As a seasoned crypto investor who has been through several market cycles, I can confidently say that this latest surge in Bitcoin’s price action is reminiscent of the excitement we felt during the 2017 bull run. The recent price appreciation and technical indicators suggest that BTC is poised for even greater heights.

The value of Bitcoin has climbed above the significant barrier at $65,000 due to a series of positive price trends and increased enthusiasm after recent interest rate reductions. This noteworthy jump has sparked anticipation among analysts and investors who are now contemplating potential further increases in the near future.

As a crypto investor, I’ve noticed an uptick in the market recently, driven by restored faith in the sector. This surge seems to indicate a potential strong upward trajectory for Bitcoin.

As a researcher delving into the crypto realm, I’ve noticed an intriguing trend from my analysis of data provided by CryptoQuant. The average profit for Bitcoin investors has witnessed a substantial rise, yet it still falls short of past record highs, indicating untapped potential for further growth. This upward swing in profits seems to mirror a shift towards optimism within the market, hinting at Bitcoin’s capability to retest its all-time highs.

With Bitcoin’s popularity growing, investors are keeping a close eye on its price movements, wondering if this upward trend might extend further into a prolonged bull run.

As Bitcoin’s price surge surpasses crucial resistance points and displays robustness, there’s growing curiosity about whether this trend will persist. Both investors and traders are keenly watching to see if BTC can continue climbing over its current height, possibly reaching unprecedented heights in the coming weeks.

The Bitcoin Network Has Room To Grow

Bitcoin has seen an impressive jump of approximately 22% from early September, a period when the price and overall public perception were close to their lowest points for the year.

As an analyst, I’m finding myself brimming with renewed optimism about Bitcoin (BTC) after witnessing this remarkable turnaround. This shift has sparked a flurry of hope among investors who are confident that BTC could potentially surge even more in the coming weeks. Such optimism seems to have been further fueled by the recent announcement from the Federal Reserve. The change in sentiment is undeniably tangible, with many analysts like myself forecasting a bullish trend for the leading cryptocurrency.

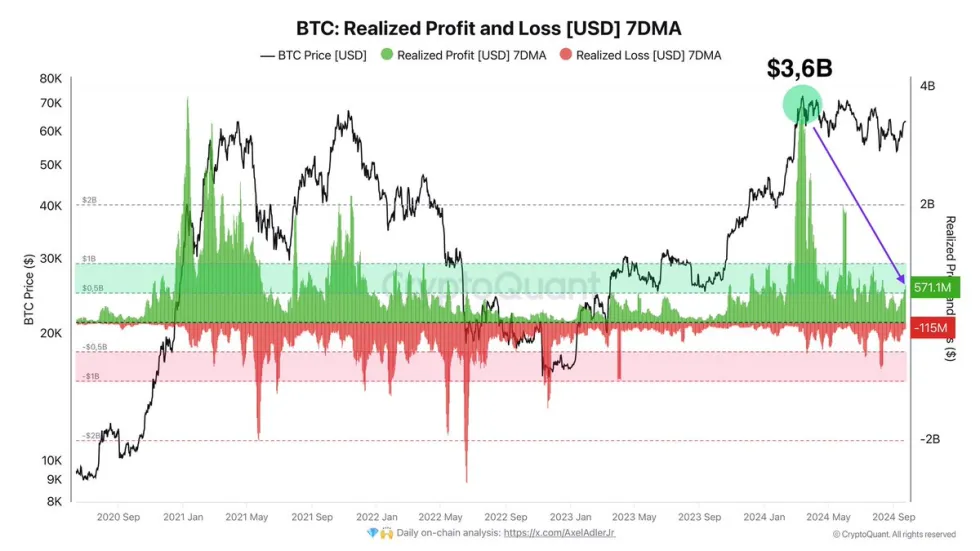

A well-known blockchain expert and investigator from CryptoQuant has recently unveiled an insightful graph and study about X, emphasizing a crucial statistic that underscores the ongoing expansion prospects of Bitcoin.

It appears that Bitcoin investors are currently reaping significant gains, raking in approximately $571 million every day while suffering only around $115 million in losses. This means they’re averaging a daily net profit of roughly $456 million, which is a substantial amount suggesting robust market confidence.

It’s worth noting that, despite being significant, the current profits are just a small portion of what was achieved earlier this year. Back in March, daily profits hit approximately $3.6 billion, indicating a potential for further expansion during this cycle.

This comparison suggests that the current increase in Bitcoin’s price might only represent the start of a more significant surge, considering the market hasn’t yet exhibited the same degree of enthusiasm observed during past peaks.

As I witness Bitcoin’s steady ascent, I find myself keenly observing the market to gauge if this surge is here to stay. The prospect of greater profits looms large, but the key question lies in Bitcoin’s ability to sustain its current pace and overcome any obstacles or resistance it might encounter in the forthcoming weeks.

BTC Technical Analysis: Price Levels To Hold

Bitcoin currently stands at approximately $65,637, having confirmed an upward trend for the day by closing convincingly above its 200-day moving average ($63,823). This action has ignited optimism among investors, who now expect prices to rise in the near future. The market interprets this confirmation as a bullish sign, suggesting potential for further price increases.

If Bitcoin (BTC) manages to stay above the significant $65,000 mark and consistently close above its 1D 200 Moving Average, there’s a possibility it could encounter resistance around the $70,000 area next. A successful breach of this barrier might initiate a robust surge, possibly propelling BTC to fresh record highs. It’s crucial that the positive trend maintains its momentum to prevent a possible correction or dip.

Alternatively, should Bitcoin (BTC) not hold its ground above these specific prices, a more natural pullback to around $60,000 might occur. This period of decrease could function as a consolidation stage, enabling the price to examine demand and develop a stronger foundation prior to any significant surge.

This adjustment might not automatically signal a bearish outlook; instead, it could establish a stronger base for the upcoming surge, enabling investors to purchase assets at reduced prices prior to a possible breakthrough.

Read More

- LUNC PREDICTION. LUNC cryptocurrency

- POL PREDICTION. POL cryptocurrency

- Brent Oil Forecast

- EUR CNY PREDICTION

- HBOs The Last of Us Used Heavy Make-up To Cover One Characters Real-Life Injury

- OKB PREDICTION. OKB cryptocurrency

- EUR ZAR PREDICTION

- Hunter x Hunter: Togashi Reveals the Rarest Nen Type In The Series

- EUR CAD PREDICTION

- EUR AUD PREDICTION

2024-09-28 00:42