As a seasoned researcher with years of experience in the cryptocurrency market, I find myself intrigued by the recent surge in Bitcoin inflows to Coinbase. This trend, as indicated by the Coinbase Flow Pulse, has historically been a bullish signal for the asset.

As an analyst, I’ve noticed a trend in on-chain data suggesting that Bitcoin is being transferred to Coinbase from other exchanges. In the past, such movements have typically indicated certain patterns in the behavior of this cryptocurrency.

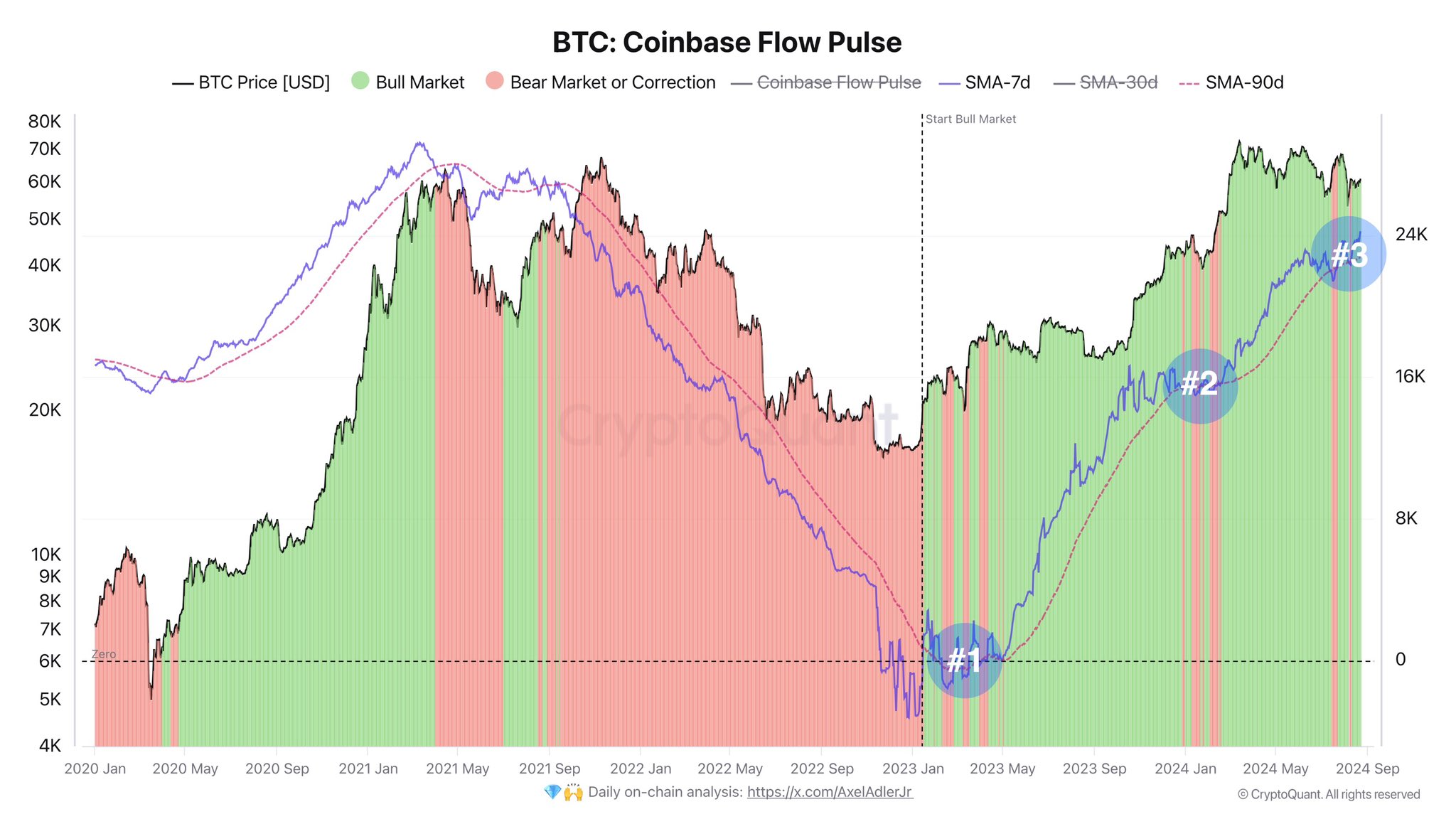

Bitcoin Coinbase Flow Pulse Has Turned Back Green Recently

According to Axel Adler Jr’s latest post on X, Coinbase has started receiving Bitcoin from other crypto exchanges again. The significant factor here is the “Coinbase Flow Pulse,” which monitors the net Bitcoin transfers between Coinbase and other digital currency platforms.

Based on my extensive experience as a data analyst, I have found that observing trends in 7-day moving averages can provide valuable insights into market behavior and help inform investment decisions. In this case, I have prepared a chart illustrating the trend of this indicator over the last few years. This chart will allow us to identify patterns and make more informed predictions about future movements in the market. As someone who has spent many hours poring over charts like this one, I can confidently say that it is an essential tool for any serious investor or analyst.

According to the provided graph, it’s clear that the Bitcoin Coinbase Flow Rate has been increasing significantly since the middle of 2023. This implies that Coinbase has been receiving more Bitcoins from other centralized exchanges compared to outflows.

