As a seasoned crypto investor with a decade-long journey under my belt, I must say that the latest Binance proof-of-reserves report has certainly piqued my interest. The decreasing holdings of major cryptocurrencies and the surge in stablecoins, particularly USDT, seem to suggest a trend towards caution among users – cashing out and holding on to their digital dollars for dear life.

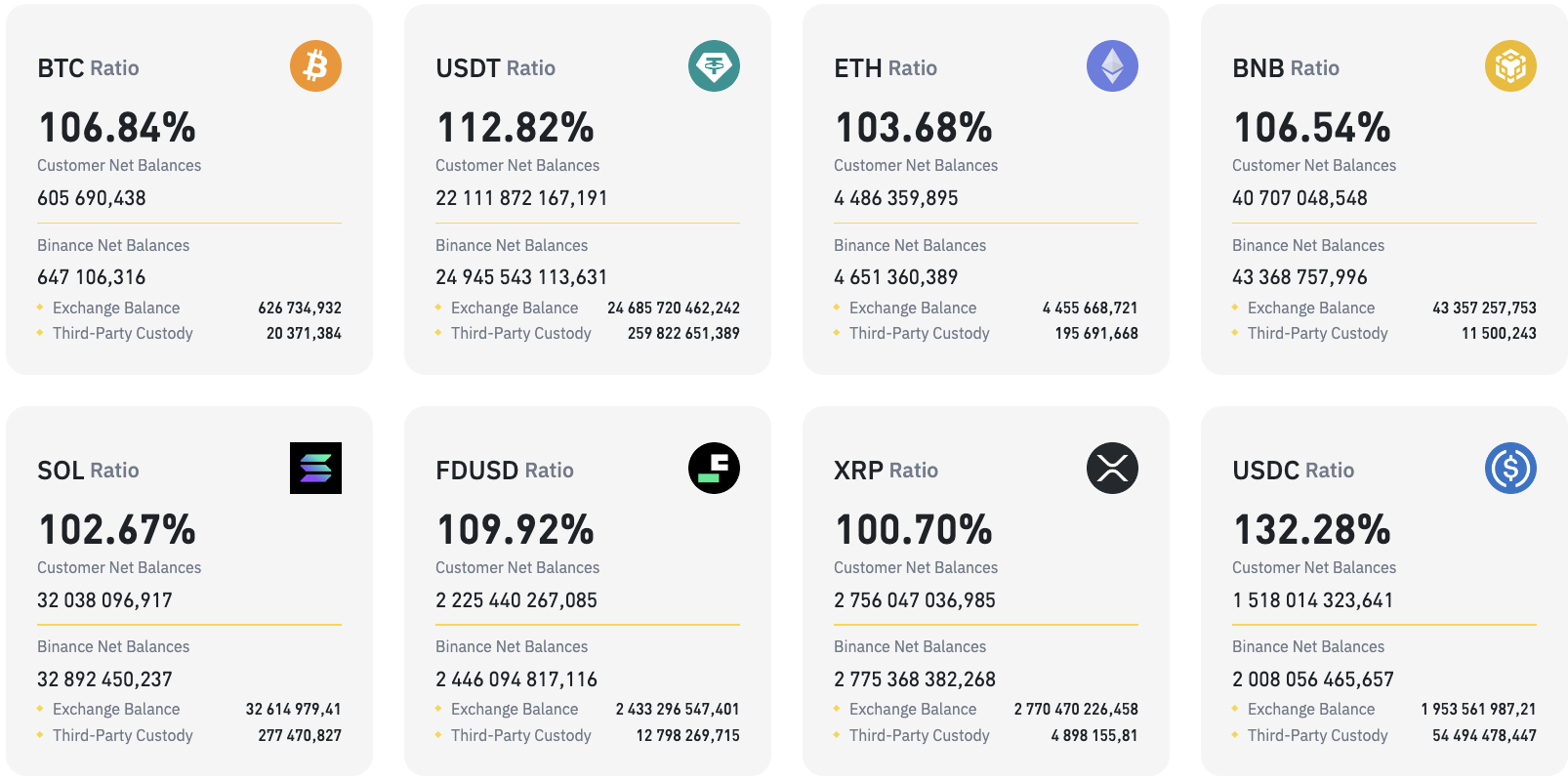

In its most recent transparency report, Binance – the world’s leading cryptocurrency exchange – has shared some intriguing and somewhat surprising findings. As per the report taken on September 1 for the 22nd month in a row, the Bitcoin holdings of Binance users have decreased by approximately 1.27%, amounting to around 605,000 BTC. Meanwhile, Ethereum assets held by users have declined by approximately 4.58% or 215,000 ETH when compared to the previous report.

At present, the user’s USDT holdings stand at approximately 22.11 billion, representing a 4.34% rise compared to the previous period. This growth amounts to about 919 million USDT.

It appears that a notable pattern emerges among prominent cryptocurrencies and Binance users: their holdings are dwindling, while stablecoins like USDT are experiencing a surge. This could be because users are converting or selling their cryptocurrency into USDT, as well as FDUSD, leading to an increase in these assets – particularly USDT, with a significant jump of 2.23 million coins, which is approximately 59.2% higher than the preceding month.

The impact of this trend was felt by XRP as well, leading to a decrease in the number of XRP held by users to approximately 2.75 billion coins, which is a reduction of about 174.89 million coins compared to August. It’s worth noting that Binance still maintains a coverage of 100.7% for all assets on its platform and currently holds around 2.77 million XRP. However, its XRP holdings were greater last month, with an increase of approximately 6.4%.

Still bullish?

If we’re looking for something positive in this situation, it could be seen as advantageous that users are choosing “cryptocurrency cash” over traditional money. Instead of fully leaving the market, they are converting their Bitcoin and alternative coins into stablecoins, maintaining a presence but essentially moving to the periphery.

It’s possible that as the hypothesis becomes more transparent, a large amount of digital currency might return to assets such as XRP, potentially sparking a fresh surge of growth in the cryptocurrency market.

Read More

- SOL PREDICTION. SOL cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD COP PREDICTION

- TON PREDICTION. TON cryptocurrency

- USD PHP PREDICTION

- USD ZAR PREDICTION

- ENA PREDICTION. ENA cryptocurrency

- Top gainers and losers

- EUR USD PREDICTION

2024-09-09 16:32