Recent on-chain data indicates that the number of Bitcoin coming into exchanges from large wallets, or “whales,” has been minimal. This could be a signal that these investors have not been inclined to sell their Bitcoins.

Bitcoin Inflows For Binance & OKX Have Stayed Low Recently

According to Ki Young Ju, the CEO of CryptoQuant, the number of Bitcoin deposits into the cryptocurrency exchanges Binance and OKX has been relatively small in recent times.

One simple way to rephrase this: The “exchange inflow” metric on the blockchain signifies the sum of Bitcoins moving into exchange wallets.

When the metric value is elevated, it signifies that a substantial number of tokens are being transferred to these platforms by investors currently. With many token holders choosing to move their assets to exchanges in order to sell, such a trend could indicate potential downward pressure on the asset’s price.

In contrast, a low reading of this indicator suggests that not many deposits are being made on these platforms at the moment. Based on the direction of the opposing data, exchange outflows, this figure could have a bullish or neutral impact on the price of the cryptocurrency.

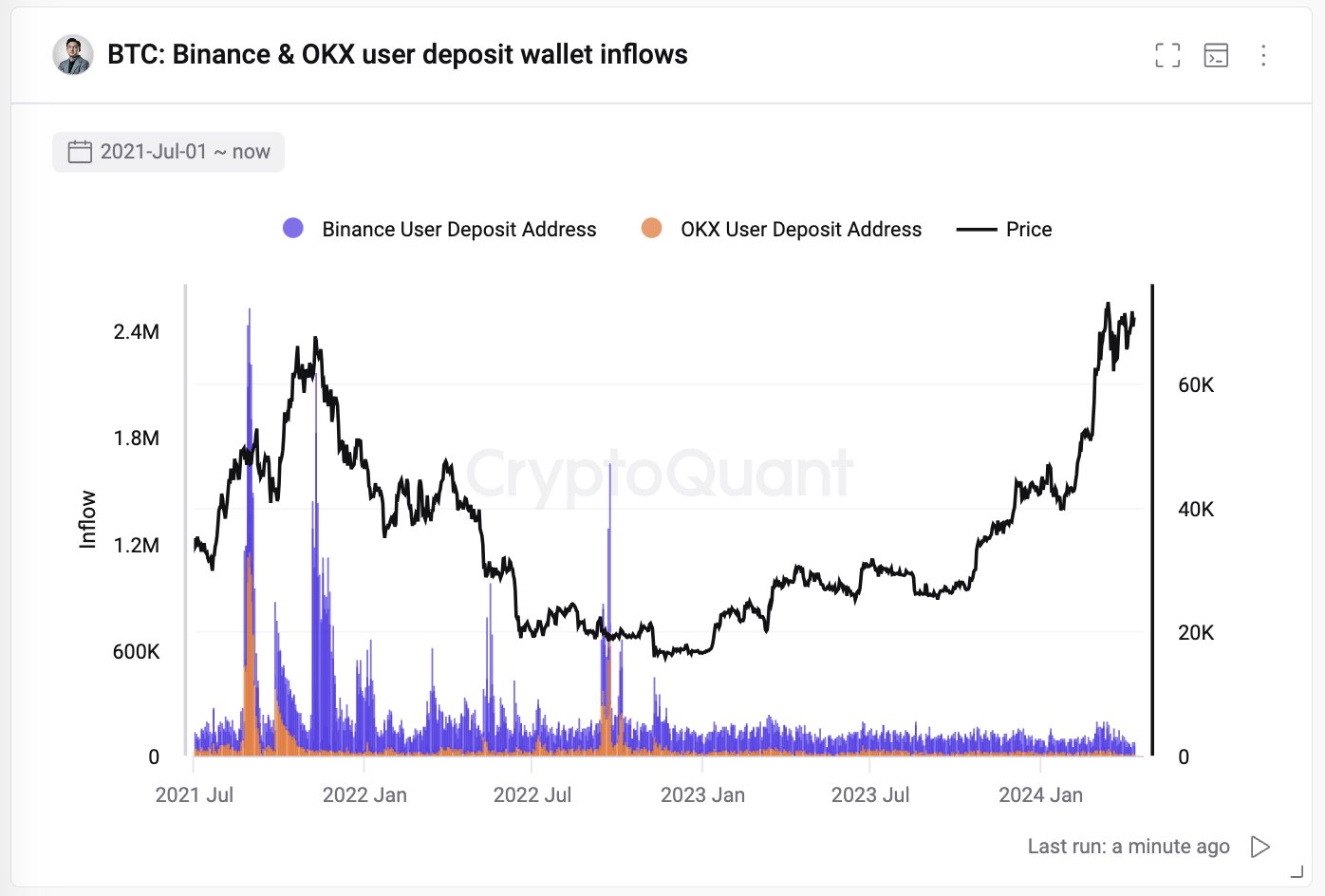

Here’s a chart illustrating the development in Bitcoin deposits for Binance and OKX over the last few years:

The trading volume on Binance makes it the biggest cryptocurrency exchange globally. OKX ranks second in this regard. Although these two exchanges don’t represent the entire market, studying their user behavior can offer insights into broader trends.

The chart shows that Binance and OKX have had relatively low exchange inflows for an extended period. When Bitcoin surged towards its new record high (ATH) earlier in the year, there was a modest increase in deposits. Lately, however, these deposits have dropped back down to minimal levels.

The lack of strong demand from major sellers, including the whales, to offload their cryptocurrencies is evident. Even reaching new all-time highs failed to significantly encourage many large platform users to sell.

During the second half of the 2021 bull run, the behavior displayed in the chart stands in contrast to that period. At that time, we witnessed significant spikes in investment inflows, which were exceptional compared to the norm. Moreover, the baseline inflow levels during the rally were consistently higher than what we’ve seen recently.

it’s worth noting that the peak points of the recent rally have aligned closely with significant influxes of funds. Based on this trend, it seems the current rally might not have reached its pinnacle just yet.

It’s uncertain if this trend will persist during the current cycle due to the recent appearance of spot ETFs.

An ETF’s availability offers investors a new method to access the asset, potentially reducing the significance of cryptocurrency exchanges within the market.

BTC Price

Currently, Bitcoin is hovering near $70,400 in value, representing a rise of over 5% during the past week.

Read More

- SOL PREDICTION. SOL cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- SHIB PREDICTION. SHIB cryptocurrency

- USD ZAR PREDICTION

- USD COP PREDICTION

- Red Dead Redemption: Undead Nightmare – Where To Find Sasquatch

- Top gainers and losers

- USD PHP PREDICTION

- CAKE PREDICTION. CAKE cryptocurrency

2024-04-12 18:11