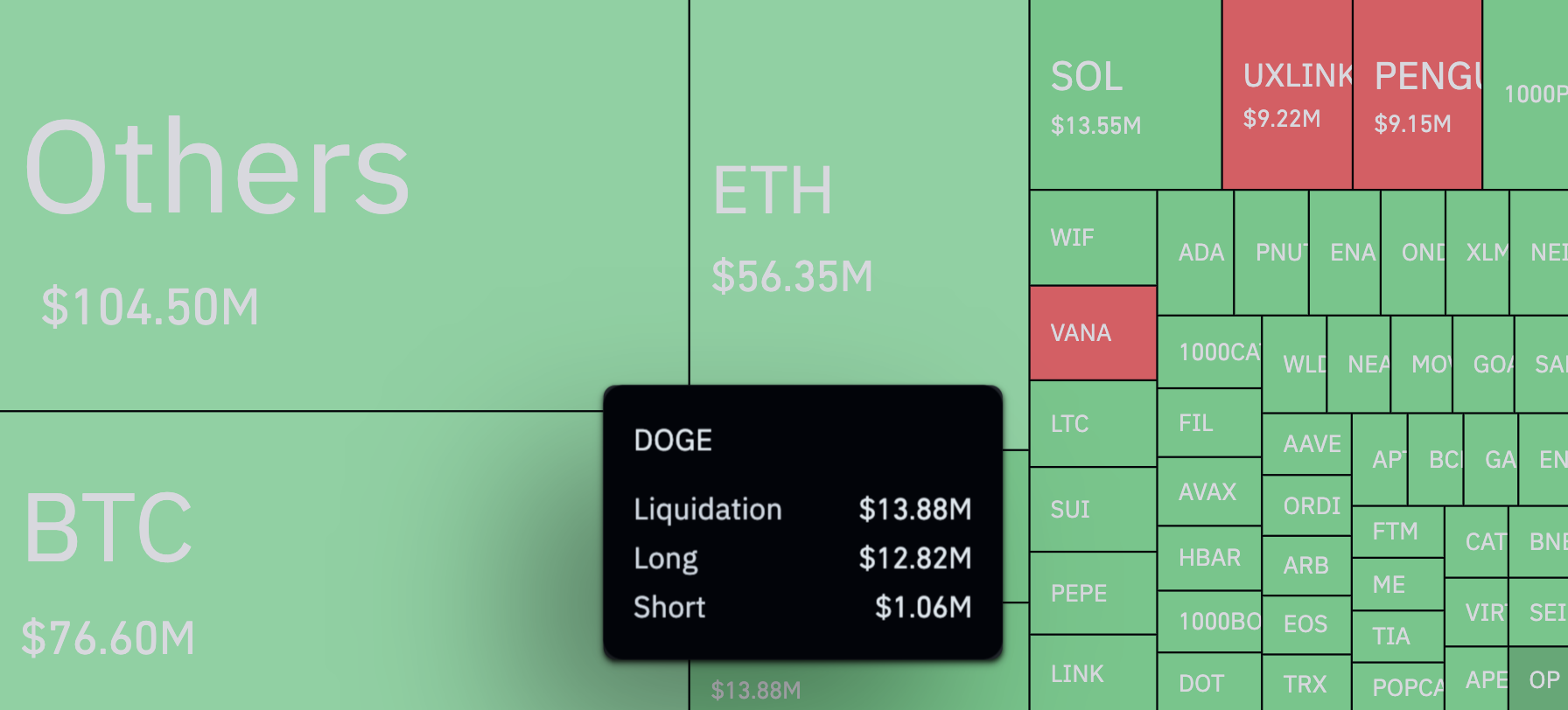

Unusual activity has been spotted in the trading of Dogecoin (DOGE). According to information from CoinGlass, there was a significant imbalance in derivatives trading for this well-known meme cryptocurrency over the past 24 hours. The total liquidated positions of Dogecoin reached $13.88 million, which might not seem like much compared to the overall market value of $402.63 million, but it still places DOGE among the larger assets in this category.

As a crypto investor, I’ve noticed that while the scale of Dogecoin liquidations might seem concerning, it’s their character that should truly grab our attention. An astounding 92.36% of these liquidations are long positions. To put it more dramatically, if we were to exaggerate, the amount of liquidated long positions is a staggering 1,209% greater than the total of liquidated shorts. This imbalance arises due to newcomers or overleveraged traders often underestimating risk and receiving margin call notices from exchanges as a consequence.