Instead of focusing solely on the current state of the indicator, it’s more significant to consider its trend over a 90-day moving average (MA), which is also illustrated in the same chart. The analyst has demarcated two BTC zones based on how the 7-day MA compares with this longer-term MA as a reference point.

When the moving average of seven days drops below the moving average of ninety days for Bitcoin, it’s a strong indication that the price may decline, which is often referred to as either a “Bear Market” or a “Correction” (marked in red on charts). Conversely, if the line above indicates an upward trend, it suggests a “Bull Market” (green).

Looking at the chart, it seems that recently, the 7-day Moving Average (MA) of Coinbase Flow Pulse dipped below its 90-day MA. However, now, these two lines have intersected again, suggesting a potential increase in demand for moving coins to Coinbase since the demand appears to be on the rise once more.

In simpler terms, the last instance where this particular pattern appeared in the crypto market preceded a surge towards a fresh record high (peak). Consequently, this pattern might again indicate a potential increase in the price.

The reason Coinbase might matter in this context could be due to it being a popular choice among American institutional investors. Consequently, an increase in coins moving from other exchanges to Coinbase might suggest that large US-based investors are demanding the asset.

From the viewpoint of Coinbase Flow Pulse, the market forecast seems optimistic; however, a different signal from the on-chain analytics company CryptoQuant might indicate less favorable conditions.

