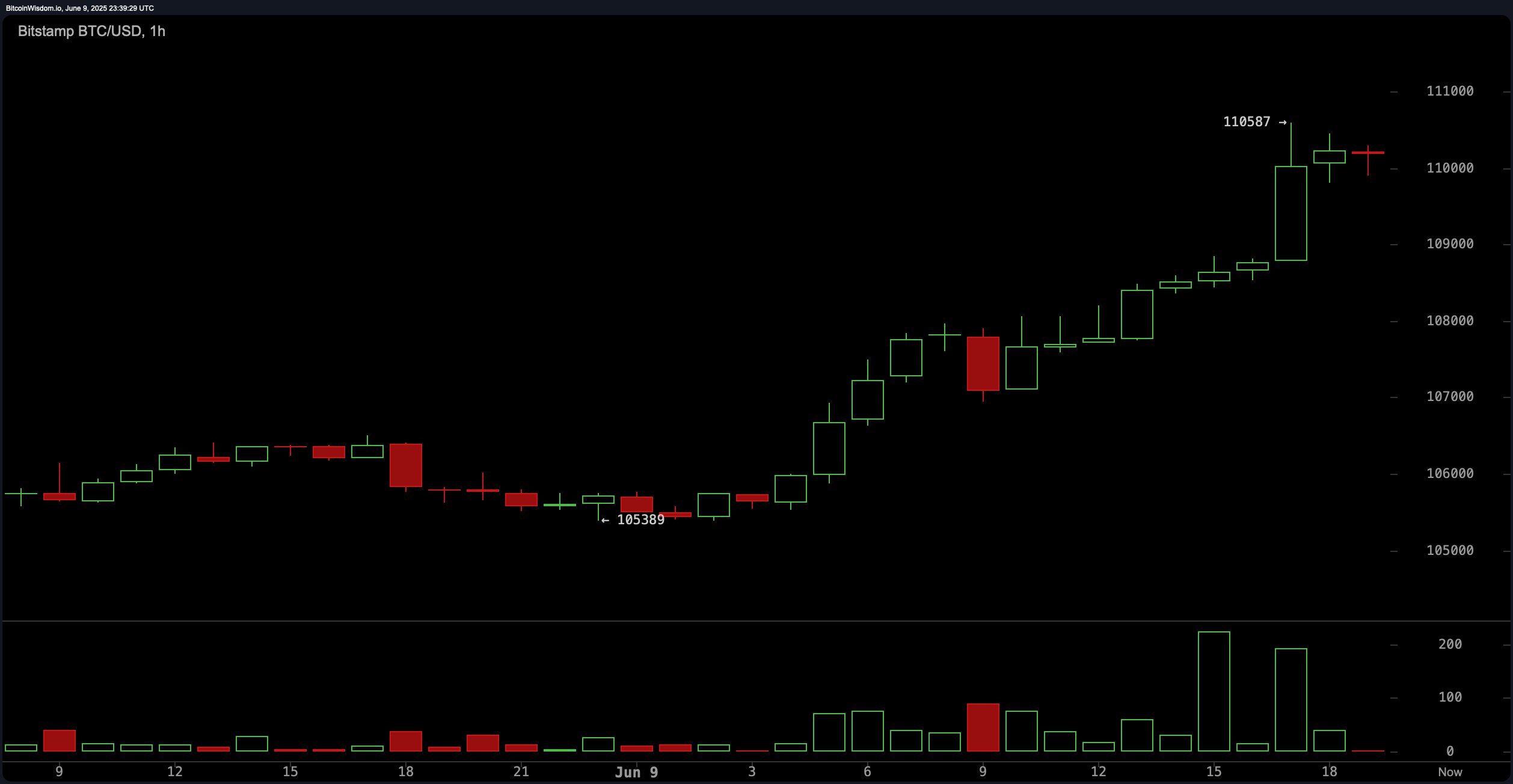

In a most audacious display of digital bravado, the price of bitcoin has galloped past the illustrious $110,000 mark, reaching a dizzying intraday peak of $110,587 per coin. With this flamboyant leap, the reigning champion of cryptocurrencies now boasts a market cap of $2.19 trillion—an impressive 63.8% of the $3.44 trillion crypto bazaar. As the clock strikes 7:30 p.m. Eastern time, bitcoin is exchanging hands for a mere $110,077, as if it were a common trinket!

Bitcoin Bulls Charge Ahead as Options Market Soars to New Heights

On this fine Monday, the crypto economy’s overall market capitalization has ascended by 3.85%, while bitcoin (BTC) has added a sprightly 4.1% over the previous 24 hours. Other major tokens have joined this raucous celebration: ethereum ( ETH) has bounced more than 6%, and dogecoin ( DOGE) has risen 5.6%. Global trade volume has also picked up speed, hitting a staggering $119 billion—a 42.95% leap compared to the day before. Who knew money could jump like that? 🤑

Bitcoin futures open interest is ablaze, totaling 696,450 BTC, or a jaw-dropping $76.69 billion at press time. CME leads the charge with 151,010 BTC in OI—valued at over $16.6 billion—and claims a 21.68% share, a clear sign of institutional shenanigans. Binance isn’t far behind, reporting 117,180 BTC ($12.9 billion) for a 16.82% slice. Both platforms have seen noticeable 24-hour gains in OI: CME with a 4.21% lift, and Binance rising 4.42%, suggesting fresh positioning on the long side or perhaps a bit of hedging. Who knows? 🤷♂️

The options scene remains tilted toward calls, with 62.38% of all open interest—230,925.8 BTC—stacked in call contracts. Puts make up the remaining 37.62%, or 139,250.36 BTC. The 24-hour trading volume mirrors this, with 62.97% (23,817.55 BTC) focused on calls and just 37.03% on puts. This skew hints at a continued appetite for upward moves, likely fueled by traders bracing for more gains or aiming for bullish breakouts into late June. The audacity! 🎉

When it comes to open interest, traders are eyeing bold bets: far out-of-the-money calls dominate the board. The biggest positions are the $140,000-call expiring Sept. 26 and the $120,000-call expiring June 27. These strike prices suggest a confidence that borders on madness—if aggressive—speculation. On the flip side, the largest put in play is the $85,000 strike for June 27, pointing to some cautious downside protection in the near term. Ah, the sweet taste of risk! 🍷

Read More

2025-06-10 03:02