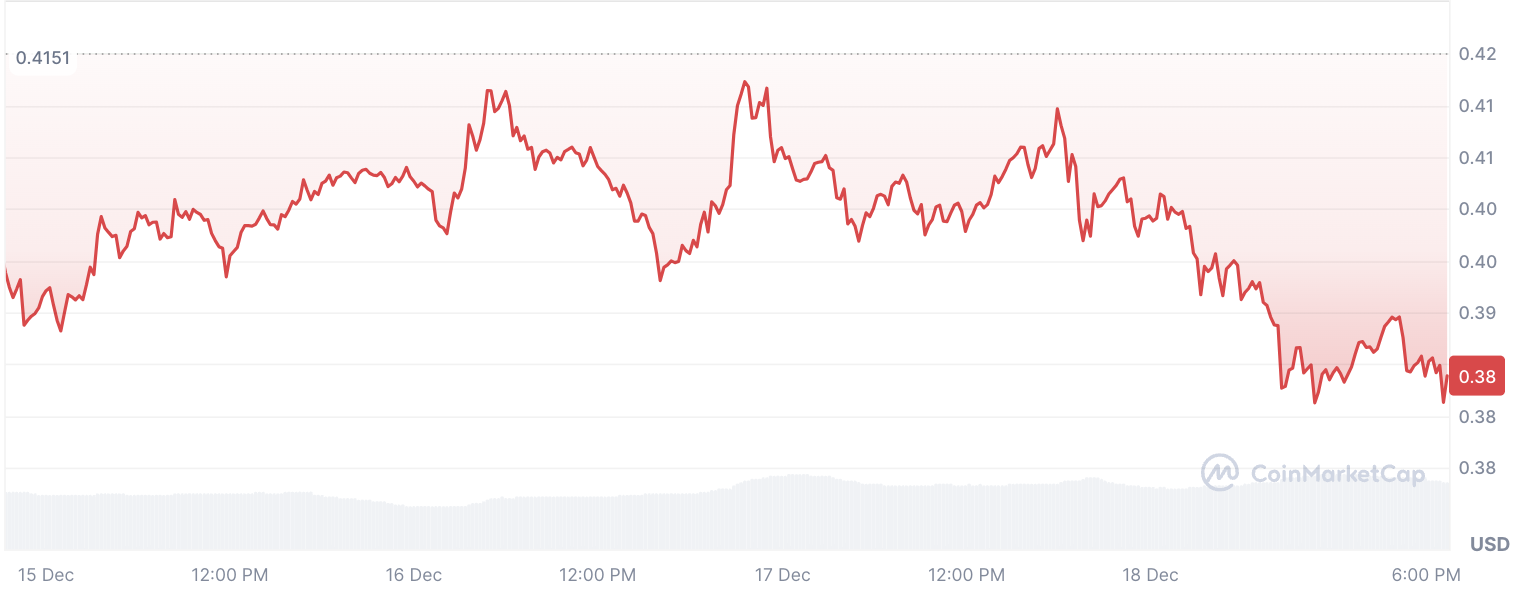

Could you elaborate on what causes this trend? Over the past day, Dogecoin’s trading pattern suggests a potential significant surge, characterized by progressively lower peaks and higher troughs. Given Bitcoin’s simultaneous achievement of its all-time high and the tendency of Dogecoin to mirror the major cryptocurrency, the charted price trend seemed optimistic.

Initially, a significant drop in trading prices at the beginning of the day dashed all hopes for a DOGE breakout and eliminated many long positions. Following this, there was another rise today, but the price increase of Dogecoin by 1.5% failed to sustain and triggered further selling by bullish investors.

Bulls punished, bears celebrating — how long this trend will last remains an open question.

Read More

- USD PHP PREDICTION

- POL PREDICTION. POL cryptocurrency

- Hunter x Hunter: Togashi Reveals the Rarest Nen Type In The Series

- Brent Oil Forecast

- LUNC PREDICTION. LUNC cryptocurrency

- OKB PREDICTION. OKB cryptocurrency

- EUR CNY PREDICTION

- ZIG PREDICTION. ZIG cryptocurrency

- Pokemon Is Collaborating With Dua Lipa

- Final Fantasy 7 Gets Switch Update

2024-12-18 18:57