As a researcher with a background in blockchain analysis and market trends, I find the recent data on Bitcoin and Dogecoin’s high holder profitability ratios particularly intriguing. Based on the information provided by IntoTheBlock, it appears that these two cryptocurrencies lead the pack when it comes to the percentage of investors with unrealized gains.

According to on-chain analysis, Bitcoin and Dogecoin currently lead in terms of profitability for their respective holders. The following is a breakdown of this ranking.

Bitcoin & Dogecoin Are Among Coins With Highest Investor Profitability Ratio

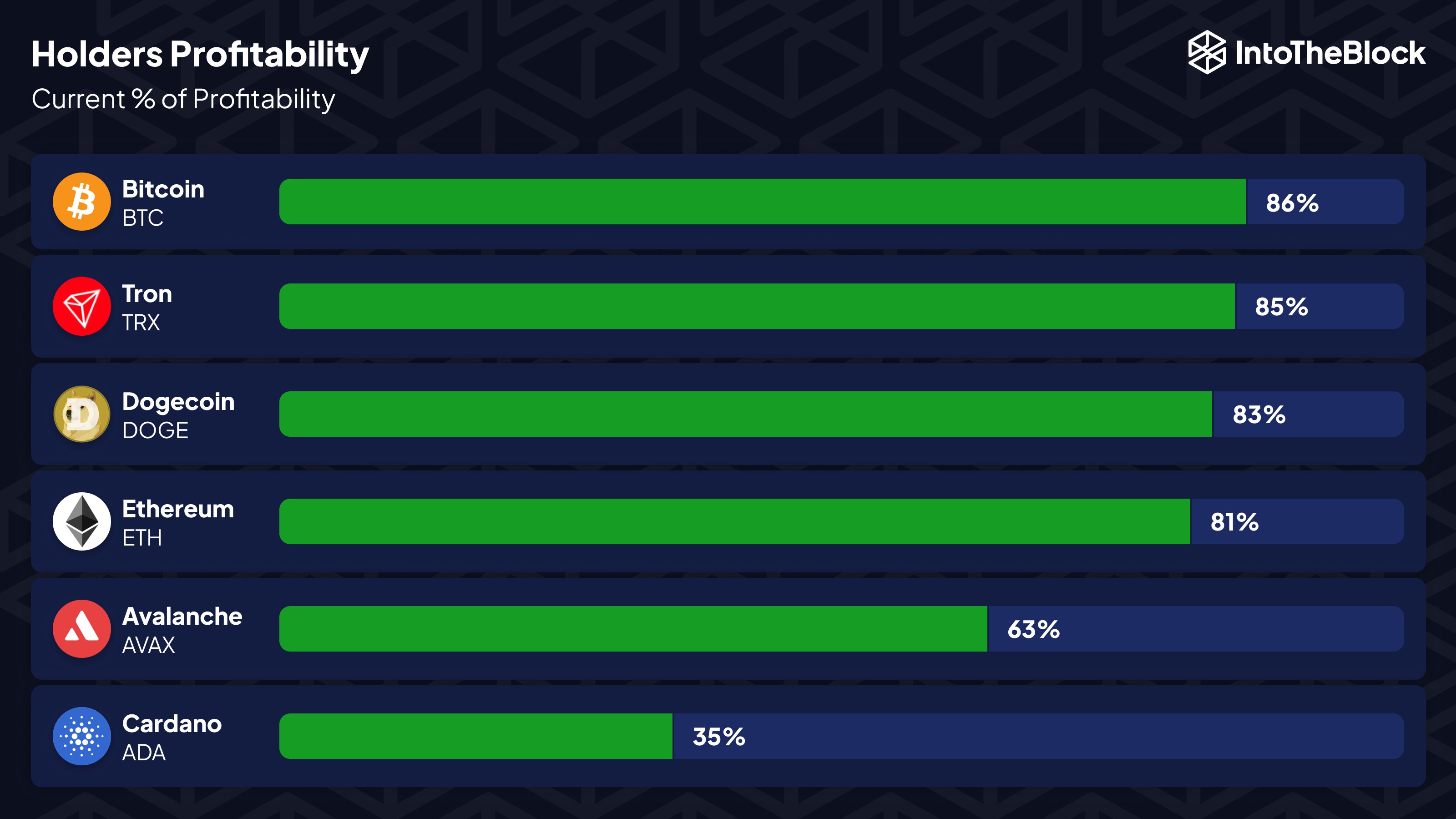

In their latest update on X, market intelligence platform IntoTheBlock discussed the variation in holder profits among the leading layer-1 networks within the crypto industry.

As a researcher studying the profitability of holders in the cryptocurrency market, I define holder profitability as the proportion of investors or crypto addresses presently experiencing positive unrealized gains within a specific cryptocurrency network.

I observe that this metric determines an investor’s profit status by examining the historical transactions of each address on the blockchain. By calculating the average cost at which coins were acquired for every holder, if this cost basis turns out to be lower than the current market price of the asset, it implies that the investor has realized profits.

The summarizer calculates the total number of given addresses and determines the proportion they represent out of the entire collection. Meanwhile, investors whose costs surpass the present value are classified as incurring losses, while those with matching costs are neither gaining nor losing.

Here’s a way to rephrase the given sentence in natural and easy-to-read language:

I’ve analyzed the data from the given graph, and I can confirm that Bitcoin leads the way among cryptocurrencies when it comes to holder profitability. A remarkable 86% of its addresses are currently in the green. Following closely behind is Tron, which boasts an impressive 85% of profitable addresses. Lastly, Dogecoin ranks third with a still considerable 83% of profitable addresses.

Despite ranking as the second largest asset in Ethereum‘s network based on market capitalization, these assets have outperformed Ethereum in this specific metric with an impressive gain of 81%. However, Ethereum isn’t lagging significantly behind with a profitability rate of nearly 81%.

From an outside perspective, the current state of affairs appears significantly more challenging for both Avalanche and Cardano investors. Among AVAX investors, a substantial 63% are currently experiencing gains, which is undoubtedly a positive sign. In contrast, however, only 35% of Cardano’s investor base finds themselves in profitable positions – a concerning statistic indeed.

Typically, investors who have earned profits are more inclined to sell, which raises the likelihood of large-scale sell-offs as the number of profitable holders grows.

In the current market conditions, cryptocurrencies such as Bitcoin and Dogecoin are experiencing substantial profits. However, this is not unusual during a bull market. Profits in these situations can become even more exaggerated, meaning the current levels could potentially moderate somewhat.

In historical market trends, peaks have often emerged when profitability levels were extremely high. On the other hand, troughs or bottoms may appear when only a small portion of investors are experiencing gains, signaling that profit-takers have largely exhausted their positions.

Based on current trends, the relatively low profits in Cardano, along with Avalanche to some extent, could indicate a potential opportunity for a price increase.

BTC Price

The price of Bitcoin has retreated from its recent gains, sliding back down to around $63,200 after an earlier week’s uptrend.

Read More

- BTC PREDICTION. BTC cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- LIT PREDICTION. LIT cryptocurrency

- USD PHP PREDICTION

- USD MYR PREDICTION

- USD COP PREDICTION

- USD CNY PREDICTION

- ORAI PREDICTION. ORAI cryptocurrency

- EUR CHF PREDICTION

- GBP USD PREDICTION

2024-04-26 01:11