The day’s numbers, writ in electric green upon the indifferent ticker — EOS, that noble coin, stirs from its torpor, ascending nineteen percent in a single, delirious lurch. In these times, we count our hopes by hours, our disappointments by minutes, and EOS stands abruptly, fists full of fleeting power, perched at a 30-day high.

Some will attribute this miracle to Federal Reserve gentleness — “dovish,” they say, as if the bureaucrats have grown feathers and coo from their marble perches. Others toast the “rebrand” of EOS into “A”, a letter as enigmatic as this entire spectacle. “A” for ambition? For absurdity? A makeshift bandage on old wounds — or an attempt to wipe history like chalk from a slate, leaving only a clean theoretical surface, soon marked by further tragedy.

EOS’ Rebrand: A Swan Song Sung by Vaulta 🎉

It was on a Wednesday (of course — rebellions never start on a Monday) that Vaulta arose and declaimed: EOS shall henceforth be known as A! Out went the old token, and in with the new, all shiny in a 1:1 swap, like a gift of stale bread for equally stale bread with a fresh wrapper.

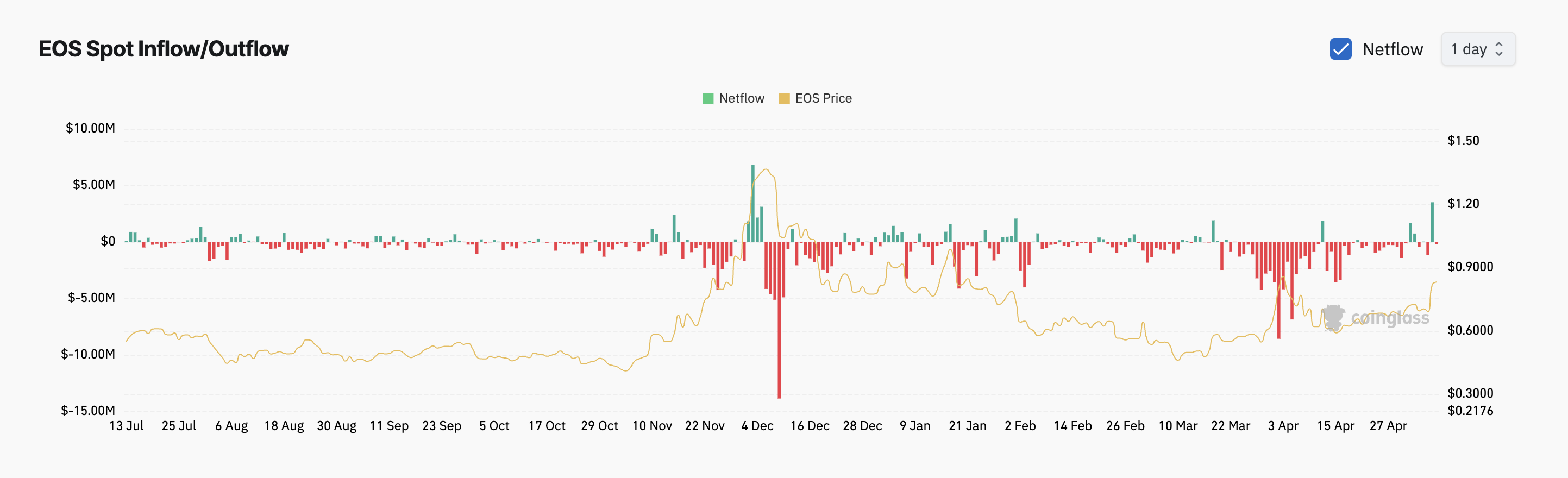

Investors, like moths drawn by the flame of novelty (or confusion?), surged inward. The tills chimed with pride: $3.49 million in a single day of spot inflows, an outpouring unseen since December 3, when people still believed in new year’s resolutions. Who could resist such drama?

The people came, baskets full of money, to buy this renamed thing, only to begin slipping away with their winnings as the day wore on — a $195,290 exodus, as if the crowd, having realized the bread is still stale, makes for the exits. Yet despite their exit, the market pulsed with reckless life, daily trading volume detonating at $480 million, up by 270%. In Russia, that would be cause for vodka — in crypto, just another tick on the doomsday clock. 🕰️

When price and volume rise together, the textbooks say “bullish.” The wise say “prepare.” Investors crowd the gates, eager hands and trembling hearts, the age-old drama of demand, of man against indifferent market. For now, EOS stands center stage, its jacket freshly pressed, hair combed for the crowd.

