As a seasoned researcher with years of experience observing the cryptocurrency market, I have learned to read between the lines and decipher the subtle signals that can predict the next move. The 26 EMA acting as a pivot for XRP is a crucial development, but it’s not a guarantee of a bullish turnaround.

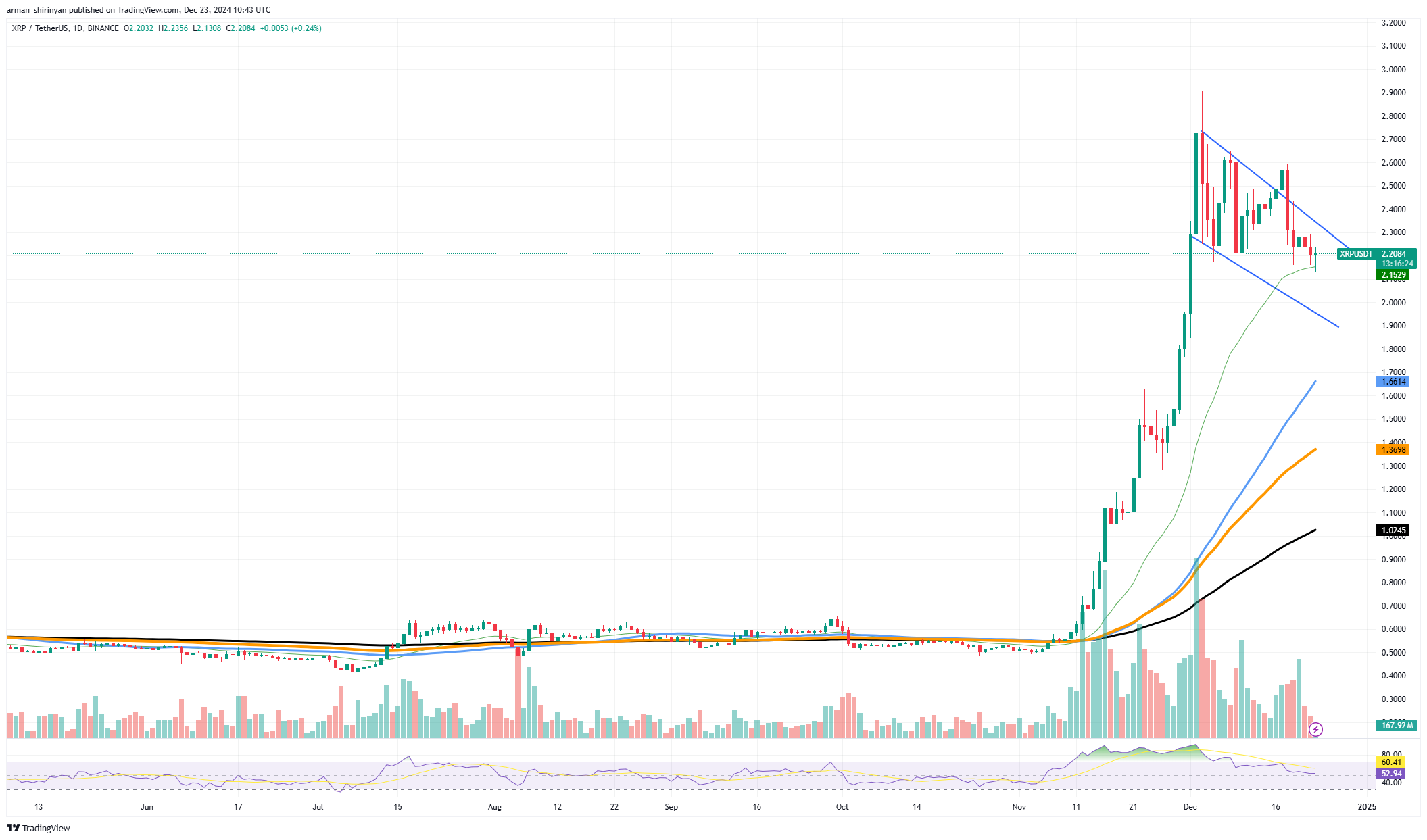

XRP’s price has recently been supported near the 26 Exponential Moving Average (EMA), a significant point that frequently influences market sentiment as a pivot. The asset’s value has stabilized in this region, suggesting either a potential reversal or further declines if this level is not maintained. Given the importance of the 26 EMA as a support zone, XRP investors are keenly watching price fluctuations to predict the next step.

Transaction volume of XRP: The number of transactions increased significantly in early December, however, it has been gradually decreasing since then, implying a decline in network usage.

Reduced activity: The number of distinct senders has dropped noticeably, indicating a decrease in retail involvement.

As a researcher, I’ve observed that during the early peak of the surge, XRP was indeed incinerated as transaction fees. However, post this initial phase, it has settled down and mirrors the decline in transactional activity, maintaining a steady state.

If XRP maintains its position above the 26-day Exponential Moving Average (EMA), it may indicate a return of buying enthusiasm, propelling the price towards approximately $2.40 as an initial resistance level. A surge in transactional activity could reinforce this recovery, potentially triggering a bullish trend that might carry XRP to $2.60 or even higher values. An uptick in active accounts and payment volumes might stimulate additional buying interest, driving the bullish sentiment further.

Dropping below the 26 EMA (Exponential Moving Average) might initiate a fall towards $2.00, probing the next support level. Continual decrease in network activity might undermine market trust, potentially driving XRP down to $1.90 or even lower. If the price trend doesn’t coincide with rising volume, it could suggest a bearish divergence and possible additional declines.

The performance of XRP is contingent upon it maintaining the 26 Exponential Moving Average (EMA) and experiencing an increase in on-chain activity. Presently, the indicators indicate prudence, but a significant surge beyond $2.40 may rekindle optimistic feelings among investors. Contrarily, if XRP fails to uphold crucial support, it might trigger additional selling pressure, with $2.00 as the upcoming level to observe closely. At present, XRP is at a juncture where its direction – whether upward or downward – depends on market circumstances.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- XDC PREDICTION. XDC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- Hunter x Hunter: Togashi Reveals the Rarest Nen Type In The Series

- EUR AUD PREDICTION

- Brent Oil Forecast

- DUSK PREDICTION. DUSK cryptocurrency

- CHR PREDICTION. CHR cryptocurrency

- USD COP PREDICTION

- POL PREDICTION. POL cryptocurrency

2024-12-23 16:31