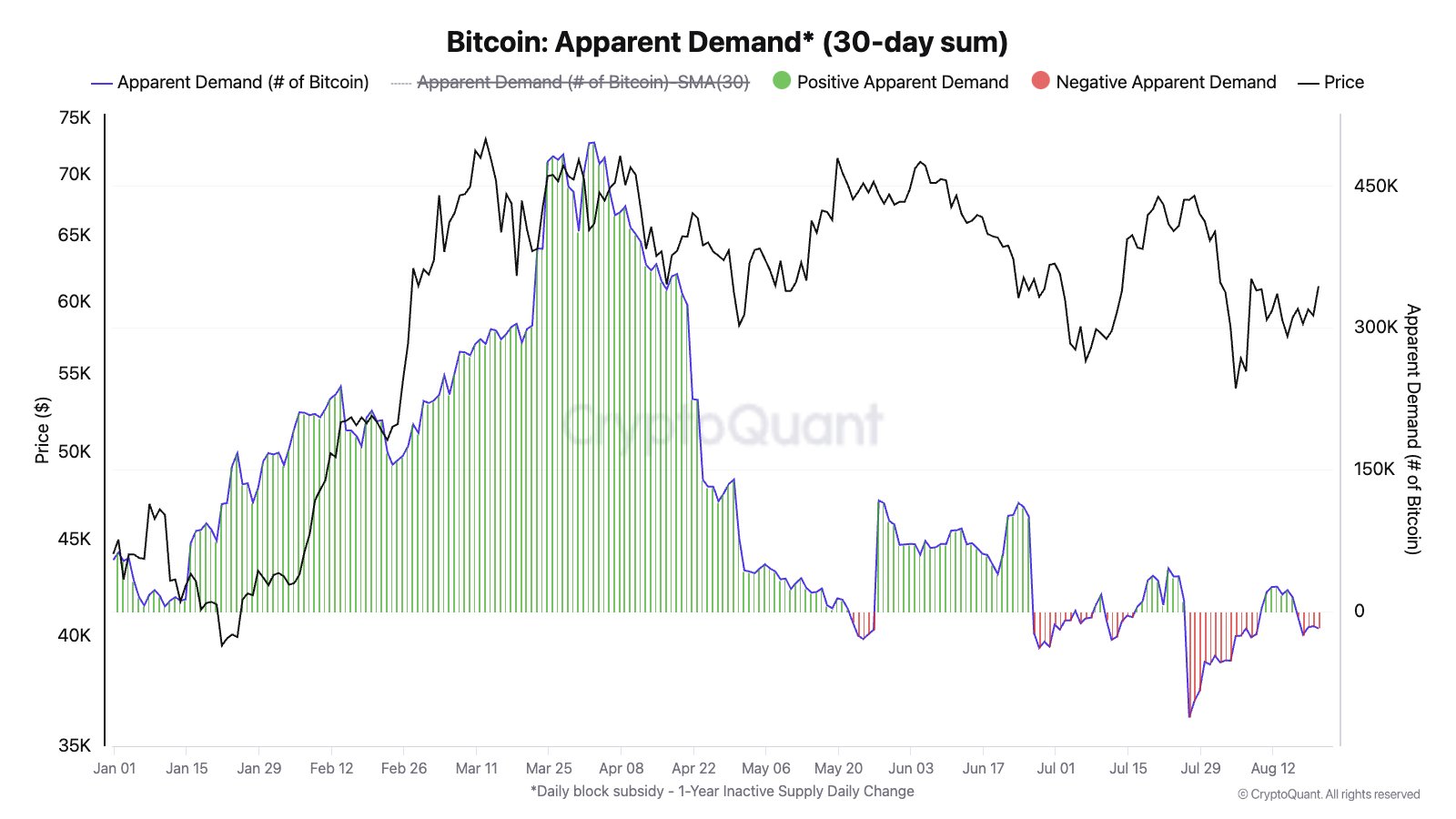

In a recent post on X, Julio Moreno, Head of Research at CryptoQuant, has clarified that Bitcoin’s current demand, as measured by the “Apparent Demand” metric, appears to be relatively subdued compared to the overall market. This metric aims to gauge demand across the entire market, rather than just a specific portion like the Coinbase Flow Pulse.

While Bitcoin’s demand was notably high earlier this year, it appears to have dropped sharply following a prolonged period of consolidation. At present, the Demand level can be considered roughly balanced or neutral.

BTC Price

At the time of writing, Bitcoin is trading at around $61,000, up over 5% in the past week.

Read More

- SOL PREDICTION. SOL cryptocurrency

- LUNC PREDICTION. LUNC cryptocurrency

- BTC PREDICTION. BTC cryptocurrency

- USD COP PREDICTION

- TON PREDICTION. TON cryptocurrency

- USD ZAR PREDICTION

- USD PHP PREDICTION

- Top gainers and losers

- ENA PREDICTION. ENA cryptocurrency

- WELSH PREDICTION. WELSH cryptocurrency

2024-08-24 03:12