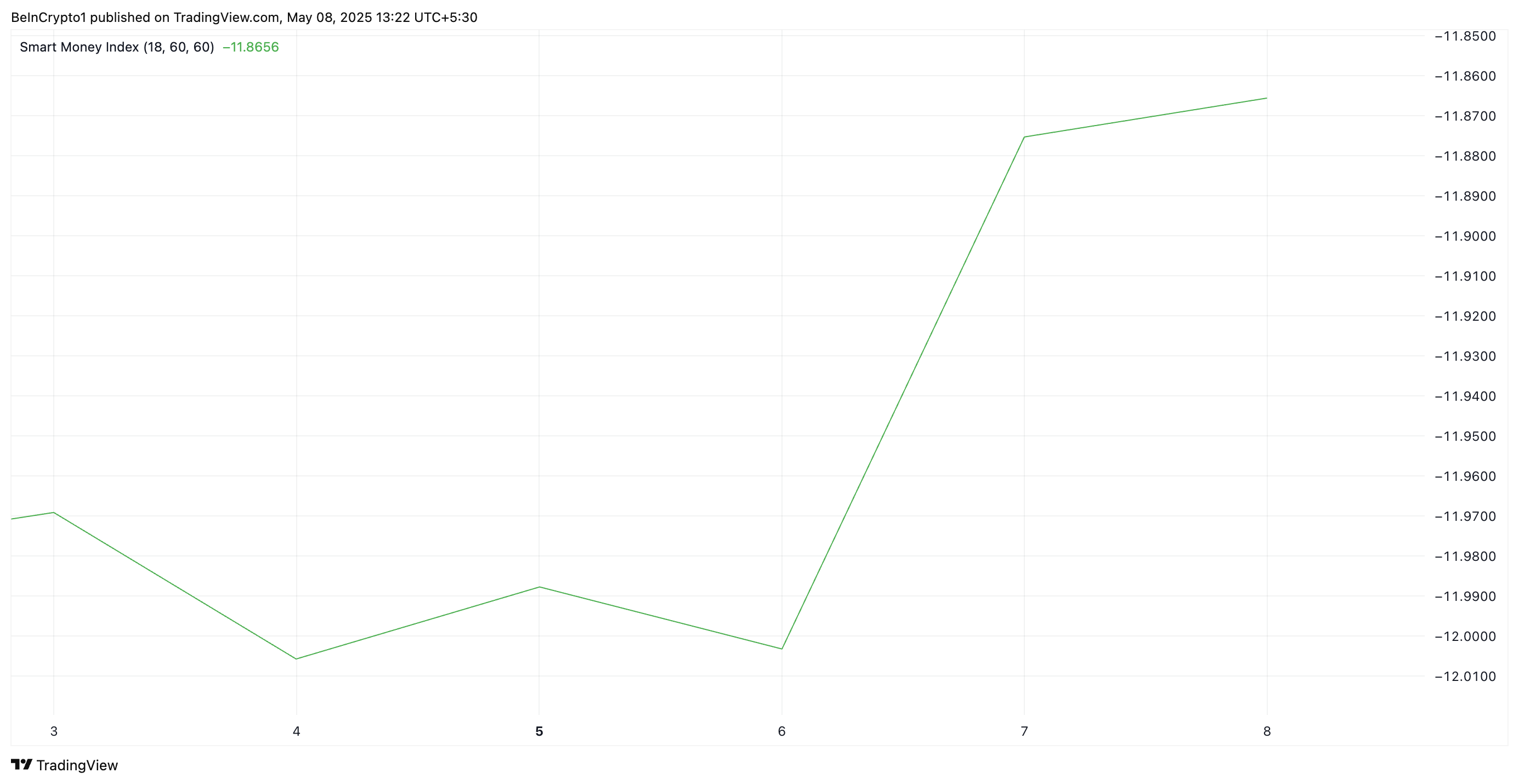

Meanwhile, the “smart money” — that legendary, shadowy beast — appears to stir. On the daily chart, the Smart Money Index surges to -11.86, a five-month peak. (Yes, negative numbers can peak, in crypto as in existential mathematics.)

The SMI, that cerebral device, tracks the lords of finance as they move tokens between their invisible towers. When it drops, expect a funeral. When it climbs (as now?), perhaps a little party — or just more dignified despair, bottled and imported by the truckload.

Will EOS Conquer $0.85 and Ascend, or Collapse Under the Weight of Its Own Irony? 🪙

At this moment — which will already be history by the time you, weary reader, peruse these lines — EOS drags itself to $0.83, a stone’s throw from the resistance at $0.85. If hope overcomes habit, it could break upward, perhaps touching $0.98, a dizzy height last glimpsed on January 18.

But beware optimism, that dangerous tonic. The profit-takers crouch, ready to turn the ladder into a trapdoor — and EOS could instead plunge to the cold, familiar $0.67. Crypto does not forgive the unwary; it merely entertains them on the way down.

Read More

- Invincible’s Strongest Female Characters

- Top 8 Weapon Enchantments in Oblivion Remastered, Ranked

- MHA’s Back: Horikoshi Drops New Chapter in ‘Ultra Age’ Fanbook – See What’s Inside!

- Nine Sols: 6 Best Jin Farming Methods

- Fix Oblivion Remastered Crashing & GPU Fatal Errors with These Simple Tricks!

- Top 8 UFC 5 Perks Every Fighter Should Use

- Gold Rate Forecast

- How to Reach 80,000M in Dead Rails

- Silver Rate Forecast

- USD ILS PREDICTION

2025-05-08 13:15